Unraveling the Mysteries of Income: Understanding Dividends and Interest

The interplay between interest rates and income-generating investments such as dividend stocks and bonds is a critical consideration for any investor seeking to optimize their portfolio’s performance. Our article, ‘Unraveling the Mysteries of Income: Understanding Dividends and Interest,’ delves into this complex relationship, offering insights into how interest rates affect dividend yields, the selection of dividend stocks, bond market dynamics, and overall investment strategies. We’ll explore historical trends, sector-specific reactions, and provide guidance on how to navigate these financial waters in the quest for maximizing returns and managing risk effectively.

Key Takeaways

- Interest rates significantly influence dividend stocks, with rising rates potentially making bonds more attractive, thus affecting stock prices.

- Historical performance shows that dividend stocks can still thrive in various interest rate environments, especially when rates are low.

- Sector-specific reactions to interest rate changes are important to consider; for instance, utilities may suffer while financials might gain.

- Intelligent stock selection for dividends involves assessing yield sustainability and the impact of taxes on returns.

- Investors must adapt their strategies to interest rate fluctuations, balancing risk and reward in their portfolios through diversification and predictive analytics.

The Impact of Interest Rates on Dividend Stocks

Understanding the Relationship Between Interest Rates and Dividend Stocks

As we delve into the intricacies of dividend stocks, it’s crucial to acknowledge the influence of interest rates on these investments. Interest rates can have a significant impact on dividend stocks, and as conscientious investors, we must remain vigilant of how these rates affect the stocks within our portfolios. While it’s true that rising interest rates often exert a negative pressure on dividend stocks, it’s equally important to recognize that these stocks have historically shown resilience, even in environments where interest rates are climbing.

To illustrate this point, consider the following insights:

- As interest rates rise, bond yields typically follow suit, potentially making bonds more appealing to risk-averse investors. This shift can render dividend stocks less attractive, leading to a potential decline in their market prices.

- The dividend yield is a critical factor for investors seeking income from their investments. Understanding how interest rates influence various market sectors enables investors to make more informed decisions.

- Historical trends offer a window into the past performance of dividend stocks in relation to interest rates. For instance, the 1970s saw high interest rates and underperforming dividend stocks, whereas the 1980s and 1990s experienced lower interest rates with dividend stocks often outperforming.

In our pursuit of maximizing returns, we must not only focus on dividend yields but also on the strategic reinvestment of dividends and ensuring that our investment choices align with our long-term financial objectives. This approach will pave the way for a more secure financial future.

Invest wisely in dividend stocks by understanding dividend yields, reinvesting dividends, and aligning with your financial goals for a secure future.

Historical Performance in Various Interest Rate Environments

As we delve into the historical performance of dividend stocks across different interest rate environments, we observe a nuanced landscape. Rising interest rates often signal a robust economy, but they can also lead to a reevaluation of dividend stocks, especially when compared to fixed-income alternatives. Conversely, falling interest rates typically make dividend stocks more attractive as investors seek income in a lower yield environment.

In periods of low interest rates, we’ve seen sectors such as utilities and real estate investment trusts (REITs) outperform due to their high dividend yields. However, in a climate of increasing rates, sectors like technology and consumer discretionary, which are less reliant on dividends for returns, may take the lead.

It’s crucial to recognize that the historical performance is not a guarantee of future results, but it does provide valuable insights for strategic planning.

To illustrate, here’s a simplified table showing the performance of dividend stocks in different interest rate periods:

| Interest Rate Environment | Dividend Stock Performance |

| Rising Interest Rates | Generally Underperform |

| Stable Interest Rates | Stable Performance |

| Falling Interest Rates | Generally Outperform |

Our analysis suggests that a diversified portfolio can help mitigate the risks associated with interest rate fluctuations. By understanding the historical trends, we can better prepare for future shifts in the economic landscape.

Sector-Specific Reactions to Interest Rate Changes

As we delve into the complexities of the financial markets, we recognize that the impact of interest rate fluctuations is not uniform across all sectors. Utility stocks, often seen as bond substitutes, may experience a decrease in demand as their yield becomes less attractive with rising interest rates. Conversely, financial stocks might see a benefit, as higher rates can lead to increased earnings on loans.

