The realm of trading is not only a test of knowledge and strategy but also a profound exploration of psychological endurance. Understanding the psychological aspects of trading is crucial for success, as the emotional roller coaster experienced by traders can significantly impact decision-making and, consequently, profitability. This guide delves into the psychology behind trading, offering strategies for mastering emotional discipline and making decisions with clarity and confidence.

Understanding the Trader’s Mindset

Trading psychology refers to the emotions and mental state that influence trading decisions. Two primary emotions that traders often battle with are fear and greed:

- Fear can lead to panic selling, missing out on profitable opportunities, or holding onto losing positions in hope of a turnaround.

- Greed might result in taking excessive risks or failing to secure profits in pursuit of higher gains.

Key Psychological Challenges in Trading

- Overconfidence: Leading to reckless decision-making and underestimation of risks.

- Anxiety: Causing hesitation or avoidance of necessary trades.

- Hope and Denial: Holding onto losing positions too long, expecting a market reversal.

Strategies for Emotional Control

Mastering emotional discipline involves recognizing emotional triggers and implementing strategies to mitigate their impact on trading decisions. Some effective strategies include:

- Developing a Trading Plan: Set clear goals, risk tolerance, and strategies, and stick to them.

- Maintaining a Trading Journal: Record trades, emotions, and outcomes to identify patterns in emotional responses.

- Stress Management Techniques: Incorporate exercises, meditation, or hobbies to reduce stress.

- Setting Realistic Expectations: Understand that losses are part of trading and learning from them is key to improvement.

Psychological Tools for Traders

| Tool | Description |

|---|---|

| Mindfulness | Practicing mindfulness can help traders stay focused and grounded, reducing impulsive decisions driven by emotions. |

| Emotional Intelligence | Enhancing emotional intelligence aids in recognizing and managing emotions, both in oneself and in interpreting market sentiment. |

| Cognitive Behavioral Therapy (CBT) | Techniques can help reframe negative thought patterns about trading and develop healthier decision-making processes. |

