Diversification is a cornerstone concept in investing, often encapsulated by the old adage, “Don’t put all your eggs in one basket.” It’s a risk management technique that mixes a wide variety of investments within a portfolio. The rationale behind diversification is that a portfolio constructed of different kinds of investments will, on average, yield higher long-term returns and lower the risk of any single investment. This comprehensive guide will explore the importance of diversification, different strategies investors can employ, and how to effectively balance a diversified portfolio.

Understanding Diversification

Diversification is not just about having a lot of investments; it’s about having the right kinds of investments that react differently to the same economic events. This section delves into the concept of diversification, its importance, and the basics of how it works.

The Essence of Diversification

At its core, diversification aims to spread the risk of investment across various financial instruments, industries, and other categories. The idea is to reduce the impact of a poor performance of a single investment on the overall portfolio performance. Diversification can protect against significant losses and can contribute to a more stable growth of the investment portfolio over time.

Why Diversification Matters

- Reduces Risk: Diversification reduces unsystematic risk, which is specific to a company or industry. By investing across different sectors, you’re less likely to suffer a major loss if one sector underperforms.

- Portfolio Stability: A diversified portfolio tends to have less volatility because the performance of various investments can offset one another.

- Improved Returns: Over time, diversification can help in achieving more consistent returns by investing in different areas that would each react differently to the same event.

Types of Diversification

- Asset Class Diversification: Involves spreading investments across stocks, bonds, real estate, and cash to balance risk and reward based on your investment goals.

- Geographical Diversification: Investing in markets across different countries and regions to mitigate the risk of local economic downturns affecting your entire portfolio.

- Sector and Industry Diversification: Involves investing in various sectors (like technology, healthcare, and energy) to reduce the risk that a single industry’s poor performance could negatively impact your portfolio.

Visual Representation: The Importance of Diversification

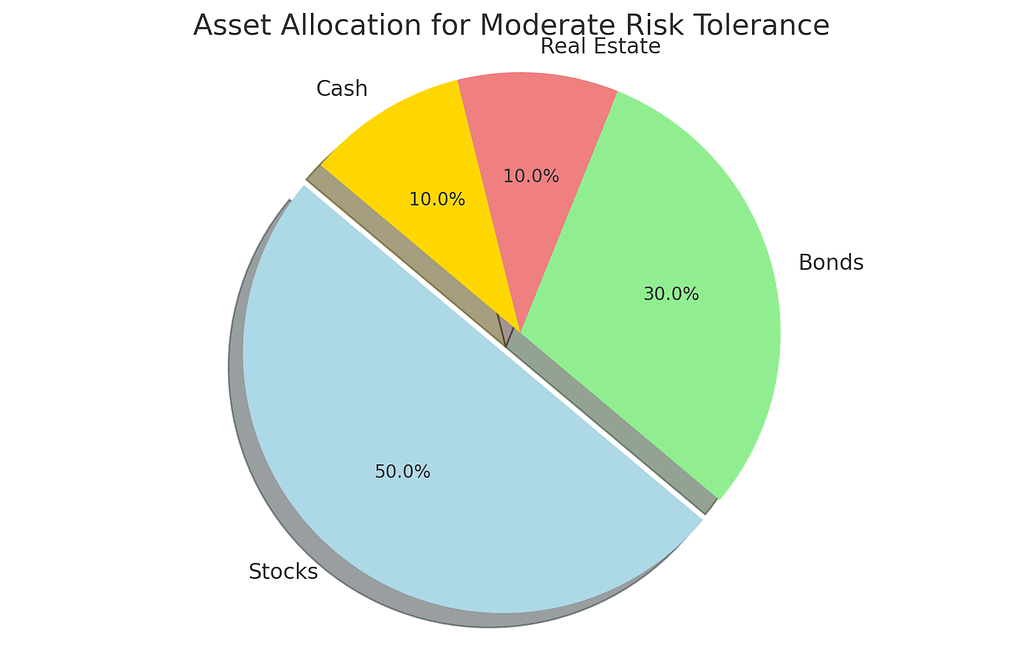

Graph: Asset Allocation Pie Chart

To illustrate diversification, consider a simple pie chart showing a balanced asset allocation for a moderate risk tolerance:

- 50% Stocks

- 30% Bonds

- 10% Real Estate

- 10% Cash

Strategies for Effective Diversification

Now that we understand the importance and types of diversification, let’s explore some strategies to achieve an effectively diversified portfolio.

Assessing Your Risk Tolerance

Before diversifying, it’s crucial to assess your risk tolerance. This will dictate how you spread your investments across asset classes. Younger investors might lean towards a higher risk tolerance with a focus on stocks for long-term growth, while older investors might prefer bonds and cash equivalents for stability and income.

