In the ever-changing landscape of financial markets, diversification has emerged as a crucial strategy for traders seeking to minimize risks and maximize potential returns. By spreading investments across different asset classes, sectors, and trading instruments, traders can mitigate the impact of market volatility and protect their portfolios from substantial losses.

The Importance of Diversification

The adage “don’t put all your eggs in one basket” rings particularly true in the world of trading. Investing solely in a single asset or market exposes traders to heightened risks, as any adverse market movement could potentially wipe out a significant portion of their capital. Diversification, on the other hand, provides a buffer against such risks by ensuring that your portfolio is not overly reliant on the performance of a single asset or market.

Asset Allocation: The Foundation of Diversification

Asset allocation is the cornerstone of a well-diversified trading portfolio. It involves distributing your investments across various asset classes, such as stocks, bonds, commodities, and currencies. Each asset class has its unique characteristics, risks, and potential rewards, and by combining them strategically, traders can create a portfolio that aligns with their risk tolerance and investment objectives.

| Risk Profile | Stocks | Bonds | Commodities | Currencies |

| Aggressive | 70% | 10% | 15% | 5% |

| Moderate | 50% | 30% | 10% | 10% |

| Conservative | 30% | 50% | 10% | 10% |

Diversification Across Trading Instruments

Within each asset class, traders can further diversify their portfolios by exploring different trading instruments. For example, in the stock market, traders can invest in individual stocks, exchange-traded funds (ETFs), or index funds. Similarly, in the commodity market, traders can trade futures contracts, options, or physical commodities.

By diversifying across trading instruments, traders can reduce their exposure to specific risks associated with individual securities or markets. For instance, investing in an ETF that tracks a broad market index can provide exposure to multiple companies across different sectors, thereby mitigating the risk of a single stock’s performance impacting the entire portfolio.

Sector Diversification

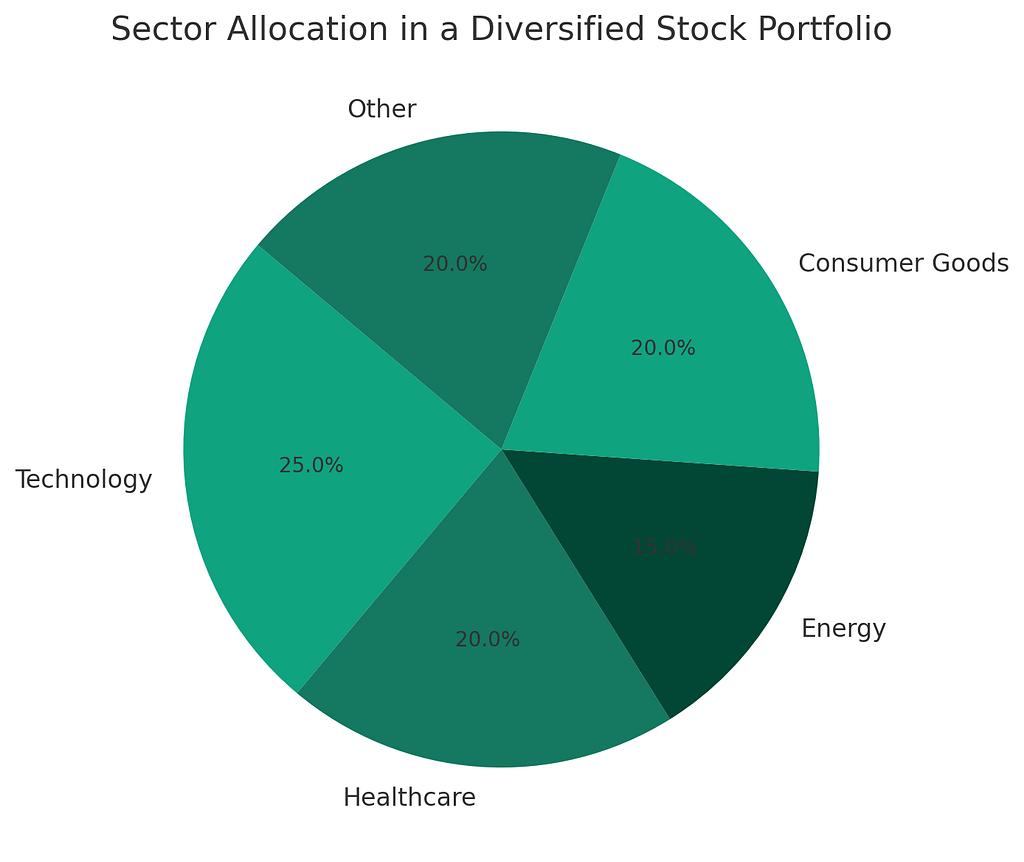

Even within the same asset class, different sectors can exhibit varying degrees of risk and performance. For example, in the stock market, the technology sector may perform differently from the healthcare sector, and the energy sector may be influenced by different factors than the consumer goods sector.

By diversifying across sectors, traders can ensure that their portfolios are not overly concentrated in a particular industry, reducing the impact of sector-specific risks. This can be achieved by investing in sector-specific ETFs or through careful stock selection across multiple sectors.

Sector Diversification

Even within the same asset class, different sectors can exhibit varying degrees of risk and performance. For example, in the stock market, the technology sector may perform differently from the healthcare sector, and the energy sector may be influenced by different factors than the consumer goods sector.

By diversifying across sectors, traders can ensure that their portfolios are not overly concentrated in a particular industry, reducing the impact of sector-specific risks. This can be achieved by investing in sector-specific ETFs or through careful stock selection across multiple sectors.

Geographic Diversification

Expanding your portfolio’s reach beyond domestic markets can further enhance diversification. Different countries and regions may experience economic cycles, political landscapes, and market conditions that can impact investment performance. By investing in international markets, traders can capitalize on growth opportunities and potentially mitigate risks associated with local market volatility.

However, it’s essential to consider the additional risks involved in international investments, such as currency fluctuations, political instability, and regulatory differences. Traders may consider investing in international ETFs or American Depository Receipts (ADRs) to gain exposure to foreign markets while mitigating some of these risks.

Risk Management Strategies

Diversification is not a one-time exercise; it requires ongoing monitoring and adjustments to ensure that your portfolio remains aligned with your risk tolerance and investment goals. Implementing robust risk management strategies, such as stop-loss orders, position sizing, and regular portfolio rebalancing, can further enhance the effectiveness of your diversification efforts.

For a comprehensive guide on building a trading plan that incorporates effective risk management strategies, check out our article on Building Trading Plan Success.

Conclusion

Diversification is a powerful tool that can help traders navigate the complexities of financial markets while minimizing risks and maximizing potential returns. By allocating investments across various asset classes, sectors, trading instruments, and geographic regions, traders can create a well-balanced portfolio that is better equipped to withstand market fluctuations.

However, it’s important to remember that diversification alone does not guarantee protection against losses. Traders should also focus on developing a solid understanding of market dynamics, implementing effective risk management strategies, and staying informed about global economic and political events that may impact their investments.

For a deeper dive into the world of Diversification Strategies for Investors, explore our comprehensive guide, which offers valuable insights and practical tips for building a resilient and well-diversified investment portfolio.

By embracing diversification as a core principle of your trading strategy, you can navigate the financial markets with confidence, mitigate risks, and position yourself for long-term success.