Visual Insights: The Impact of Emotions on Trading Success

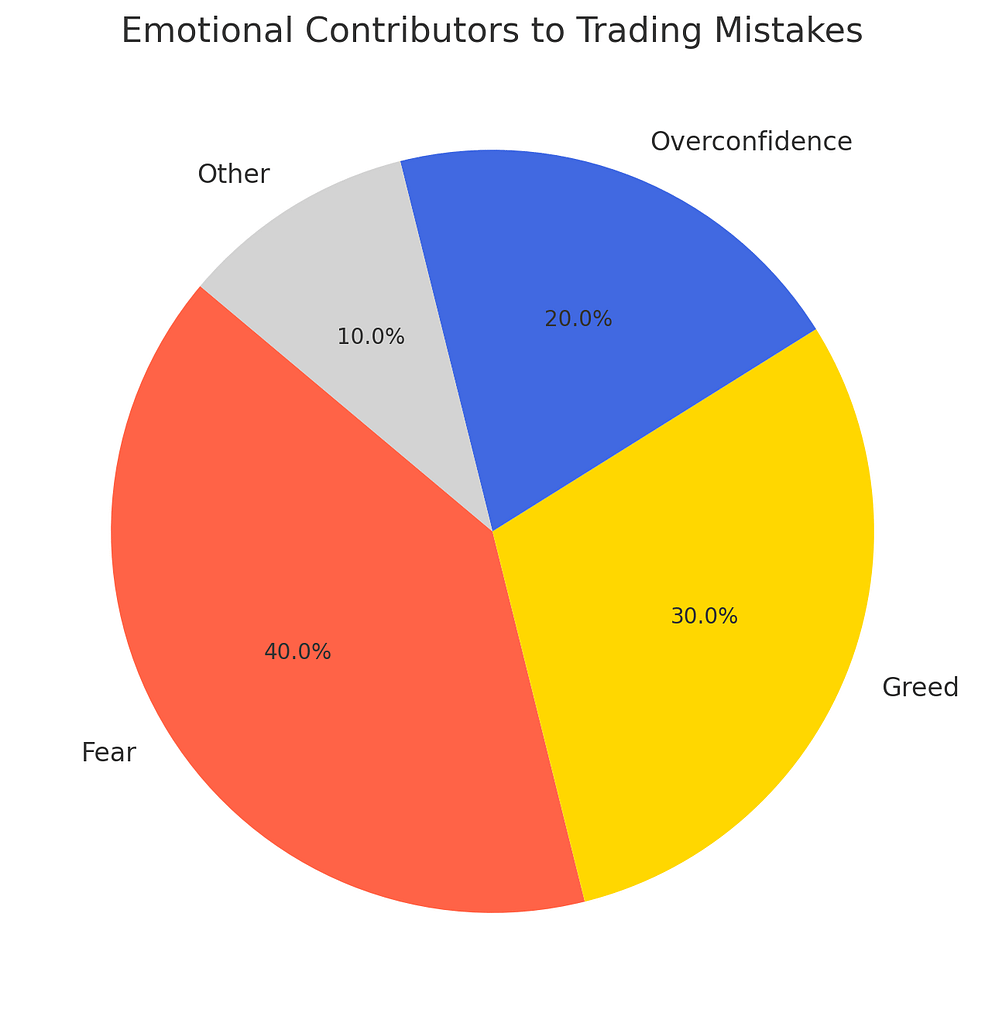

Pie Chart: Emotional Contributors to Trading Mistakes

This pie chart shows the major emotional factors contributing to trading mistakes. Fear is the leading factor at 40%, followed by greed at 30%, overconfidence at 20%, and other emotional factors at 10%.

This distribution highlights the critical role emotions play in trading, with fear and greed being the primary drivers behind many trading errors.

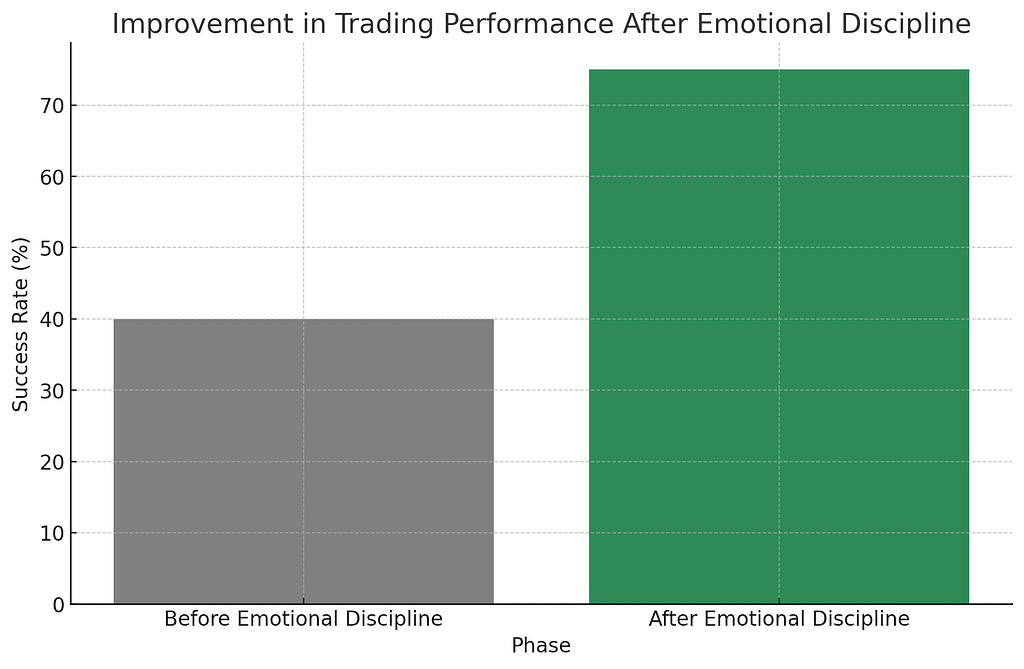

Bar Graph: Improvement in Trading Performance After Implementing Emotional Discipline Strategies

The bar graph illustrates a stark improvement in trading performance through the implementation of emotional discipline strategies. It compares a before-and-after scenario, showing a success rate jumping from 40% before applying emotional discipline to 75% after.

This dramatic increase underscores the effectiveness of managing emotions in enhancing trading outcomes, demonstrating that emotional discipline is key to achieving trading success.

Conclusion

The psychology of trading is a critical aspect that often goes overlooked in the pursuit of technical knowledge and market analysis. However, mastering emotional discipline is essential for sustained success in the volatile world of trading. By understanding and managing the psychological challenges inherent in trading, individuals can make more rational, informed decisions that align with their long-term goals and strategies. Embracing psychological tools and techniques not only improves trading performance but also contributes to personal growth and emotional resilience.