In the realm of personal finance and investing, understanding these sector-specific dynamics is crucial. We’ve observed that while some sectors, like utilities, may falter, others such as financials, could potentially thrive. Here’s a brief overview of how different sectors may react:

- Utilities: Decreased demand due to lower relative yields

- Financials: Increased profitability from loan interest

- Commodities: Increased volatility with higher rates

- Index Funds: Stability in high-rate environments, volatility when rates are low

It’s essential to monitor these patterns, especially with potential rate cuts on the horizon. A strategic approach to investing requires not only recognizing these patterns but also preparing for the shifts they can cause in the market.

Strategies for Investing in Dividend Stocks Amidst Fluctuating Interest Rates

In navigating the complex landscape of fluctuating interest rates, we prioritize strategies that enhance the resilience of our dividend stock portfolio. We focus on dividend growth stocks, which have historically demonstrated the ability to adapt to changing economic conditions. These stocks typically boast a consistent track record of increasing their dividends, potentially offsetting declines in dividend yield when interest rates rise.

Historical trends are also a valuable compass. For instance, the 1970s saw high interest rates and underperforming dividend stocks, while the lower rates of the 1980s and 1990s favored them. This historical perspective informs our approach, guiding us to make more informed decisions during different interest rate environments.

We must remain vigilant, understanding that while rising interest rates can pose challenges, they do not necessarily preclude the success of dividend stocks. Our strategies are designed to adapt and capitalize on the opportunities presented by each unique market scenario.

An in-depth exploration of high-yield bonds, also known as ‘junk bonds’, is essential. These instruments offer the potential for higher income but come with increased credit risks. We discuss strategies for maximizing gains and managing risks to ensure a balanced approach to income generation.

Dividend Yield: Maximizing Returns through Intelligent Stock Selection

Criteria for Selecting High-Yield Dividend Stocks

When we consider adding high-yield dividend stocks to our portfolio, we must carefully evaluate each potential investment. High-dividend stocks can be a good choice for investors seeking income, particularly in a low-interest rate environment. However, it’s crucial to understand that as interest rates rise, the allure of these stocks may wane.

One key factor we look at is the sustainability of the dividend payments. A company with a strong track record of dividend growth is often better positioned to handle fluctuations in interest rates. These dividend growth stocks not only provide a steady income but also offer the potential for capital appreciation.

It’s important to not solely focus on the dividend yield but to also consider the overall financial health and growth prospects of the company.

To aid in the selection process, we analyze historical trends, as they can shed light on how dividend stocks have performed in various interest rate scenarios. For instance, the 1970s saw high interest rates and underperforming dividend stocks, while the subsequent decades experienced the opposite.

Here’s a simple checklist to guide our selection:

- Look for companies with a history of consistent dividend payments.

- Assess the dividend payout ratio to ensure sustainability.

- Examine the company’s financial health and growth potential.

- Consider the current and projected interest rate environment.

