Creating a comprehensive trading plan is a crucial step for any trader aiming to navigate the complexities of the financial markets successfully. A well-structured trading plan acts as a roadmap, guiding traders through their decisions by establishing clear goals, risk management protocols, and effective strategies. This guide outlines the essential elements required to build a trading plan that can enhance your trading discipline, decision-making, and overall performance.

Goal Setting

The foundation of a successful trading plan starts with setting clear, achievable goals. Goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Whether it’s achieving a certain percentage return, learning new trading strategies, or enhancing risk management, having defined objectives keeps you focused and motivated.

Key Elements for Goal Setting

- Financial Objectives: Annual or monthly income targets from trading.

- Educational Objectives: Skills or knowledge you aim to acquire.

- Performance Objectives: Specific trading performance targets, such as win-rate or risk-reward ratio.

Risk Management

Effective risk management is vital to protect your trading capital and ensure longevity in the markets. It involves identifying, assessing, and prioritizing risks followed by coordinated and economical application of resources to minimize, control, or eliminate unfortunate events.

Risk Management Strategies

- Setting Stop-Loss Orders: Defines the maximum loss you are willing to take on a trade.

- Risk-Reward Ratio: Aims for trades where the potential reward justifies the risk.

- Position Sizing: Determines how much of your capital to allocate to a single trade based on your risk tolerance.

Strategy Development

Your trading strategy is the core of your trading plan, outlining how you make decisions to buy or sell assets. It should be based on thorough research and backtesting and must align with your trading style and risk tolerance.

Components of Strategy Development

- Market Analysis: Fundamental or technical analysis to identify trading opportunities.

- Entry and Exit Criteria: Specific conditions that must be met before entering or exiting a trade.

- Trading Instruments: Types of assets you will trade, such as stocks, forex, commodities, etc.

Monitoring and Review

Continuously monitoring your trading activity and reviewing the performance against your set goals is crucial for long-term success. This process helps identify what is working well and areas for improvement.

Review Checklist

- Performance Evaluation: Compare actual performance with your trading goals.

- Strategy Adjustment: Modify your trading strategy based on performance and market changes.

- Emotional Assessment: Reflect on your emotional responses to trading and their impact on your decisions.

