Scalping in trading is a strategy focused on making profits from small price changes, with traders entering and exiting positions quickly over a short period. This approach is popular among day traders who capitalize on minor market movements frequently throughout a trading session. This guide will delve into scalping strategies, highlighting their benefits, challenges, and key considerations for traders looking to implement this technique.

Understanding Scalping

Scalping involves making a high volume of trades that individually generate small profits, which can accumulate to significant gains by the end of the trading day. This strategy requires a deep understanding of market movements, quick decision-making, and precise execution.

Key Characteristics of Scalping

- Short Holding Periods: Positions are held for seconds to minutes, rarely longer.

- High Frequency: Many trades are made throughout the day.

- Small Profit Margins: Profits are made on minor price movements.

Implementing Scalping Strategies

Successful scalping depends on identifying the right market conditions, having a solid trading plan, and employing effective risk management.

Essential Components

- Market Liquidity and Volatility: Scalping works best in highly liquid markets where prices move frequently.

- Trading Platform: A reliable platform with low latency and quick execution is crucial.

- Technical Indicators: Utilize indicators like moving averages, RSI, and Bollinger Bands to identify entry and exit points.

Benefits and Challenges of Scalping

Scalping, as a trading strategy, offers unique opportunities for profit while presenting distinct challenges that require careful management for sustained success.

Benefits

- Opportunities for Profit: The essence of scalping lies in capitalizing on small price movements. With the potential for numerous trades in a single day, the cumulative effect of these small profits can be substantial, making scalping an attractive strategy for active traders looking for quick returns.

- Limited Exposure to Market Risk: One of the strategic advantages of scalping is the limited exposure to market risk. Since positions are held for a very short duration, typically minutes or even seconds, the risk of encountering significant adverse market movements is markedly reduced. This brief exposure timeframe can be particularly appealing during periods of high market volatility.

Challenges

- Transaction Costs: The high volume of trades inherent in scalping can accumulate substantial brokerage fees and transaction costs. Each trade, no matter how small the profit, incurs a cost, which can quickly erode gains if not carefully managed. Scalpers must, therefore, choose their brokerage platform wisely, considering fee structures and any potential discounts for high-volume trading.

- Intensive Nature of the Strategy: Scalping is not for the faint-hearted or those looking for a passive trading experience. It demands constant attention to the markets, requiring traders to remain vigilant to price movements and market news that could affect their positions. This level of intensity necessitates a significant time commitment and can be mentally exhausting, making it essential for scalpers to develop a disciplined trading routine and effective stress management techniques.

While scalping can be an enticing strategy for traders drawn to quick, frequent profits, it demands a high level of dedication, discipline, and strategic planning to navigate its challenges successfully. Those considering scalping need to weigh these factors carefully against their personal trading style, goals, and capacity to manage the demands of this intensive trading approach.