Assessing the Sustainability of Dividend Payments

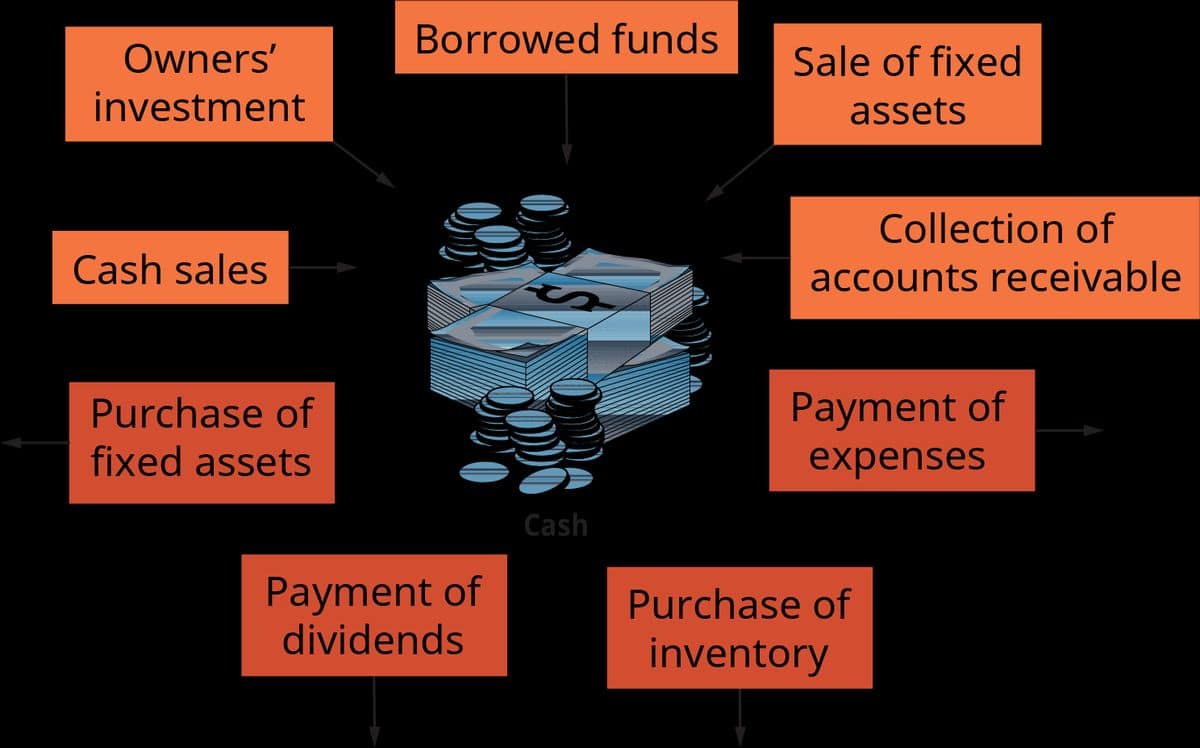

When we consider investing in dividend-paying stocks, it’s crucial to assess the sustainability of these payments. A company’s ability to maintain and grow its dividends is a testament to its financial health and operational efficiency. To evaluate this, we look at several key indicators:

- The payout ratio, which compares the dividends paid to the company’s net income.

- Free cash flow, as dividends are paid from cash, not profits on paper.

- Debt levels, since high debt can threaten dividend sustainability.

- Historical dividend growth, indicating a commitment to returning value to shareholders.

By focusing on these factors, we can gauge whether a company is likely to continue rewarding its investors with dividends or if the payments are at risk. This analysis is essential for ensuring that our income from investments remains stable and grows over time.

In our pursuit of financial success, we must balance income and spending. This principle applies not only to personal finance but also to the companies we invest in. A firm that manages its finances well, diversifying income streams and maintaining a healthy balance sheet, is more likely to sustain its dividend payments, providing us with a reliable source of income.

The Role of Dividend Yield in Total Return

We recognize the dividend yield as a crucial component in the total return of our investment portfolio. It represents the ratio of a company’s annual dividends to its current stock price, offering a glimpse into the income-generating potential of our stock selections. The allure of dividend stocks lies in their dual return streams: regular income and potential capital appreciation.

In the context of total return, we must consider the sustainability of dividend payments. A high dividend yield may be enticing, but it’s only beneficial if the company can maintain or grow its dividends over time. Here’s a simple breakdown of what we look for in a dividend-paying stock:

- Consistent dividend payment history

- Strong financial health and cash flow

- A reasonable payout ratio

- Growth potential in earnings and dividends

When interest rates rise, the competition for income-generating investments intensifies. Bonds and other fixed-income securities become more appealing, potentially diminishing the relative attractiveness of dividend stocks. It’s essential for us to assess the impact of interest rate changes on our dividend-focused strategies to ensure we are maximizing total returns while managing risk.

