In the ever-evolving landscape of investments, commodities have emerged as a distinct asset class that offers both risks and rewards. From precious metals like gold and silver to agricultural products like coffee and wheat, commodities provide investors with a unique opportunity to diversify their portfolios and potentially capitalize on global market trends. In this comprehensive guide, we’ll delve into the nuances of commodity investing, exploring its advantages, risks, and strategies for navigating this dynamic market.

Understanding Commodities

Commodities are raw materials or primary products that serve as inputs for various industries. They can be categorized into several groups, including:

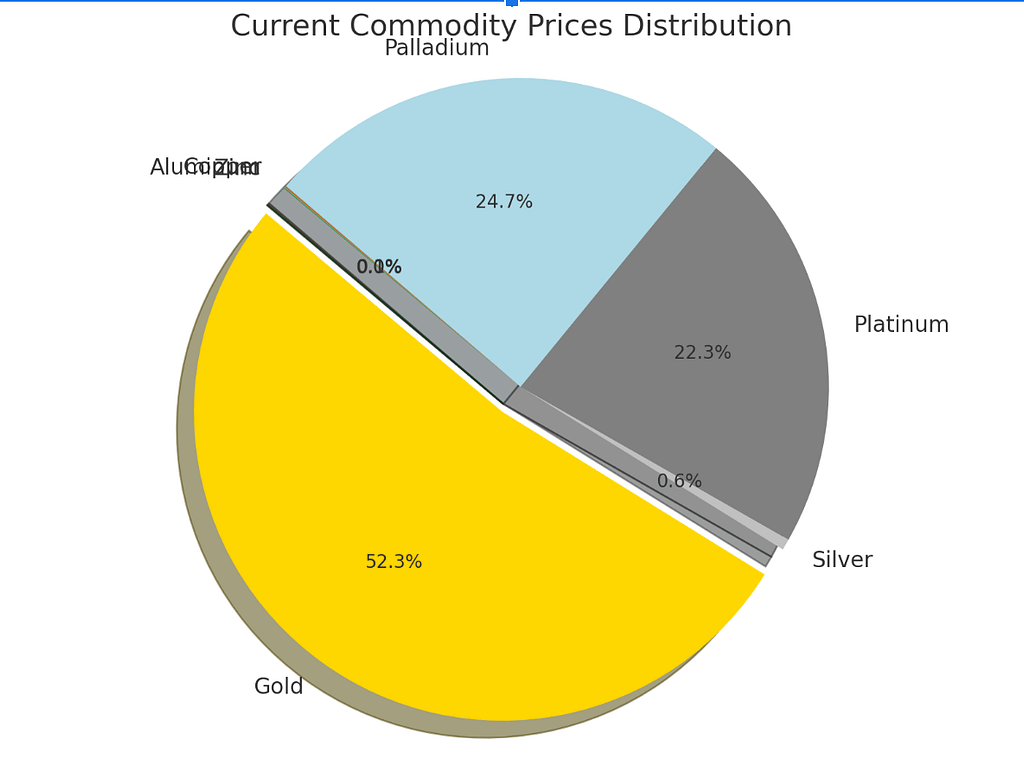

- Precious Metals: Gold, silver, platinum, and palladium.

- Base Metals: Copper, aluminum, zinc, and lead.

- Energy: Crude oil, natural gas, and gasoline.

- Agriculture: Wheat, corn, soybeans, and livestock.

These commodities are traded on global exchanges, and their prices are influenced by a variety of factors, including supply and demand, geopolitical events, weather patterns, and economic conditions.

Advantages of Investing in Commodities

- Diversification: Commodities often have low or negative correlations with traditional asset classes like stocks and bonds, providing portfolio diversification benefits.

- Inflation Hedge: Commodity prices tend to rise in response to inflation, offering a potential hedge against purchasing power erosion.

- Global Demand: With growing populations and industrialization, global demand for commodities remains robust, presenting investment opportunities.

Risks of Commodity Investing

- Volatility: Commodity markets are highly volatile and subject to rapid price fluctuations due to various factors, including supply disruptions and speculative trading.

- Market Unpredictability: Accurately predicting commodity price movements can be challenging due to the complex interplay of supply, demand, and geopolitical factors.

- Storage and Transportation Costs: Physical commodities require storage and transportation, which can add to the overall investment costs.

Strategies for Investing in Commodities

Direct Investment

Investors can purchase physical commodities like gold, silver, or agricultural products and store them securely. However, this approach involves significant logistical challenges and costs.

Futures Contracts

Commodity futures contracts allow investors to buy or sell a specific commodity at a predetermined price on a future date. These contracts provide exposure to commodity price movements without physical ownership.

Commodity ETFs and Mutual Funds

Exchange-traded funds (ETFs) and mutual funds that track commodity indexes or baskets of commodities offer a convenient way to gain exposure to the commodity markets.

Commodity Stocks

Investing in stocks of companies involved in commodity production, processing, or exploration can provide indirect exposure to commodity price movements.

Commodity Trading Risks

While commodity trading can be lucrative, it also carries substantial risks. Here are some key considerations:

| Risk Factor | Description |

|---|---|

| Leverage Risk | Futures contracts involve leverage, amplifying potential gains and losses. |

| Counterparty Risk | Counterparty defaults can lead to financial losses in over-the-counter (OTC) trades. |

| Regulatory Risk | Regulatory changes can impact commodity trading rules and dynamics. |

Conclusion

Investing in commodities can offer diversification benefits and potentially lucrative returns, but it also carries substantial risks. Thorough research, risk management strategies, and a deep understanding of market dynamics are essential for successful commodity investing. By carefully evaluating your investment objectives, risk tolerance, and market conditions, you can make informed decisions and potentially capitalize on the opportunities presented by this dynamic asset class.

Remember, commodity investing is not suitable for all investors, and it’s crucial to consult with financial professionals before allocating a significant portion of your portfolio to this asset class.

Explore our educational resources for more in-depth analysis and expert guidance on various investment topics.