Key Takeaways

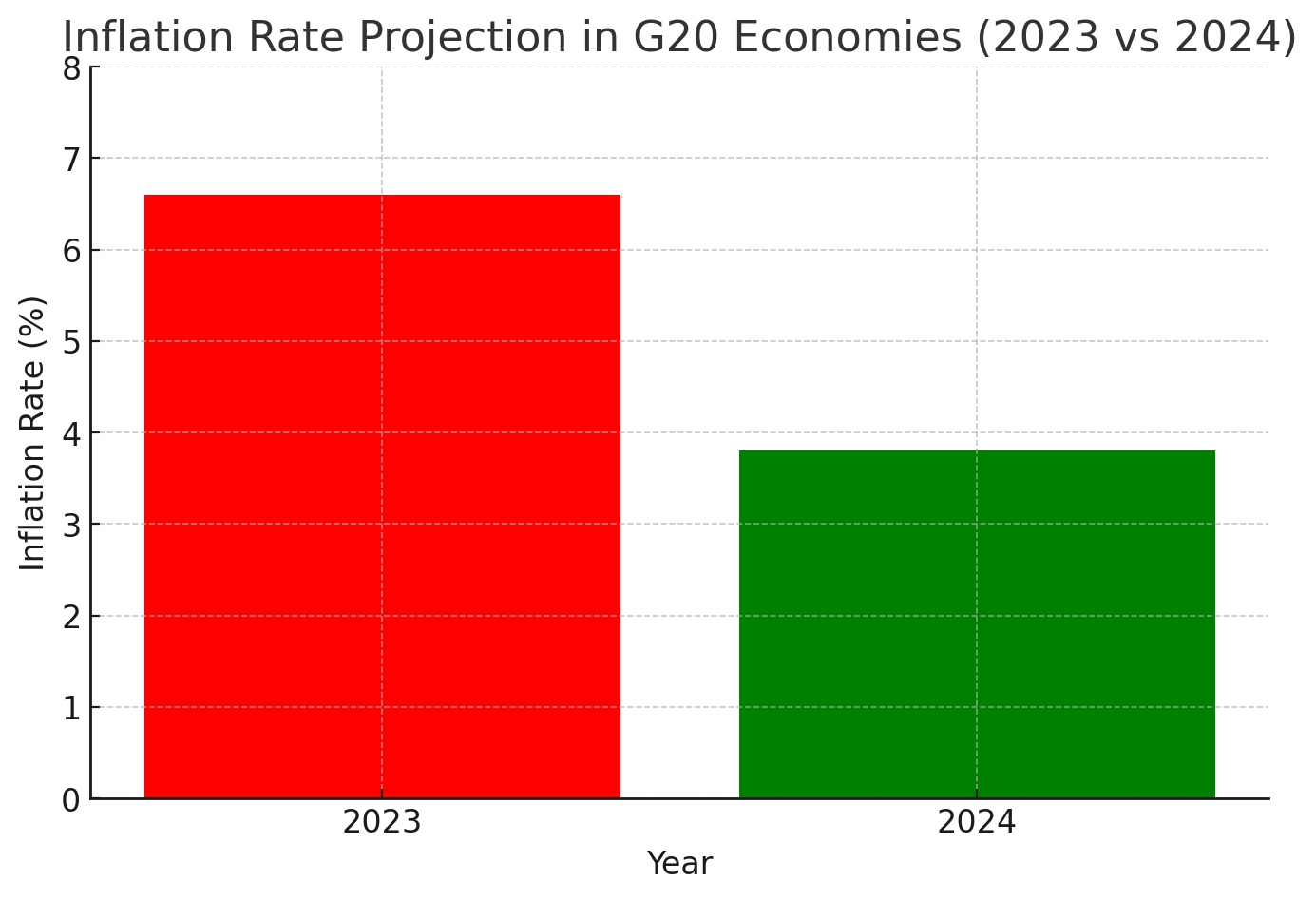

- Understanding Challenges: Inflation, debt, and investment risks are common financial hurdles.