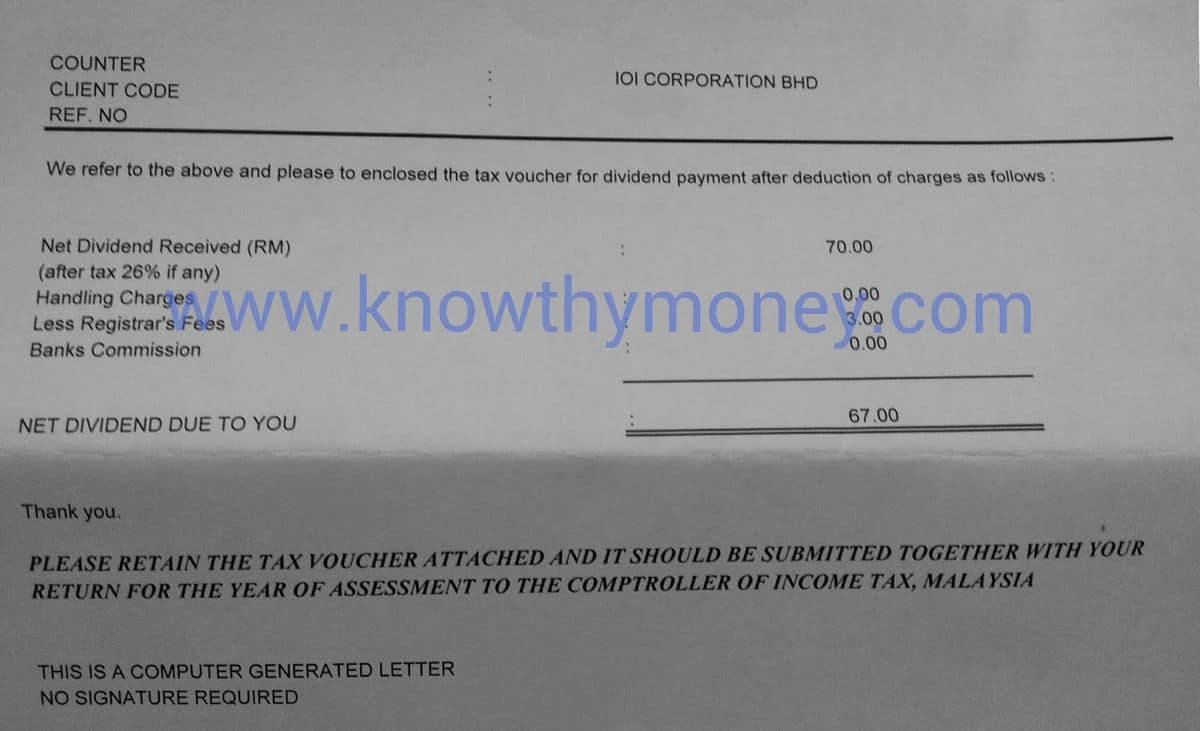

Navigating Tax Considerations for Dividend Income

When we delve into the realm of dividend investing, we must not overlook the tax implications that accompany dividend income. Tax treatment of dividends varies significantly across different jurisdictions, and understanding these nuances is crucial for optimizing post-tax returns. For instance, in Canada, investors receive a dividend tax credit for dividends from Canadian corporations, acknowledging the taxes already paid by the company. This system is designed to prevent double taxation and makes domestic dividends more attractive to Canadian investors.

Conversely, dividends from foreign corporations do not come with such credits in Canada, increasing the relative tax cost of owning these stocks for Canadian residents. It’s essential to factor in these disparities when building a dividend-focused portfolio. Here’s a simple list to help us navigate these tax considerations:

- Determine the origin of the dividend – domestic or foreign.

- Understand the local tax laws and credits available for domestic dividends.

- Assess the tax treaty status between your country and the source of the foreign dividends.

- Calculate the effective tax rate on dividend income after accounting for potential credits or deductions.

By meticulously analyzing the tax landscape, we can make informed decisions that enhance our investment’s after-tax performance. It’s a step we cannot afford to skip if we aim to maximize our investment returns.

