Trading has undergone a remarkable transformation over the past few decades, transitioning from the chaotic and boisterous environment of open outcry trading pits to the sleek and efficient world of electronic trading platforms. This evolution has reshaped the financial markets, introducing new levels of speed, transparency, and accessibility to traders worldwide.

The Era of Open Outcry Trading

Before the advent of electronic trading, financial markets relied on the open outcry system, where traders would gather in physical trading pits to buy and sell securities through a series of hand signals, shouts, and frenzied negotiations. This traditional method of trading was a spectacle to behold, with traders executing orders amidst a cacophony of noise and a flurry of physical gestures.

The open outcry system had its advantages, allowing traders to gauge the depth of the market and capitalize on subtle nuances in the trading pit’s atmosphere. However, it was also prone to inefficiencies, human errors, and potential conflicts of interest, as traders relied heavily on their physical presence and personal relationships within the trading community.

The Birth of Electronic Trading

The rise of computer technology and the internet ushered in a new era for trading – the age of electronic trading platforms. These platforms revolutionized the way traders interacted with the markets, eliminating the need for physical trading floors and enabling transactions to be executed with the click of a button.

One of the pioneering electronic trading platforms was the NASDAQ, which launched in 1971 as the world’s first electronic stock market. This groundbreaking platform paved the way for other exchanges and trading venues to adopt similar electronic systems, ultimately transforming the global financial landscape.

Benefits of Electronic Trading Platforms

- Increased Efficiency and Speed: Electronic trading platforms operate at lightning-fast speeds, allowing traders to execute orders almost instantaneously. This efficiency enables traders to capitalize on fleeting market opportunities and react swiftly to changing market conditions.

- Enhanced Transparency: Electronic platforms provide real-time access to market data, including bid and ask prices, trading volumes, and historical price movements. This transparency empowers traders to make informed decisions based on comprehensive market information.

- Global Accessibility: Trading is no longer confined to physical locations or specific time zones. Electronic platforms have opened up financial markets to a global audience, allowing traders from around the world to participate seamlessly in various markets.

- Reduced Costs: By eliminating the need for physical trading floors and associated infrastructure, electronic platforms have significantly reduced the operational costs associated with trading, benefiting both traders and financial institutions.

| Feature | Open Outcry | Electronic Trading |

|---|---|---|

| Speed | Slower | Near-instantaneous |

| Transparency | Limited | Real-time data |

| Accessibility | Restricted to trading pits | Global access |

| Costs | Higher operational costs | Lower operational costs |

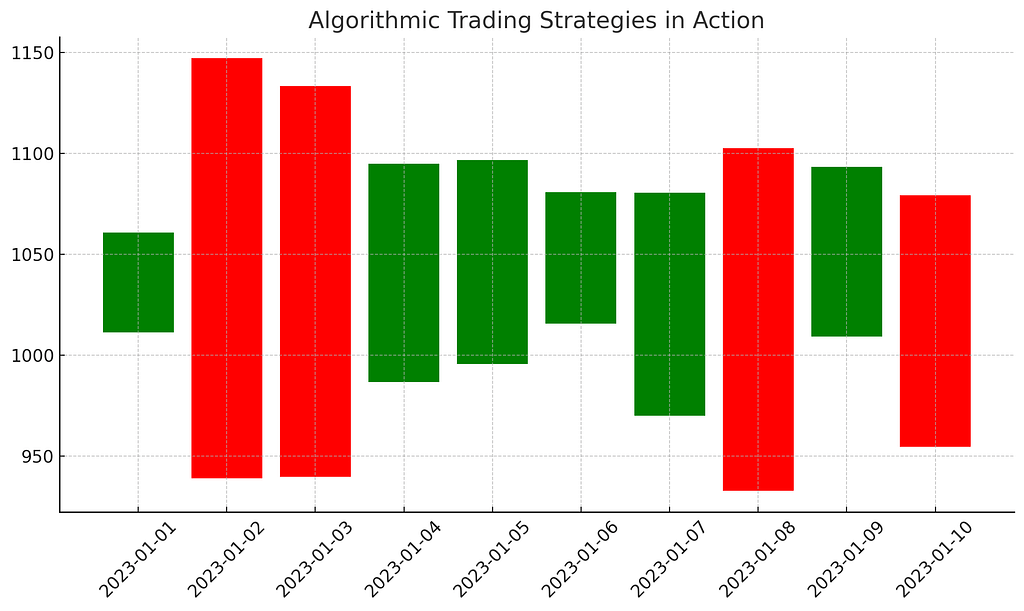

The Rise of Algorithmic Trading

The advent of electronic trading platforms has also given rise to algorithmic trading, a sophisticated form of trading that utilizes computer programs and advanced algorithms to execute trades based on predefined rules and market conditions. Algorithmic trading strategies, such as high-frequency trading (HFT), have further accelerated the pace of trading, introducing new challenges and opportunities for market participants.

Regulatory Landscape and Market Oversight

As trading platforms have evolved, regulatory bodies have adapted to ensure fair and orderly markets. Measures such as circuit breakers, trade surveillance systems, and enhanced market monitoring have been implemented to mitigate the risks associated with electronic trading, such as market manipulation and flash crashes.

Reputable organizations like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play crucial roles in overseeing electronic trading platforms, enforcing rules, and maintaining market integrity.

The Future of Trading: Embracing Innovation

As technology continues to advance, the future of trading promises even more innovation and disruption. Emerging technologies like distributed ledgers, quantum computing, and artificial intelligence are poised to reshape the trading landscape further, introducing new trading strategies, enhancing market efficiency, and revolutionizing the way traders interact with financial markets.

For those interested in exploring alternative investment strategies, our guide on Introduction to Alternative Investments offers valuable insights into emerging opportunities beyond traditional asset classes.

Conclusion

The evolution of trading from open outcry to electronic platforms has been a transformative journey, driven by technological advancements and the ever-changing demands of the financial markets. While the transition has brought about significant improvements in efficiency, transparency, and accessibility, it has also introduced new challenges and complexities.

As traders navigate this dynamic landscape, it is essential to stay informed, embrace continuous learning, and adapt to the rapidly evolving trading environment. By understanding the historical context and the driving forces behind these changes, traders can position themselves to capitalize on the opportunities presented by electronic trading platforms while mitigating the associated risks.

For a comprehensive exploration of Trading Psychology: Emotional Discipline, which is crucial in the fast-paced world of electronic trading, be sure to check out our dedicated article on this topic.

Ultimately, the evolution of trading from open outcry to electronic platforms is a testament to the resilience and adaptability of financial markets, and it underscores the importance of embracing innovation while maintaining a commitment to market integrity and ethical practices.