Strategic Asset Allocation

This involves setting target allocations for various asset classes and periodically rebalancing the portfolio to maintain these targets. This strategy requires a disciplined approach and a long-term perspective.

Tactical Asset Allocation

Tactical allocation allows for taking advantage of short-term market opportunities while still maintaining the overall strategic asset allocation. This might involve temporarily increasing the allocation to a particular asset class if it’s expected to outperform in the short term.

The Role of Alternative Investments

Incorporating alternative investments like commodities, hedge funds, and private equity can further diversify a portfolio. These assets often have low correlations with traditional stock and bond markets, providing additional diversification benefits.

Visual Representation: Diversification Over Time

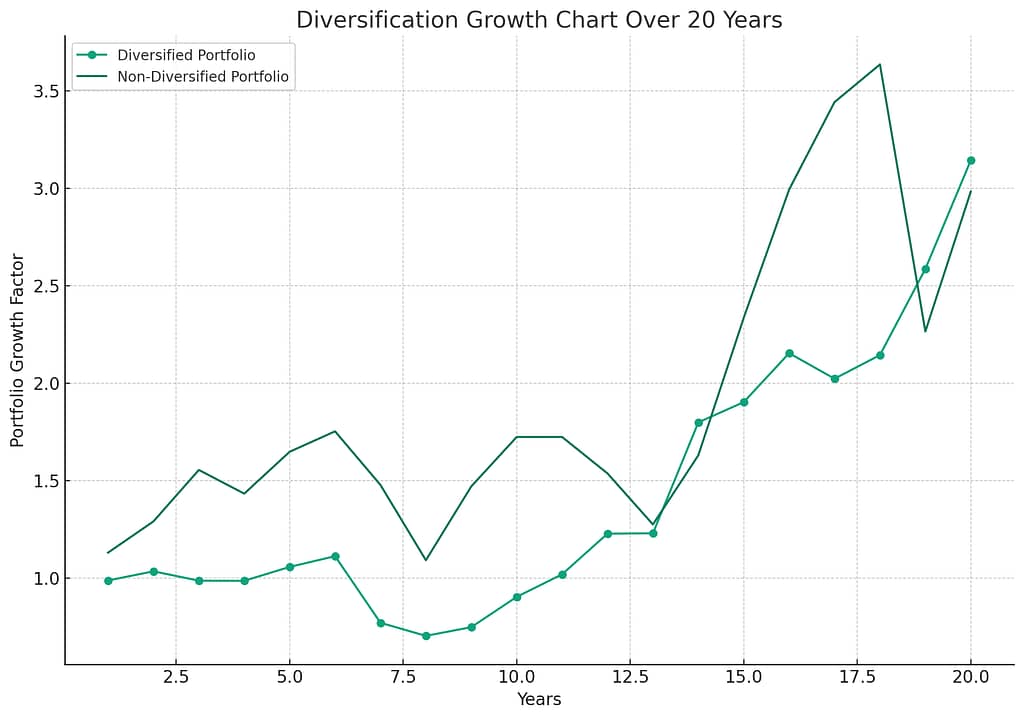

Graph: Diversification Growth Chart

This hypothetical growth chart demonstrates the potential impact of diversification on investment returns over time. It compares the growth of a diversified portfolio versus a non-diversified portfolio over a 20-year period.

Balancing and Maintaining a Diversified Portfolio

Achieving diversification is just the first step. Maintaining that diversification as markets fluctuate and as your personal circumstances change is crucial for long-term investing success.

Regular Portfolio Reviews

Conduct regular portfolio reviews to ensure your investments remain aligned with your financial goals and risk tolerance. This might involve rebalancing your portfolio to adjust for changes in market conditions or personal preferences.

Rebalancing Strategies

Rebalancing involves buying or selling assets in your portfolio to maintain your original asset allocation. This can be done on a regular schedule (such as annually or semi-annually) or when your asset allocation deviates significantly from your target.

Incorporating New Investment Opportunities

Stay informed about new investment opportunities that can enhance your portfolio’s diversification. Emerging markets, new sectors, and innovative financial instruments can offer fresh diversification prospects.