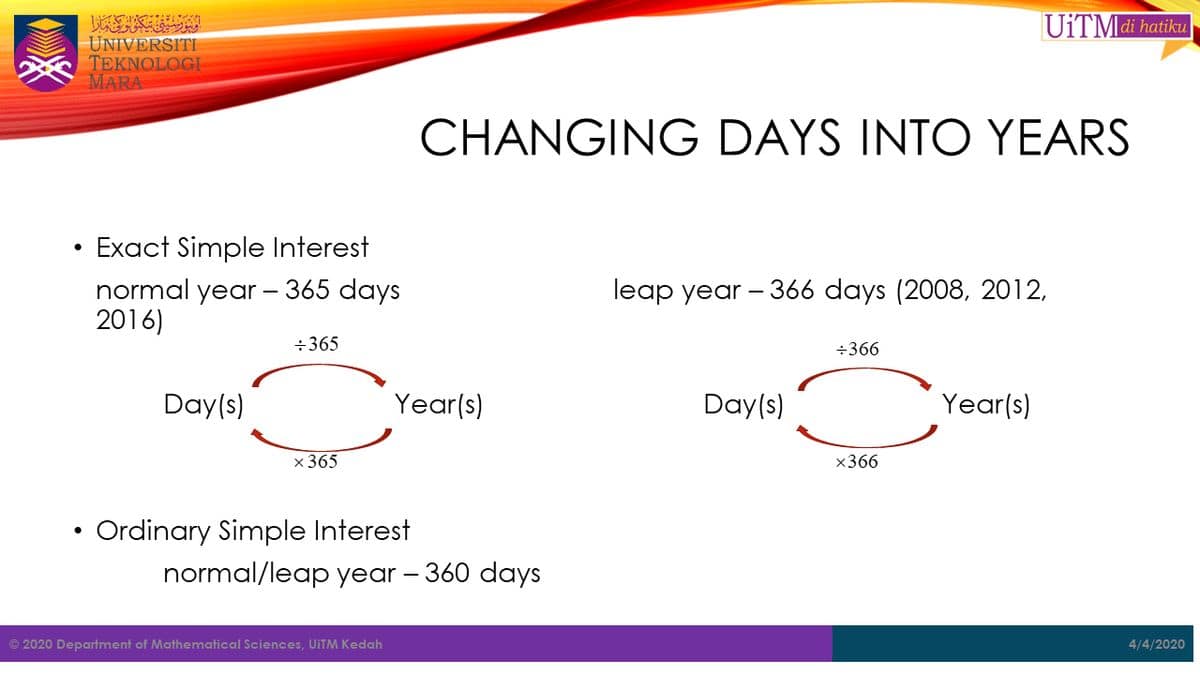

Interest Rates and Bond Yields: A Comparative Analysis

The Inverse Relationship Between Interest Rates and Bond Prices

We understand that the bond market is often seen as a haven for stability in the face of stock market turbulence. However, it is crucial to recognize the inverse relationship between interest rates and bond prices. As interest rates climb, the allure of newly issued bonds with higher yields intensifies, leading to a decline in demand for existing bonds that offer lower returns. This shift results in a decrease in the market value of these older bonds.

Conversely, when interest rates take a downturn, the market witnesses an increase in the value of existing bonds. Their higher yields compared to new bonds make them more desirable, driving up their prices. It’s a dance of supply and demand governed by the rhythm of interest rates.

To navigate this landscape effectively, we must:

- Monitor the Federal Reserve’s interest rate decisions and market projections.

- Diversify investments with a mix of bonds, treasury securities, and fixed annuities to mitigate the impact of market volatility.

- Utilize volatility to our advantage by rebalancing our portfolio and engaging in opportunistic buying when prices are favorable.

In the realm of fixed-income investments, staying informed and agile is paramount. By understanding the fundamental principles that drive bond prices, we can make more strategic decisions that align with our investment goals.

Evaluating the Attractiveness of Bonds Versus Dividend Stocks

When we consider the investment landscape, we often weigh the merits of bonds against dividend stocks, especially in light of fluctuating interest rates. Bonds are traditionally viewed as safer investments, offering more predictable returns compared to the potential for higher, but more variable, income from dividend stocks. However, as interest rates rise, the yield on bonds and other fixed-income securities also rises, potentially making them more attractive to income-seeking investors.

In our analysis, we must remember that paying more income than stock dividends is a starting point for evaluating bonds, not an ending point. A fairer test is how Treasury yields compare with the earnings yield on stocks. Here’s a simple comparison to consider:

- Bonds: Offer higher security and fixed income, but with lower growth potential.

- Dividend Stocks: Provide potential for growth and income, but with higher risk.

It’s crucial to assess not just the current yield, but also the sustainability and growth prospects of dividends versus the interest payments from bonds.

Ultimately, our goal is to balance the desire for income with the need for capital appreciation and risk management. This balance will guide us in making informed decisions that align with our investment objectives.

Interest Rate Projections and Their Influence on Fixed Income Investments

As we delve into the realm of fixed income investments, it’s crucial to recognize how interest rate projections play a pivotal role in shaping our strategies. Interest rates are a fundamental determinant of bond values, and their movements can significantly impact the performance of our fixed income portfolio. When interest rates rise, the value of existing bonds typically decreases, as newer bonds may offer higher yields, making older issues less attractive. This phenomenon is particularly pronounced for longer-term securities, where the risk of value depreciation is greater.