Visual Insights: The Trading Plan Framework

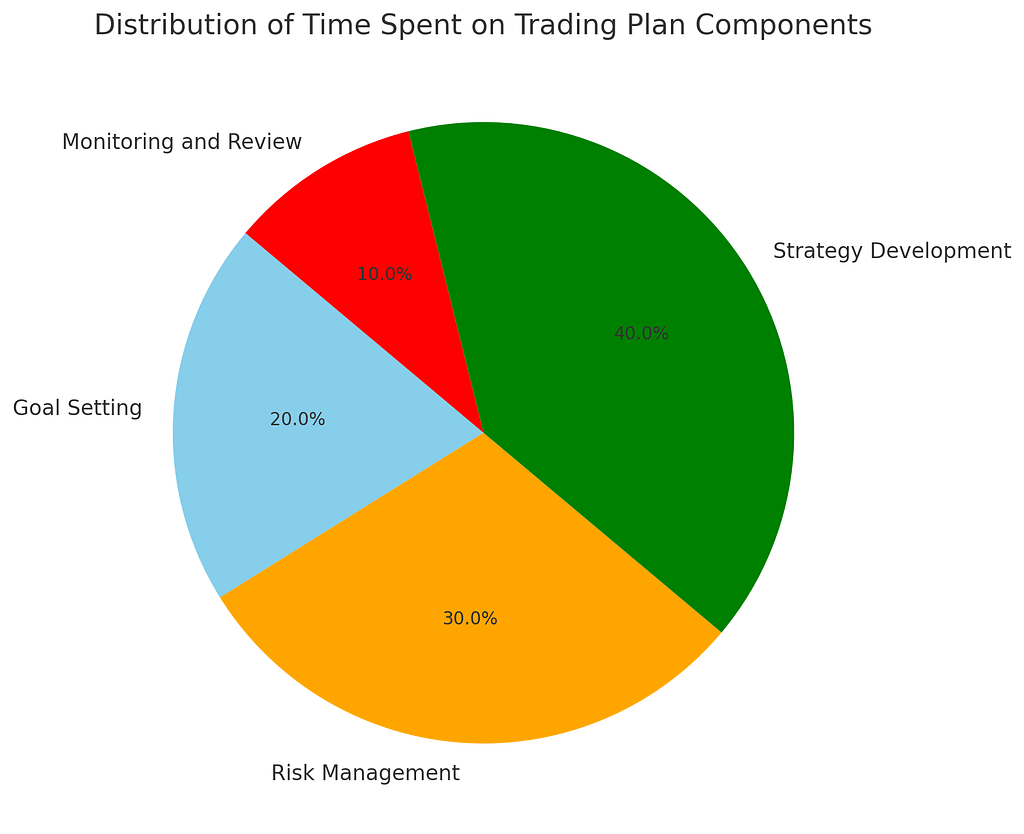

Pie Chart: Distribution of Time Spent on Trading Plan Components

This pie chart details how traders might allocate their time across various components of a trading plan, with 40% dedicated to strategy development and 30% to risk management.

This allocation emphasizes the importance of focusing on these areas, highlighting their critical roles in crafting a successful trading strategy.

Goal setting and monitoring and review are also essential but occupy smaller portions of time allocation, at 20% and 10% respectively.

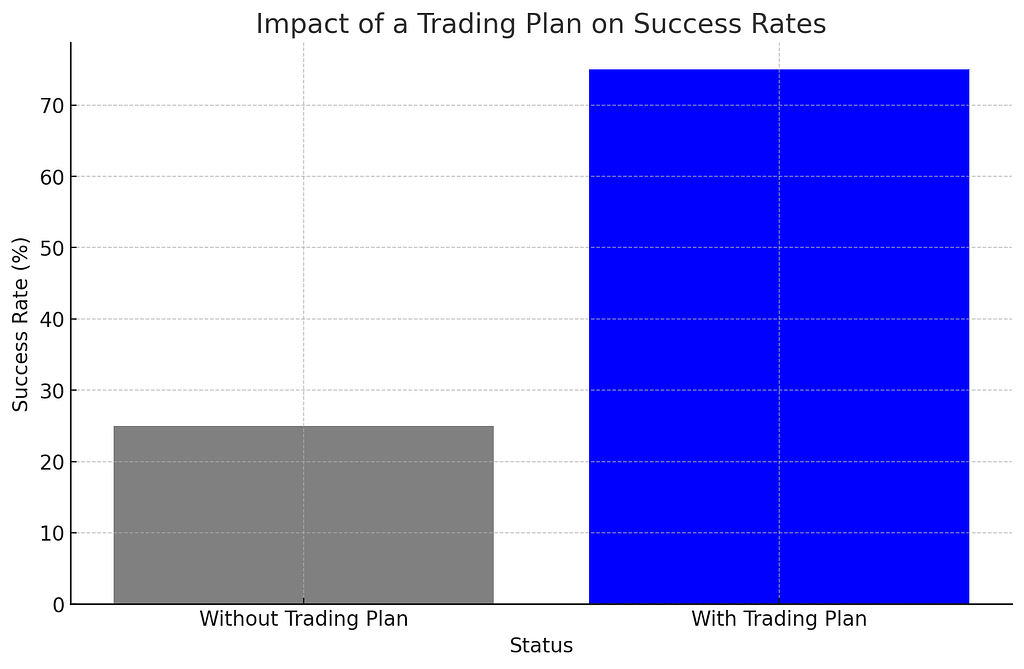

Bar Graph: Impact of a Trading Plan on Success Rates

The bar graph showcases the dramatic difference in success rates between trading with and without a comprehensive trading plan.

A trading plan significantly improves success rates, jumping from 25% without a plan to 75% with one.

This stark contrast underscores the value of a well-considered trading plan in achieving trading objectives, stressing that thorough preparation and strategy are key to trading success.

Conclusion

Building a trading plan is an essential process that lays the groundwork for disciplined, systematic trading. By clearly defining your goals, implementing robust risk management strategies, developing a coherent trading strategy, and regularly reviewing your performance, you can enhance your ability to navigate the markets successfully. Remember, a trading plan is a living document that should evolve as you grow as a trader, adapting to new experiences, market conditions, and personal objectives.