Visual Representation: The Impact of Rebalancing

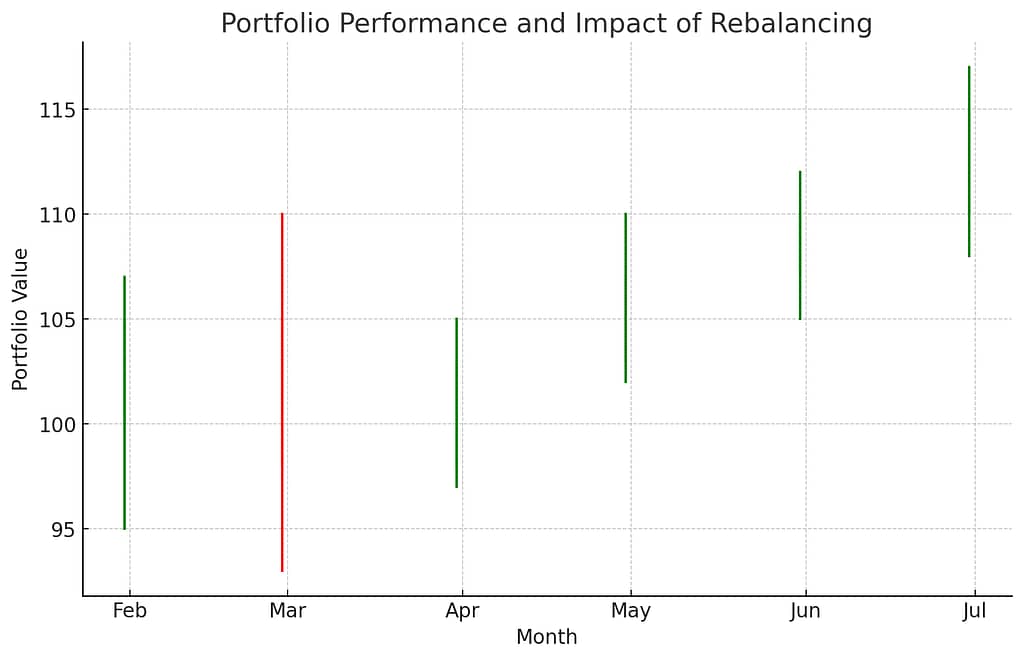

Graph: Candlestick Chart Showing Portfolio Performance

A candlestick chart can illustrate the volatility of a portfolio and the potential benefits of regular rebalancing. Each “candle” represents a period of time (e.g., a month) and shows the portfolio’s performance highs and lows, as well as the opening and closing balance.

In conclusion, diversification is a powerful tool in the investor’s arsenal, crucial for managing risk and aiming for consistent returns. By understanding and implementing effective diversification strategies, you can build a resilient portfolio capable of weathering market ups and downs. Remember, the goal of diversification isn’t to maximize returns but to set a balance between risk and return that aligns with your financial goals and risk tolerance. Regular reviews and adjustments to your portfolio ensure that your investment strategy remains on track, adapting to both market changes and personal financial growth.

Diversification is a crucial strategy for investors to manage risk and optimize returns in their investment portfolios. Here are some key diversification strategies based on the provided search results:

- Asset-Class Diversification: Allocating funds across different asset classes like stocks, bonds, commodities, and real estate can reduce the risk of losing all your money in one market. By diversifying across asset classes, investors can potentially mitigate losses during market downturns[2][3].

- Sector Diversification: Investors can further diversify within asset classes by investing in different sectors such as healthcare, technology, energy, and consumer staples. Sector diversification helps reduce exposure to a single sector’s performance, allowing for potential growth in other sectors even if one sector underperforms[2].

- Geographic Diversification: Investing in different geographic regions can help mitigate country-specific risks and currency fluctuations. By diversifying internationally, investors can reduce the impact of domestic economic shifts and potentially enhance returns through exposure to global markets[2].

- Time-Horizon Diversification: Diversifying over time involves adjusting your portfolio based on different life stages and investment goals. Investors with a long time horizon may focus more on equities for growth, while retirees may lean towards bonds and income-producing investments for stability[2].

- Risk Diversification: Balancing risk and reward based on individual risk tolerance is essential for creating a diversified portfolio. Investors with low-risk tolerance may prefer fixed-income investments, while those comfortable with higher risk may opt for equities to potentially achieve higher returns[2].

- Regular Review and Rebalancing: Regularly reviewing your portfolio’s performance and rebalancing it to maintain desired asset allocations is crucial for effective diversification. Market changes and individual financial goals may necessitate adjustments to ensure optimal diversification[3].

- Consulting a Financial Advisor: Seeking guidance from a financial advisor can help investors determine the most suitable diversification strategies based on their unique financial situation, goals, and risk tolerance. Professional advice can enhance portfolio diversification and overall investment success[3].

By implementing these diversification strategies effectively, investors can build robust investment portfolios that optimize returns, mitigate risks, and withstand market volatility across various economic conditions and investment landscapes.

Citations:

[1] https://www.investopedia.com/articles/03/072303.asp

[2] https://www.forbes.com/sites/melissahouston/2023/06/14/diversification-strategies-for-investing-maximizing-your-portfolio/?sh=58df1c603dad

[3] https://www.usbank.com/financialiq/invest-your-money/investment-strategies/diversification-strategies-for-your-investment-portfolio.html