When it comes to managing credit cards and other forms of revolving credit, understanding credit limits is crucial. A credit limit is the maximum amount of credit a lender is willing to extend to a borrower. It represents the highest outstanding balance that can be carried on a credit account at any given time. In this comprehensive guide, we’ll explore what credit limits are, how they’re determined, and strategies to increase them, empowering you to better manage your credit and financial well-being.

What Is a Credit Limit?

A credit limit is the maximum amount of credit that a lender or credit card issuer is willing to extend to a borrower. It’s the highest balance that can be carried on a credit account at any given time. Credit limits typically apply to revolving credit accounts, such as credit cards, personal lines of credit, and certain types of loans.

Credit limits serve as a safeguard for both the lender and the borrower. For lenders, it helps manage their risk exposure by limiting the potential losses in case of non-payment. For borrowers, credit limits can help prevent overspending and excessive debt accumulation.

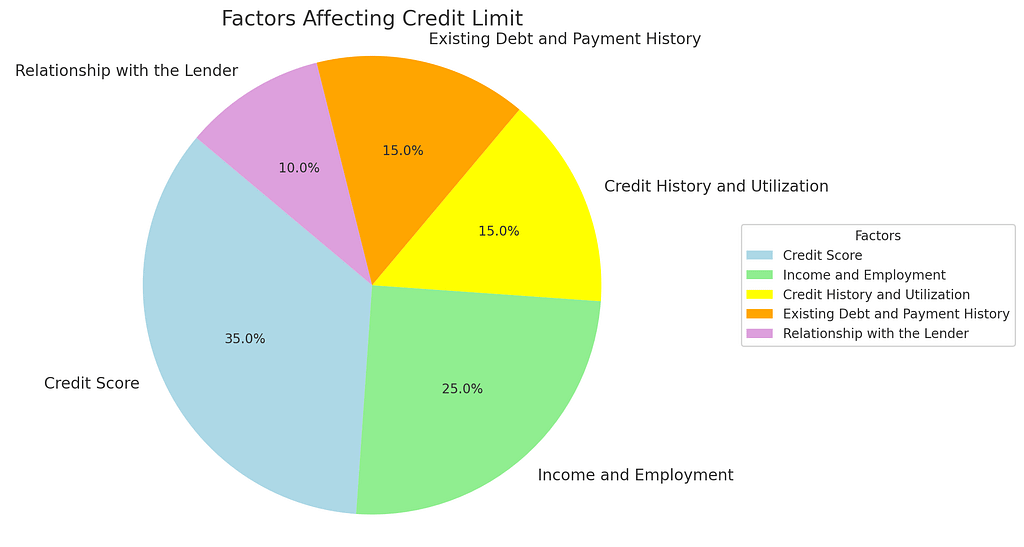

How Credit Limits Are Determined

Credit card issuers and lenders consider various factors when determining an individual’s credit limit. Here are some of the key considerations:

Credit Score

Your credit score is one of the most significant factors influencing your credit limit. A higher credit score generally indicates a lower risk of default, which can result in a higher credit limit.

Income and Employment

Lenders evaluate your income and employment status to assess your ability to repay outstanding balances. Higher and more stable income sources typically lead to higher credit limits.

Credit History and Utilization

A longer credit history and responsible credit utilization (keeping balances low relative to credit limits) can positively impact your credit limit.

Existing Debt and Payment History

Lenders consider your existing debt obligations and payment history. A lower debt-to-income ratio and a history of timely payments can contribute to a higher credit limit.

Relationship with the Lender

Existing customers with a positive history and loyalty to a particular lender may be offered higher credit limits as a retention strategy.

How to Increase Your Credit Limit

If you find your current credit limit restricting, there are several strategies you can employ to potentially increase it:

| # | Strategy | Description | Relative Importance |

|---|---|---|---|

| 1 | Request a Credit Limit Increase | Contact your issuer to request an increase, highlighting financial improvements. | 8 |

| 2 | Maintain a Good Credit Score | Practice responsible borrowing to maintain or improve your credit score. | 10 |

| 3 | Pay Down Existing Balances | Reduce outstanding balances to demonstrate responsible credit management. | 7 |

| 4 | Apply for a New Credit Card | Applying for a new card with another issuer may offer a higher limit. | 6 |

| 5 | Become an Authorized User | Boost your credit by being an authorized user on another’s positive account. | 5 |

| 6 | Provide Additional Income Documentation | Submit proof of additional income to reassess your creditworthiness. | 4 |

| 7 | Opt for a Secured Credit Card | Make a security deposit on a secured card for a higher limit and to build credit. | 3 |

Request a Credit Limit Increase

Contact your credit card issuer or lender and request a credit limit increase, highlighting any positive changes in your financial situation, such as an increase in income or a decrease in debt obligations.

Maintain a Good Credit Score

Consistently maintaining a good credit score by practicing responsible borrowing habits can increase your chances of being approved for a higher credit limit.

Pay Down Existing Balances

Reducing your outstanding balances and keeping your credit utilization low can demonstrate responsible credit management and potentially lead to a credit limit increase.

Apply for a New Credit Card

If your current lender is unwilling to increase your credit limit, you can apply for a new credit card with a different issuer, which may offer a higher initial credit limit.

Become an Authorized User

Being added as an authorized user on someone else’s account with a high credit limit and a positive payment history can help boost your own credit profile and potentially lead to a higher credit limit.

Provide Additional Income Documentation

If you have additional sources of income that were not initially considered, providing documentation to your lender can help them reassess your creditworthiness and potentially increase your credit limit.

Opt for a Secured Credit Card

If your credit history is limited or poor, consider applying for a secured credit card. By making a refundable security deposit, you may be able to obtain a higher credit limit and build or rebuild your credit.

Credit Limit Best Practices

While pursuing strategies to increase your credit limit, it’s essential to maintain responsible credit habits:

- Monitor your credit utilization ratio and keep it below 30% of your total credit limit.

- Make all payments on time to avoid negative impacts on your credit score.

- Periodically review your credit reports for accuracy and address any errors or discrepancies.

- Avoid applying for too many new credit accounts in a short period, as it can negatively impact your credit score.

- Regularly review your credit limits and adjust them as your financial situation changes.

By understanding credit limits and employing strategies to increase them responsibly, you can better manage your credit and maintain a healthy financial profile.