Key Takeaways:

| Key Point | Summary |

|---|---|

| Risk Tolerance | Understand your comfort with risk before investing. |

| Minimum Investments | It’s possible to start investing with as little as $10. |

| Diversification | Spread investments across various assets to mitigate risk. |

| Financial Advisors | Seek professional advice for personalized investment strategies. |

| Emergency Funds | Establish a solid fund before stepping into the investment world. |

| Continuous Education | Educate yourself continuously for making informed decisions. |

Introduction

Investing is not just for the wealthy; it’s a path to building wealth. The world of investing can be complex, but we’re here to make it straightforward, especially if you’re just starting in 2024.

Understanding Risk and Return

At the core of investing is the relationship between risk and return. High-risk investments like stocks can potentially deliver higher returns but come with more uncertainty. Conversely, low-risk options such as HYSEs, CDs, or MMAs provide stability but at lower growth rates.

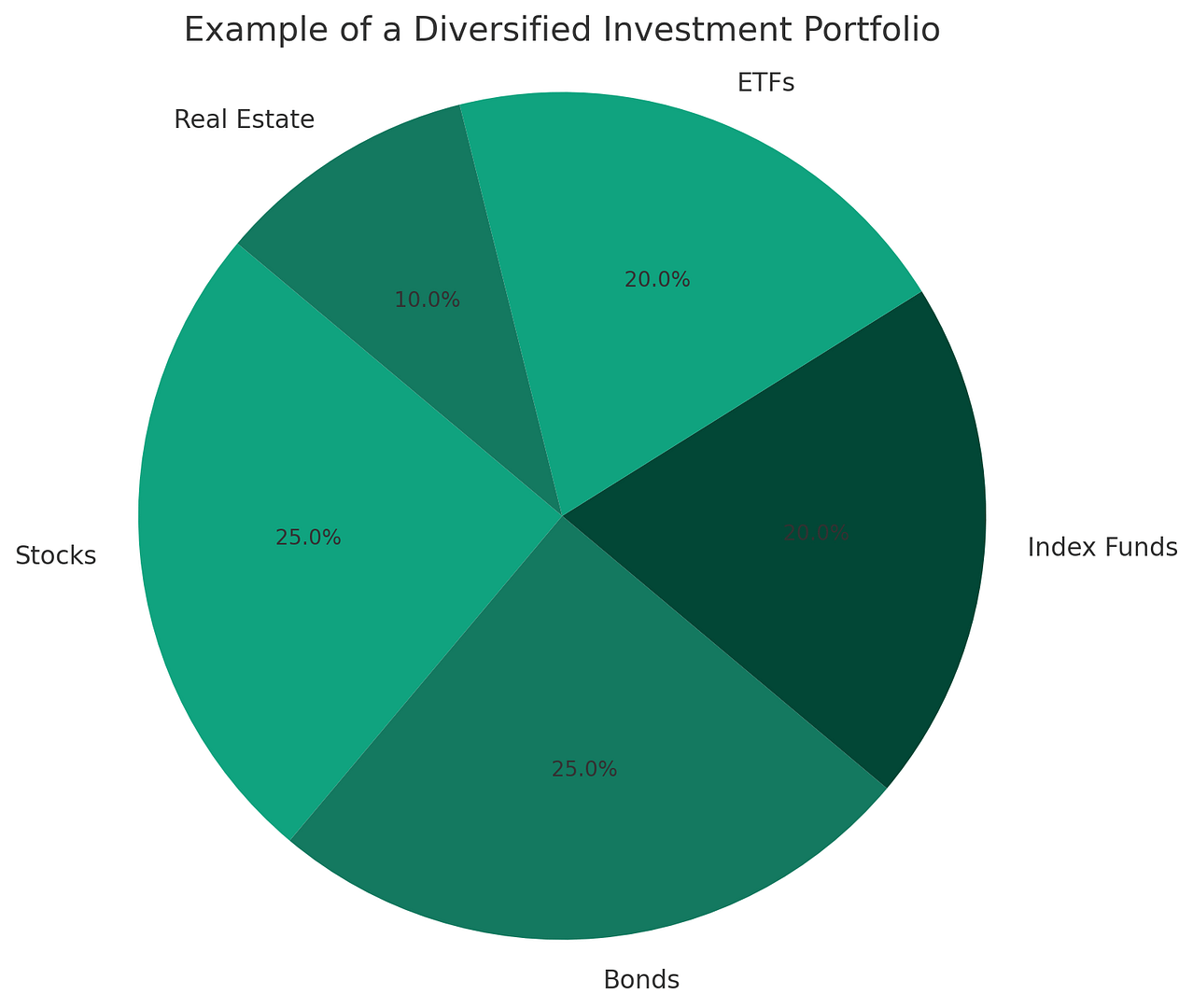

The Basics of Diversification

One key strategy in managing investment risk is diversification. It’s about not putting all your eggs in one basket. By spreading your investments across different asset classes, you reduce the risk of significant losses.

Starting Small in Investments

You might think you need a lot of money to start investing, but that’s not true. With investment minimums decreasing, it’s possible to begin with as little as $10. Every tiny amount can grow over time thanks to the power of compound earnings.

Learn More about Starting Small in Investments

Choosing the Right Investment Account

Whether it’s an IRA, a Roth IRA, or a traditional brokerage account, selecting the right investment account is crucial. Each account type offers different benefits depending on your goals and financial situation.

Passive vs. Active Investing

Passive investments, like index funds, require less hands-on management and typically have lower fees. Active investing involves more direct management and is suited for those who prefer a hands-on approach.

| Investment Strategy | Management | Fees |

|---|---|---|

| Passive | Minimal | Low |

| Active | Hands-on | High |

Choosing Between Passive and Active Investing Strategies

Consulting with Financial Advisors

Financial advisors can help clarify your financial goals and suggest the best investment strategies tailored to your needs and risk tolerance. Make sure you choose a fiduciary who has your best interest at heart.

How to Choose the Right Financial Advisor

The Importance of Emergency Funds

Before you dive into investing, ensure you have a solid emergency fund set up. This fund acts as a financial buffer to cover unexpected expenses without derailing your investment plans.

The Perpetual Student of Investing

The world of investing is always evolving. Staying informed and continuously learning is key to making wise investment choices. Utilize reputable sources for your financial education.

Explore Our Financial Education Resources

Conclusion

Stepping into the investment world might seem daunting, but armed with the right information, tools, and a solid plan, it can be a rewarding journey. Start small, stay informed, and consider professional advice to navigate the complexities of personal investing.