To navigate this landscape, we must consider several factors:

- The current yield curve and its potential shifts

- Central bank policies and their implications for future rates

- The credit risk associated with varying interest rate environments

By staying informed and agile, we can adjust our bond holdings to mitigate the effects of rate changes and preserve capital.

In our pursuit of portfolio optimization, we must be vigilant in monitoring the interplay between interest rate forecasts and the credit risk they impose on our fixed income investments.

Diversification Strategies in a Rising Interest Rate Environment

As we navigate the complexities of a rising interest rate environment, it’s crucial to understand that diversification is more than just a buzzword; it’s a strategic necessity. Rising rates often signal economic shifts that can affect various asset classes differently. For instance, while fixed income securities are subject to increased loss of principal during periods of rising interest rates, other sectors may not react in the same way.

In our pursuit of diversification, we must recognize that correlation among assets can dilute the effectiveness of our strategy. It’s essential to select investments that respond differently to interest rate changes.

Here are some steps we can take to ensure our portfolio remains robust in the face of rising rates:

- Reassess our asset allocation to include a mix of stocks, bonds, and alternative investments.

- Explore fixed income alternatives that offer yields based on illiquidity and complexity premia, coupled with high diversification benefits.

- Monitor sectors that historically show resilience or even thrive when interest rates climb, such as financials or commodities.

By implementing these strategies, we aim to mitigate the risks associated with a single asset class and maintain a balanced portfolio that can withstand economic fluctuations.

Testing the Impact on Open Rates

Methodologies for Assessing the Impact of Interest Rates on Open Rates

When we delve into the methodologies for assessing the impact of interest rates on open rates, we primarily focus on quantitative analysis and historical data review. We scrutinize past performance metrics to discern patterns that may indicate how open rates respond to changes in interest rates. This involves a detailed examination of open rate trends during periods of both rising and falling interest rates.

To ensure a comprehensive analysis, we employ a variety of statistical tools and models. These include regression analysis, which helps us understand the strength and nature of the relationship between interest rates and open rates. We also utilize time-series analysis to observe how this relationship evolves over time. It’s essential to consider the broader economic context, as open rates are not only influenced by interest rates but also by other macroeconomic factors.

Our approach is methodical, ensuring that every step of the analysis is geared towards uncovering the nuanced ways in which interest rates impact open rates.

For a structured presentation of our findings, we might use a table like the one below:

| Period | Avg. Interest Rate | Avg. Open Rate | Observations |

| Q1 2020 | 1.75% | 2.50% | Stable |

| Q2 2020 | 1.50% | 2.65% | Slight Increase |

| Q3 2020 | 1.25% | 2.70% | Steady Growth |

In our financial planning, we prioritize debts and track income, ensuring that we understand the impact of interest rates to manage debts effectively.

Case Studies: Open Rate Performance During Interest Rate Fluctuations

In our analysis, we’ve closely examined several case studies that highlight the intricate dance between open rates and interest rate fluctuations. We observed a clear pattern where higher interest rates often led to more conservative investment behaviors, impacting the open rates of various financial instruments.

One notable example is the behavior of callable bonds during periods of rising interest rates. Investors, anticipating potential calls, showed a marked preference for non-callable securities, which in turn affected the open rates of these bonds. To illustrate this, consider the following table:

| Interest Rate Environment | Callable Bond Open Rates | Non-Callable Bond Open Rates |

| Low Interest Rate | High | Moderate |

| Rising Interest Rate | Moderate | High |

| High Interest Rate | Low | High |

Significant impact was also seen in sectors sensitive to interest rate changes, such as real estate and utilities, where open rates responded swiftly to even minor rate adjustments.

Our collective experience suggests that understanding these patterns is crucial for investors aiming to optimize their portfolios in the face of interest rate volatility.

As we continue to navigate through various economic cycles, it becomes increasingly important to adapt our investment strategies to maintain a balance between risk and reward in an interest rate-sensitive market.

