Are you familiar with the term “high-frequency trading” (HFT)? If not, you’re about to discover how this cutting-edge trading strategy has transformed the landscape of financial markets worldwide. HFT is a type of algorithmic trading that utilizes advanced technological tools and computer programs to rapidly trade securities on stock exchanges at lightning-fast speeds, often measured in milliseconds or even microseconds.

HFT has gained significant traction in recent years, accounting for a substantial portion of overall trading volumes. According to estimates, HFT firms are responsible for more than 50% of equity trading volume in the United States. This article will delve into the mechanisms of high-frequency trading, its potential benefits, controversies, and its far-reaching impact on financial markets.

High-Frequency Trading (HFT) is a type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios. HFT leverages sophisticated algorithms, co-location, and very short-term investment horizons to move in and out of positions in seconds or fractions of a second. High-frequency traders aim to capture small price movements by making high volumes of trades at rapid speeds. They do not hold positions overnight and compete against other HFTs rather than long-term investors

High-frequency trading a type of algorithmic trading in finance

Definition: High-frequency trading (HFT) utilizes high speeds, high turnover rates, and high order-to-trade ratios, leveraging high-frequency financial data and electronic trading tools.

Key Characteristics: Characterized by sophisticated algorithms, co-location, and very short-term investment horizons.

Trading Strategy: Proprietary strategies carried out by computers to move in and out of positions in seconds or fractions of a second.

Market Impact: In 2016, HFT initiated 10-40% of trading volume in equities, and 10-15% in foreign exchange and commodities.

Profit Strategy: Aims to capture a fraction of a cent in profit on every trade, making up low margins with high volumes of trades, frequently numbering in the millions.

Risks and Challenges: HFT and electronic trading have been linked to increased volatility, including contributing to the Flash Crash of May 6, 2010.

Regulatory Response: Several European countries have proposed curtailing or banning HFT due to concerns about volatility.

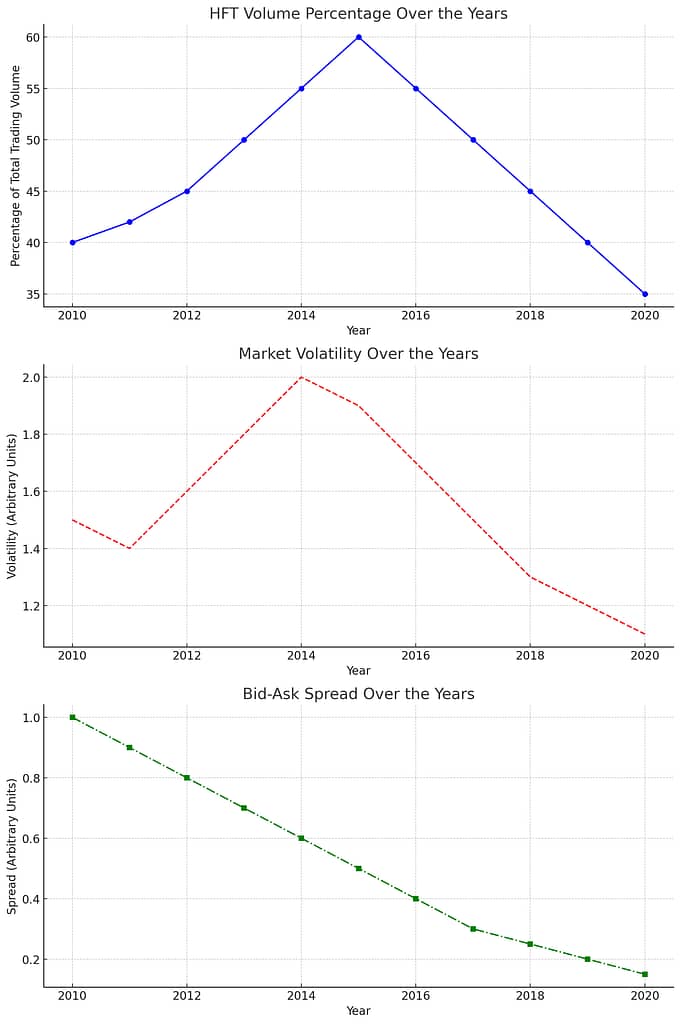

Graphs illustrating the trends

- HFT Volume Percentage Over the Years: This graph shows a peak in the percentage of total trading volume attributed to HFT around the mid-2010s, followed by a gradual decrease. This reflects the intense competition and the increasing costs and challenges faced by HFT firms, as well as the impact of regulatory and market structure changes.

- Market Volatility Over the Years: The market volatility graph indicates a peak period followed by a gradual decline. This trend could suggest that while HFT initially may have contributed to increased volatility, improvements in technology, market mechanisms, and possibly regulatory measures have helped stabilize the markets.

- Bid-Ask Spread Over the Years: This graph demonstrates a clear downward trend in the bid-ask spread, highlighting the positive impact of HFT on market liquidity by reducing transaction costs over time. However, the competition among HFTs and their role as both market-makers and speculators could influence these dynamics.

These visualizations serve as a simplified representation of the complex dynamics and impact of HFT on the financial markets over the past decade.

The Mechanisms Behind High-Frequency Trading

Algorithmic Trading Strategies At the heart of HFT lies the use of complex algorithms designed to analyze real-time market data and identify profitable trading opportunities. These algorithms are programmed to capitalize on small price discrepancies across different markets or securities, executing trades at lightning speeds.