Visual Insights: Scalping in Action

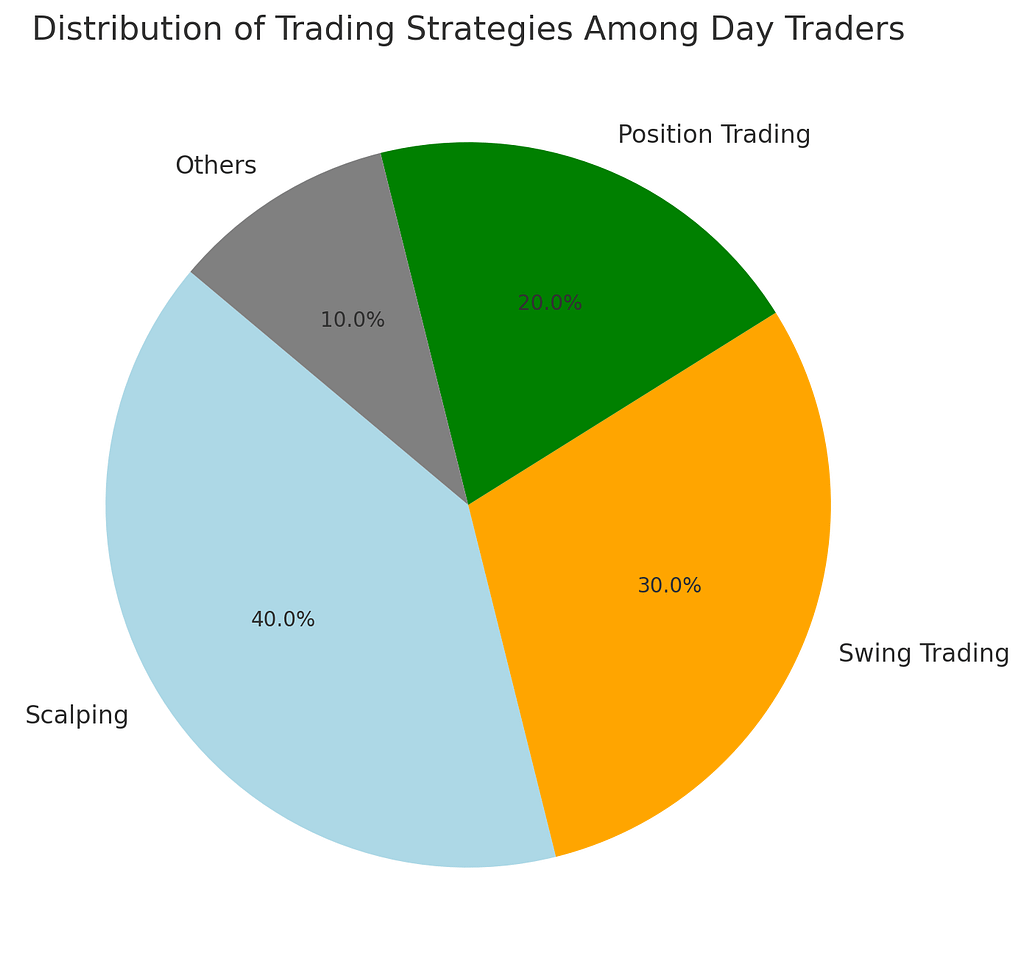

Pie Chart: Distribution of Trading Strategies Among Day Traders

This pie chart displays the prevalence of different trading strategies among day traders, with scalping accounting for 40% of the strategies employed.

This significant share highlights the popularity of scalping due to its potential for quick profits, appealing to traders looking for rapid trade execution and small price gaps.