Predictive Analytics and Forecasting Open Rate Trends

In our quest to optimize investment strategies, we’ve turned to predictive analytics to forecast open rate trends. By analyzing historical data and identifying patterns, we can anticipate future market behaviors and adjust our approaches accordingly. The utilization of predictive analytics is pivotal in understanding the nuances of open rates and their correlation with interest rate movements.

We’ve observed that crafting effective subject lines is a continuous process, necessitating constant testing and refinement. A/B testing different subject lines has provided us with valuable insights into what resonates with our audience and drives higher open rates. Here’s a simple list of steps we follow:

- Experiment with various subject lines.

- Monitor the results meticulously.

- Adapt strategies based on the data collected.

By understanding the impact of subject lines on open rates, we can unleash the optimization potential of our investment communications, leading to more informed and successful investment decisions.

Adapting Investment Strategies Based on Open Rate Data

As we delve into the intricacies of open rates and their implications for investment strategies, it’s crucial to recognize the predictive power these metrics hold. Open rates can serve as a barometer for market sentiment, offering insights into the likely direction of stock prices at market open. By analyzing open rate data, we can adapt our investment approaches to better align with anticipated market movements.

To effectively utilize open rate data, we must consider several factors:

- The influence of international markets on open rates

- Historical open rate trends and their correlation with market performance

- Indicators that can help predict the opening direction of stocks

By integrating open rate analysis into our investment strategy, we position ourselves to make more informed decisions, potentially enhancing our portfolio’s performance.

Incorporating open rate data into our investment strategy is not just about reacting to market changes; it’s about proactively adjusting our positions to capitalize on the information at hand. This requires a continuous assessment of the data and a willingness to pivot our strategy as new trends emerge.

Interest Rates’ Influence on Investment Decisions

How Interest Rates Shape Investor Behavior and Market Dynamics

As we delve into the intricacies of the financial markets, we recognize that interest rates are a fundamental force influencing investor behavior. Interest rates dictate the attractiveness of various investment options, steering capital flow between stocks, bonds, and other assets. When rates rise, the allure of fixed-income investments often increases, leading to a potential shift away from equities, particularly dividend-paying stocks.

In our analysis, we’ve observed a pattern where higher interest rates can cause a ripple effect on the financial markets, impacting sectors differently. For instance, financial institutions may benefit from a wider interest margin, while consumer discretionary companies could face headwinds from decreased consumer spending due to higher borrowing costs. This dynamic is crucial for us to understand as it directly affects our investment strategies and portfolio allocations.

By staying vigilant and responsive to the changes in interest rates, we can better navigate the market currents and align our investment decisions with the evolving economic landscape.

To illustrate the impact of interest rates on market dynamics, consider the following points:

- The yield curve serves as a predictor of economic health, with steepening indicating growth expectations and flattening suggesting caution.

- Central bank policies are closely monitored as they set the tone for interest rates, influencing investor sentiment and market liquidity.

- Credit risk assessment becomes more pronounced as interest rates fluctuate, affecting the creditworthiness of borrowers and the valuation of fixed-income assets.

The Psychological Impact of Interest Rate Changes on Investors

We often underestimate the profound effect that interest rates have on our collective psyche as investors. When rates rise, we may perceive an increased opportunity cost of holding dividend stocks and feel compelled to shift towards assets with higher immediate yields, such as bonds. Conversely, when rates fall, the allure of dividend stocks often increases, as they become more attractive relative to the lower yields offered by fixed-income investments.

Interest rates can have both positive and negative effects on U.S. stocks, bonds, and inflation. This dual impact can lead to a psychological tug-of-war, where we balance the fear of missing out on higher yields against the potential for capital appreciation in equities.

Interest rate fluctuations are a critical factor we must consider, as they directly influence our risk tolerance and decision-making processes. To illustrate, let’s consider the following points:

- The anticipation of interest rate hikes can trigger a defensive posture in our portfolios.

- We may seek to lock in fixed-income investments before yields rise further.

- Conversely, the expectation of rate cuts could lead us to favor growth-oriented dividend stocks.

In navigating these turbulent waters, we must remain vigilant and adaptable, ensuring that our investment strategies align with the evolving economic landscape.

Interest Rates as a Tool for Economic and Monetary Policy

We recognize that central banks wield interest rates as a pivotal tool for steering the economy. By adjusting rates, they influence borrowing costs, investment decisions, and ultimately, economic activity. Lower interest rates typically spur economic growth by making borrowing more affordable, which can lead to increased spending and investment. Conversely, higher rates can help temper inflation by cooling down an overheated economy.

