Unlock the power of financial planning tools and apps to manage your finances effectively. Discover key features, benefits, and tips for selecting the right tools for your needs, ensuring a brighter financial future.

Key Takeaways

- Budget Tracking: Essential for daily finance management.

- Investment Integration: Provides a holistic view of financial health.

- Data Security: Ensures personal information is protected.

- Multi-Platform Availability: Access your finances anywhere, on any device.

- Customer Support: Reliable assistance when you need it.

Introduction to Financial Planning Tools and Apps

In an era where financial stability is paramount, financial planning tools and apps stand out as vital resources. Offering a variety of features aimed at managing and enhancing financial resources, these tools are more crucial than ever.

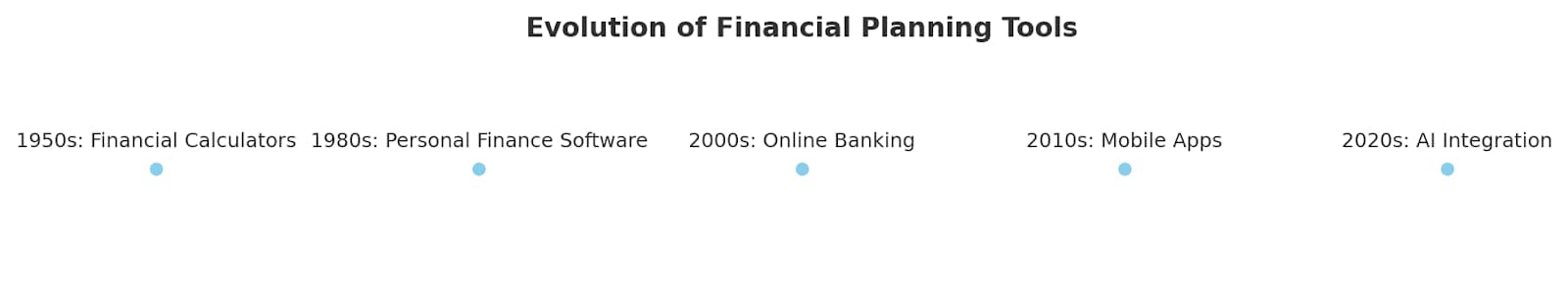

The Evolution of Financial Planning Tools

From traditional ledger books to sophisticated digital platforms, the journey of financial planning tools reflects significant technological advancements and shifts in user needs.

Data Visualization: Timeline of Financial Planning Tools

- 1950s: Introduction of basic financial calculators.

- 1980s: Emergence of personal finance software for early personal computers.

- 2000s: Rise of online banking and budgeting tools.

- 2010s: Expansion of mobile app-based financial planning and investment tools.

- 2020s: Integration of AI and machine learning for personalized financial advice.

Key Features of Modern Financial Planning Apps

The year 2024 heralds a range of user-centric features, from budget tracking to investment integration, emphasizing ease of use and customization.

Benefits of Using Financial Planning Apps

These tools revolutionize fund management, goal setting, and achieving financial clarity, making financial freedom more accessible.

Comparing Top Financial Planning Tools

A comparative analysis reveals standout tools based on functionality, user experience, and affordability, aiding users in informed decision-making.

Security and Privacy in Financial Apps

With data breaches on the rise, ensuring user data security and privacy is a top priority for leading apps in 2024. Protecting your financial information is critical, learn how to safeguard your data.

How to Choose the Right Tool for Your Needs

Choosing the ideal tool involves evaluating personal financial goals, app features, and support levels. Consider your financial objectives and how different tools can help you achieve them.

Conclusion: The Future of Financial Management

Embracing the right financial planning tool can significantly impact your financial well-being. We encourage exploring these modern solutions for organized and promising financial management.