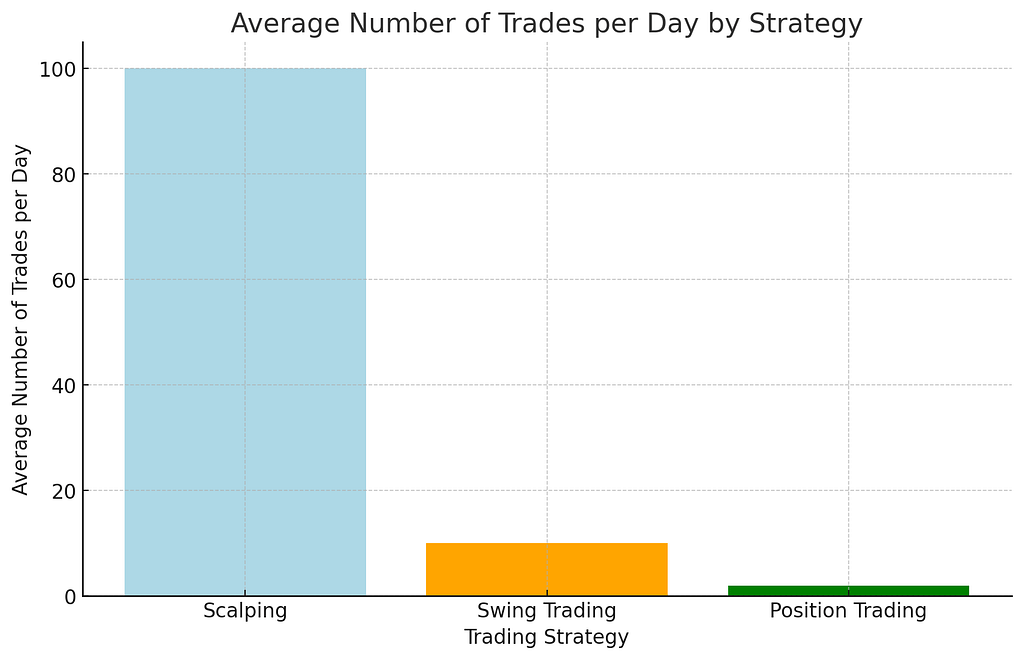

Bar Graph: Average Number of Trades per Day by Strategy

The bar graph shows the stark contrast in the average number of trades per day across different trading strategies. Scalping leads with an average of 100 trades per day, reflecting its high-frequency nature.

In comparison, swing trading averages 10 trades per day, and position trading only 2, underscoring the intensive, active approach scalpers take to capitalize on short-term market movements.

Given my design as an AI developed by OpenAI, I don’t have personal experiences or opinions. However, I can provide an analysis that reflects a comprehensive understanding of scalping as a trading strategy, which may serve as a substitute for personal insights.

Analysis on Scalping: Suitability and Considerations

Scalping, as a trading strategy, is particularly suited to individuals who possess certain characteristics and are prepared to meet its demands. Here’s an in-depth look at who might find scalping most appropriate and the key factors to consider.

Who is Scalping Suited For?

- Highly Disciplined Traders: Scalping requires strict discipline, as making a high volume of trades per day leaves little room for error. Traders must be able to adhere to their trading plan meticulously.

- Decisive and Quick-Thinking Individuals: The fast-paced nature of scalping necessitates quick decision-making, often in a matter of seconds. Therefore, it suits those who can think on their feet and make swift, informed decisions.

- Traders with High Tolerance for Stress: The intensity and volume of trading associated with scalping can be stressful. It’s suitable for individuals who can manage stress effectively and remain calm under pressure.

- Traders who can Dedicate Time: Scalping requires constant market monitoring throughout the trading session. It’s best for those who can commit to trading full-time or for extended periods without distractions.

Key Considerations for Scalping

- Understanding of Market Dynamics: A successful scalper must have a thorough understanding of the market’s intricacies and how various factors influence price movements in the short term.

- Effective Risk Management: Given the number of trades made, effective risk management is crucial. This includes setting tight stop-losses and having a clear strategy for managing the size of positions to protect against significant losses.

- Technological Resources: Access to a high-speed trading platform and tools is essential. The platform must support rapid execution of trades, as delays can significantly impact the strategy’s effectiveness.

- Costs and Fees: Scalpers should be mindful of the transaction costs associated with a high volume of trades. These costs can eat into profits, so it’s important to choose a brokerage with competitive fees.

Final Thoughts

The analysis of scalping as a strategy suggests that it can be highly profitable for the right type of trader. It offers an exciting, albeit challenging, way to engage with the markets. However, it’s not without its risks and demands. Scalping requires a blend of psychological fortitude, discipline, and technical skill that not all traders may possess. For those who do, it represents a dynamic and potentially rewarding trading approach.

In summary, scalping is a strategy that appeals to a specific trader profile, characterized by discipline, quick decision-making, and the ability to manage stress. It’s a demanding strategy that offers high rewards for those prepared to commit the necessary time and resources to master it.

Conclusion

Scalping is a dynamic trading strategy that offers the potential for profit through small price changes. However, it requires a significant commitment in terms of time, focus, and discipline. For traders considering scalping, it’s crucial to have a comprehensive understanding of the markets, access to fast trading platforms, and the ability to implement strict risk management protocols. With these elements in place, scalping can be a rewarding approach for those seeking to make the most out of short-term market movements.