Some common HFT strategies include:

| Strategy | Description |

|---|---|

| Statistical Arbitrage | Exploiting temporary pricing inefficiencies across related securities or markets. |

| Market Making | Providing liquidity by continuously posting buy and sell quotes. |

| News-Based Trading | Analyzing and reacting to news and events that impact asset prices. |

| Order Anticipation | Anticipating and exploiting order flow patterns by rapidly placing and canceling orders. |

- Low-Latency Execution To gain a competitive edge, HFT firms employ cutting-edge technologies to minimize latency – the time it takes for market data to reach their systems and for orders to be executed. This includes:

- High-speed networks and co-location of servers within exchange facilities

- Advanced computing systems with ultra-fast processors

- Fiber optic cables and microwave transmission for faster data transmission

By reducing latency to the bare minimum, HFT firms can execute trades faster than their competitors, potentially capitalizing on fleeting market opportunities.

Order Anticipation and Quote Stuffing Some controversial HFT strategies involve anticipating and exploiting order flow patterns by rapidly placing and canceling orders, a practice known as “quote stuffing” or “flickering quotes.” While legal, this practice has raised concerns about potential market manipulation and unfair advantages for HFT firms.

Potential Benefits of High-Frequency Trading

- Increased Liquidity One of the primary benefits of HFT is the increased liquidity it provides to financial markets. HFT firms contribute a substantial volume of buy and sell orders, facilitating smoother trading and narrower bid-ask spreads. This increased liquidity can benefit all market participants, including institutional and retail investors.

- Efficient Price Discovery The rapid execution of trades by HFT algorithms can lead to more accurate and efficient price discovery. As new information is quickly incorporated into market prices, asset values can better reflect their true worth, promoting market efficiency.

- Reduced Transaction Costs With increased competition and liquidity provided by HFT, transaction costs for all market participants can potentially be reduced. Tighter bid-ask spreads and lower trading fees can benefit investors, particularly those executing large trades.

Controversies and Criticisms Surrounding HFT

While HFT offers potential benefits, it has also been the subject of intense scrutiny and criticism:

- Market Instability and Flash Crashes Critics argue that HFT activities can exacerbate market volatility and contribute to flash crashes – sudden and severe price movements that can destabilize markets. The infamous May 6, 2010, “Flash Crash,” when the Dow Jones Industrial Average plunged nearly 1,000 points in a matter of minutes, has been partly attributed to HFT activities.

- Unfair Advantage There are concerns that HFT firms have an unfair advantage due to their ability to access market data and execute trades at extremely high speeds, potentially disadvantaging other market participants, such as institutional and retail investors.

- Market Manipulation Certain HFT strategies, such as order anticipation and quote stuffing, have raised concerns about potential market manipulation or the creation of artificial price movements. While not illegal, these practices have sparked debates about their impact on market integrity.

- Regulatory Challenges The rapid pace of HFT activities poses significant challenges for regulators in monitoring and maintaining fair and orderly markets. Developing appropriate oversight and rules to govern HFT practices has proven to be a complex task.

The Impact of HFT on Financial Markets

High-Frequency Trading (HFT) has undoubtedly carved a significant niche in the financial markets worldwide, influencing trading volumes and market dynamics in profound ways.

- U.S. Equity Markets: The heart of financial trading, the U.S. equity markets, is a bustling arena where HFT contributes to an estimated 50-70% of the annual trading volume. While it’s challenging to pin down the exact total trading volume due to fluctuations and the diverse range of traded instruments, HFT’s influence is unmistakable, with their share translating into trillions of dollars changing hands every year.

- European Equity Markets: Across the Atlantic, European equity markets exhibit a vibrant tapestry of trading activity, with HFT accounting for approximately 30-40% of the annual trading volume. Though the European markets are as diverse as its countries, the consistent presence of HFT underscores its critical role in liquidity and market efficiency, weaving through transactions worth trillions of euros annually.

- Global Foreign Exchange Markets: The global foreign exchange (forex) markets, where currencies are traded around the clock, see HFT strategies driving 25-30% of the daily trading volume. Given the forex market’s staggering daily turnover—exceeding $6 trillion on some estimates—HFT’s role is pivotal in ensuring the smooth execution of trades and the maintenance of market liquidity.

Reflections on Market Influence:

The presence of HFT has reshaped market landscapes, narrowing bid-ask spreads and enhancing liquidity, which benefits investors through reduced transaction costs. However, this efficiency comes with its own set of concerns, especially regarding market stability during periods of high stress or volatility. There’s an ongoing debate about HFT’s role in potential systemic risks, with worries that rapid withdrawals of HFT in turbulent times could exacerbate market movements.

Regulatory Response:

In light of these dynamics, regulators worldwide have taken steps to mitigate potential risks associated with HFT. Implementations such as circuit breakers, designed to halt trading temporarily during extreme volatility, aim to provide buffers against market shocks. Measures like order-to-trade ratios help prevent practices that could lead to market manipulation or unnecessary noise, ensuring a fairer trading environment for all participants.

The evolution of HFT continues to be a topic of keen interest and scrutiny within the financial community, balancing between harnessing its benefits for market efficiency and guarding against potential pitfalls for market stability.

Striking the Right Balance

High-Frequency Trading remains a complex and controversial topic, with ongoing debates surrounding its benefits, risks, and overall impact on financial markets. As technology continues to evolve, regulators and market participants must adapt and find the appropriate balance between promoting innovation and maintaining market integrity and stability.

Continued research, dialogue, and collaboration among industry stakeholders, policymakers, and the public are crucial to navigating the challenges posed by HFT and harnessing its potential benefits while mitigating its risks.