In the ever-changing landscape of finance, one factor that consistently demands attention is inflation. This insidious force can erode the purchasing power of your hard-earned money, potentially undermining the growth and long-term viability of your investments. Understanding the impact of inflation on investments is crucial for making informed decisions and safeguarding your financial future. In this comprehensive guide, we’ll explore the intricate relationship between inflation and investments, examining strategies to mitigate its effects and capitalize on opportunities.

What is Inflation?

Inflation is a sustained increase in the general price level of goods and services within an economy over time. When prices rise, the purchasing power of a currency unit (such as a dollar) decreases, meaning that the same amount of money buys fewer goods and services than before. Inflation is typically measured by the Consumer Price Index (CPI) or other price indexes, which track the changes in the cost of a representative basket of consumer goods and services.

The Impact of Inflation on Investments

Inflation can have a profound impact on various investment vehicles, affecting their real returns and long-term performance. Here’s how inflation can influence different asset classes:

Fixed-Income Investments

- Bonds: Inflation erodes the real value of fixed coupon payments and principal repayments, making bonds less attractive in high-inflation environments.

- Certificates of Deposit (CDs): CDs are vulnerable to inflation as their fixed interest rates may fail to keep pace with rising prices, resulting in diminished purchasing power.

Equities

- Stocks: While stocks can potentially outpace inflation through company growth and appreciation, high inflation can lead to increased costs, reduced consumer spending, and lower corporate profits.

Real Estate

- Residential and Commercial Properties: Real estate investments can provide a hedge against inflation, as property values and rents tend to rise along with overall price levels, preserving real returns.

Commodities

- Gold, Silver, Oil, and Agricultural Products: Commodities are often seen as inflation-resistant assets, as their prices tend to rise in inflationary environments, preserving purchasing power.

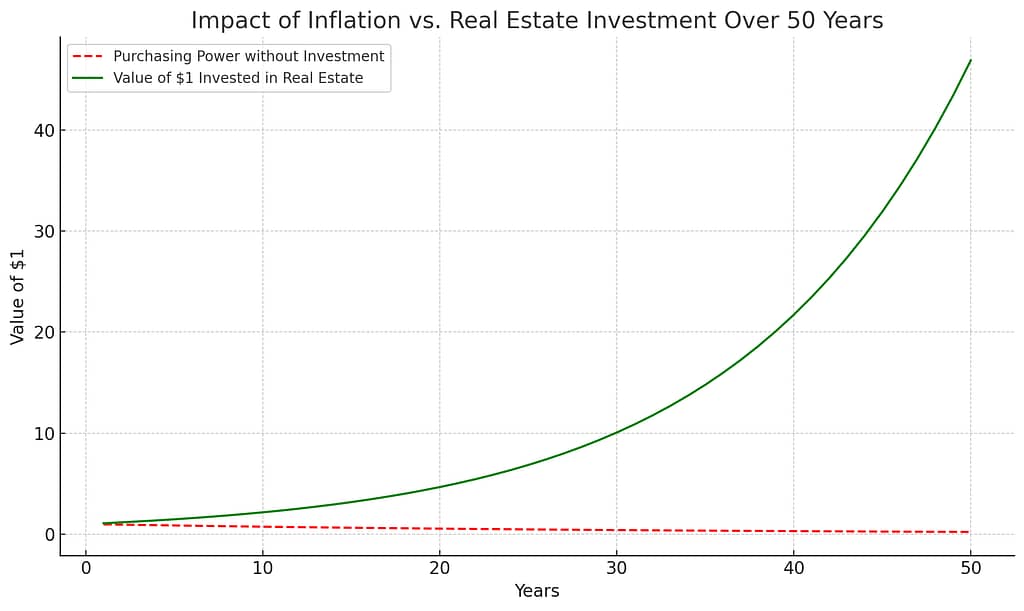

This graph illustrates the impact of inflation on purchasing power compared to the potential growth of an investment in real estate over the last 50 years. The red dashed line represents how the purchasing power of $1 would decrease over time due to an average annual inflation rate of 3%. In contrast, the green solid line shows how $1 invested in real estate, assuming an average annual return of 8%, would increase in value over the same period.

Strategies to Combat Inflation

While inflation is an unavoidable economic reality, there are strategies investors can employ to mitigate its impact and potentially capitalize on inflationary environments:

Diversification

Maintaining a well-diversified portfolio across various asset classes can help reduce the overall impact of inflation on your investments. By including inflation-resistant assets like real estate, commodities, and stocks with strong pricing power, you can better protect your purchasing power.

Treasury Inflation-Protected Securities (TIPS)

TIPS are a type of U.S. government bond designed to protect against inflation. Their principal and interest payments are adjusted based on changes in the Consumer Price Index (CPI), providing a hedge against rising prices.

Investing in Equities with Pricing Power

Companies with strong pricing power, such as those in essential industries or with dominant market positions, may be better positioned to pass on increased costs to consumers, maintaining profitability and real returns during inflationary periods.

Real Estate Investment Trusts (REITs)

REITs invest in income-producing real estate properties, providing exposure to an asset class that tends to perform well during inflationary times. As rents and property values rise, REITs can generate higher returns.

Commodity-Based Investments

Investing in commodities, such as precious metals (gold, silver), energy (oil, natural gas), or agricultural products (wheat, corn), can provide a hedge against inflation, as their prices tend to rise in tandem with overall price levels.

Inflation and Investment Time Horizons

It’s important to consider the impact of inflation on investments with different time horizons:

- Short-term: For short-term investments, the impact of inflation may be relatively minimal, as prices tend to be more stable over shorter periods.

- Medium-term: Over several years, inflation can begin to erode the purchasing power of your investments, making it essential to factor in inflation-hedging strategies.

- Long-term: Over decades, the compounding effects of inflation can significantly diminish the real value of your investments, underscoring the importance of incorporating inflation-resistant assets and strategies into your long-term portfolio.

Conclusion

Inflation is an ever-present force that can have a profound impact on the real returns and long-term viability of your investments. By understanding the relationship between inflation and different asset classes, you can make informed decisions and implement strategies to mitigate the erosion of purchasing power. Diversification, inflation-protected securities, equities with pricing power, real estate investments, and commodity-based holdings are all potential tools in your arsenal against the relentless march of inflation.

Remember, the impact of inflation on investments is a complex and nuanced topic, and seeking guidance from financial professionals can be invaluable in navigating this critical aspect of investment management.