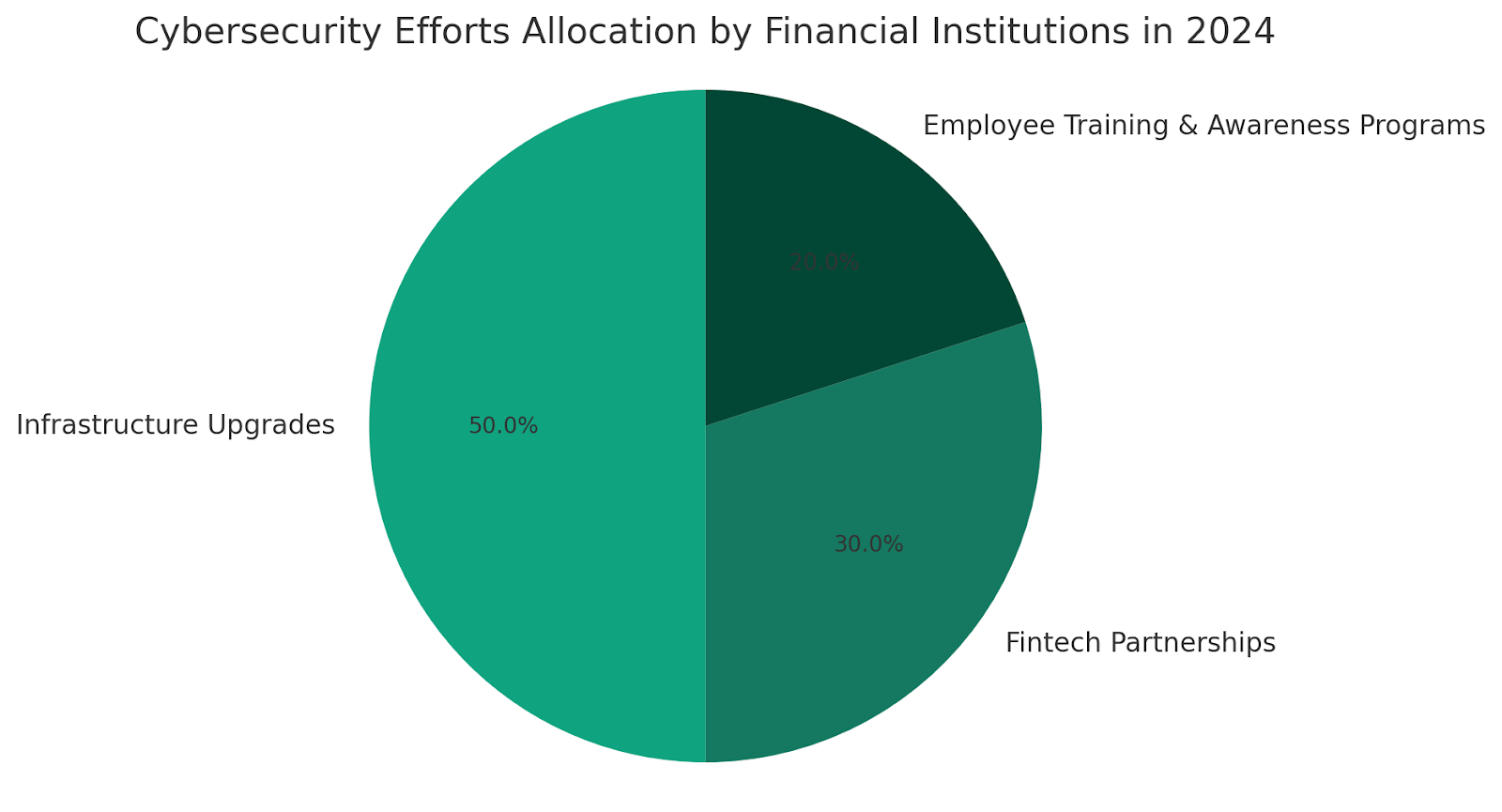

- Technological Advancements: AI, blockchain, and fintech solutions are revolutionizing finance.

- Strategies for Debt Management: Effective management includes budgeting and debt restructuring.

- Smart Investment Choices: Diversify portfolios and consider long-term returns.

- Future Preparedness: Financial planning is crucial for weathering future uncertainties.

In today’s rapidly changing economic landscape, individuals and businesses face myriad financial challenges. From keeping up with inflation to managing debt, the road to financial stability seems increasingly complex. The importance of strategies to navigate these challenges cannot be overstated.

Understanding Financial Challenges

The first step towards overcoming financial difficulties is understanding them. Inflation eats away at your purchasing power, while debt can hinder financial growth and security. Moreover, navigating the investment world without proper knowledge can increase financial risks.

Technological Advancements in Finance

Thankfully, technology offers new paths to managing and overcoming these challenges. Innovations like AI-powered financial tools, blockchain for secure transactions, and user-friendly fintech solutions are creating opportunities for improved financial management.

Strategies for Debt Management

Managing debt effectively requires a strategy — from negotiating lower interest rates to consolidating or restructuring debt. Making informed choices can significantly ease the burden of debt.

Leveraging Investments for Financial Health

Smart investing is about more than picking stocks. It’s about creating a diversified portfolio, understanding your risk tolerance, and having a clear financial goal. Long-term planning and utilizing innovations like robo-advisors can make investing less daunting and more rewarding.

Investing 101: Everything You Need to Know to Get Started

Preparing for the Future

Future financial stability requires planning. Adopting sound financial strategies today can mitigate future uncertainties, ensuring you’re prepared for whatever comes your way.

Conclusion

Facing financial challenges can be daunting, but with the right knowledge and tools, it is possible to navigate these uncertainties. Leveraging technology for better financial management, adopting effective debt strategies, and making smart investments are steps in the right direction.

We invite you to explore more financial management tools and resources. Embracing technology and strategic planning are your allies in achieving financial stability and preparedness for the future.