Our investment strategies must account for these policy shifts, as they can significantly affect market dynamics and the performance of our portfolios. For instance, when central banks lower rates to stimulate growth, it can enhance the creditworthiness of borrowers, reducing their interest expense burden. However, this can also lead to increased asset prices and potential bubbles.

Inflation erodes purchasing power, impacting investments. We employ strategies like diversification and seek assets that can mitigate inflation’s effects, such as Treasury Inflation-Protected Securities (TIPS) and real estate investment trusts (REITs).

Understanding the nuanced role of interest rates in economic and monetary policy allows us to better navigate the investment landscape, balancing risk and reward in our interest rate-sensitive portfolios.

Balancing Risk and Reward in an Interest Rate-Sensitive Portfolio

In our quest to balance risk and reward within an interest rate-sensitive portfolio, we must embrace a multifaceted approach. Diversification is a cornerstone of this strategy, allowing us to spread risk across various asset classes. By incorporating a mix of stocks, bonds, and alternative investments, we can mitigate the impact of volatile interest rates on our portfolio’s performance.

Interest rates play a pivotal role in shaping the value and attractiveness of different investments. As the Federal Reserve adjusts rates, we see a ripple effect across the market. Less corporate investment can lead to weaker earnings, while rising bond yields make them more competitive compared to the value of future stock dividends. It’s crucial to understand these dynamics and adjust our strategies accordingly.

We must remain vigilant, constantly evaluating our portfolio to ensure it aligns with our long-term financial goals and risk tolerance. This ongoing assessment allows us to make informed decisions, whether it’s rebalancing our holdings or seizing new opportunities that arise from interest rate fluctuations.

Here are some steps we can take to maintain equilibrium in our portfolio:

- Monitor the yield curve and central bank policies to anticipate changes.

- Consider the liquidity needs and time horizons for different investments.

- Evaluate the risk-return profile of each asset class in the context of current and projected interest rates.

By adhering to these principles, we can strive to achieve a portfolio that not only withstands the ebb and flow of interest rates but also thrives in a variety of economic conditions.

Conclusion

In unraveling the mysteries of income through dividends and interest, we have explored the intricate relationship between interest rates and dividend stocks. It is clear that interest rates wield a significant influence on the attractiveness and performance of dividend-yielding investments. Investors must navigate these waters with a keen understanding of how shifts in interest rates can affect various sectors differently, from utilities to financials. Historical trends offer valuable lessons, indicating that while rising rates often challenge dividend stocks, strategic selection and a long-term perspective can lead to favorable outcomes. As we close this discussion, it is imperative for investors to remain vigilant, continuously educating themselves to maximize returns and achieve a higher after-tax real rate of return in a dynamic economic landscape.

FAQs

Interest rates can significantly influence dividend stocks. As rates rise, bond yields typically increase, making bonds more attractive to risk-averse investors. This can lead to a decrease in the attractiveness and price of dividend stocks. However, historical trends show that dividend stocks can still perform well in rising interest rate environments.

Investors should look at the sustainability of dividend payments, the company’s financial health, the track record of dividend payments, and the potential for future earnings growth. It’s also important to consider the dividend yield in the context of total return and to be aware of tax implications.

No, the impact of interest rate changes on dividend stocks can vary by sector. For instance, utilities may suffer due to their high dividend yields becoming less attractive, while financial companies might benefit from the ability to earn more on loans.

Interest rate projections can affect the attractiveness of fixed income investments like bonds. If rates are expected to rise, the value of existing bonds may decrease, making new bonds with higher yields more appealing. Investors need to consider these projections when building their investment portfolios.

Investors can consider diversifying their portfolios, focusing on sectors that may benefit from interest rate increases, and selecting dividend stocks with strong fundamentals and a history of weathering interest rate fluctuations. They may also look at fixed income investments that are less sensitive to interest rate changes.

Analyzing historical interest rate trends can provide insights into how dividend stocks and other investments have performed under similar conditions. For example, dividend stocks underperformed during high-interest periods in the 1970s but outperformed when rates were lower in the 1980s and 1990s. This historical perspective can help investors set expectations and strategies for the future.