The burden of student debt has become a pressing issue affecting millions of individuals across the United States. As tuition costs continue to rise, students and graduates are facing unprecedented levels of debt, impacting their financial well-being and economic prospects. In this section, we will provide a brief overview of the student debt crisis and outline the purpose of this discussion, which is to explore the potential impact of canceling student debt.

Brief Overview of the Student Debt Crisis

Over the past few decades, the cost of higher education in the United States has skyrocketed, outpacing inflation and wage growth. As a result, more students are relying on loans to finance their education, leading to a staggering increase in student debt levels. According to recent data from the Federal Reserve, the total outstanding student loan debt in the U.S. has surpassed $1.7 trillion, making it the second-largest category of consumer debt after mortgages.

The burden of student debt is not only affecting recent graduates but also impacting individuals of all ages, including older adults who are still repaying loans taken out years ago. Student debt has significant implications for borrowers’ financial well-being, often delaying major life milestones such as buying a home, starting a family, or saving for retirement. Additionally, high levels of student debt can hinder economic mobility, exacerbate wealth inequality, and pose risks to the broader economy.

Statement of Purpose

Given the magnitude of the student debt crisis and its far-reaching implications, it is crucial to explore potential solutions that could alleviate the burden on borrowers and address the broader economic and social impacts. One proposed solution that has gained traction in recent years is the idea of canceling or forgiving student debt. This discussion aims to delve into the potential impact of such a policy on individuals, the economy, and society as a whole.

By examining the potential consequences of canceling student debt, we can gain a deeper understanding of the complexities involved and inform discussions on policy interventions aimed at addressing the student debt crisis. From economic implications to socioeconomic effects and policy considerations, this exploration seeks to shed light on the potential benefits and challenges of canceling student debt and its impact on various stakeholders.

Economic Implications

The economic implications of the student debt crisis are profound and wide-ranging, affecting not only individual borrowers but also the broader economy. In this section, we will discuss the current state of student debt in the economy and analyze how canceling student debt could impact consumer spending, saving, and investment.

Discussion on the Current State of Student Debt in the Economy

Student debt has reached unprecedented levels in the United States, with millions of borrowers carrying significant amounts of debt well into their adult lives. This debt burden has far-reaching implications for the economy, affecting everything from household spending to long-term economic growth.

The rising cost of higher education has led to an explosion in student loan borrowing, with many students graduating with tens of thousands of dollars in debt. This debt load can weigh heavily on borrowers, impacting their ability to make major purchases, such as homes or cars, and limiting their discretionary spending.

Furthermore, student debt can also hinder borrowers’ ability to save and invest for the future, as a significant portion of their income may be dedicated to repaying loans. This can have long-term implications for wealth accumulation and retirement preparedness, as individuals with student debt may have less disposable income available for saving and investing.

Analysis of How Canceling Student Debt Could Affect Consumer Spending, Saving, and Investment

Canceling student debt could have significant implications for consumer spending, saving, and investment. On one hand, eliminating or reducing student debt obligations would free up disposable income for affected borrowers, potentially leading to an increase in consumer spending.

With more disposable income available, borrowers may feel more confident making major purchases and contributing to economic growth. Increased consumer spending could stimulate demand for goods and services, benefiting businesses and contributing to overall economic activity.

Additionally, canceling student debt could also have positive effects on saving and investment. With less debt to repay, borrowers may be able to allocate more funds towards saving for emergencies, retirement, or other financial goals. This could lead to an increase in personal savings rates and provide a boost to investment in financial markets.

However, it’s important to consider the potential trade-offs and unintended consequences of canceling student debt. While it may stimulate short-term economic activity, there could be long-term implications for government finances, credit markets, and moral hazard. Additionally, the distributional effects of debt cancellation would need to be carefully considered to ensure that the benefits are equitably distributed across society.

In summary, the economic implications of canceling student debt are complex and multifaceted, with potential effects on consumer spending, saving, and investment. While debt cancellation may provide short-term relief for borrowers and stimulate economic activity, careful consideration of the broader economic consequences is essential to inform policy decisions in addressing the student debt crisis.

Socioeconomic Effects

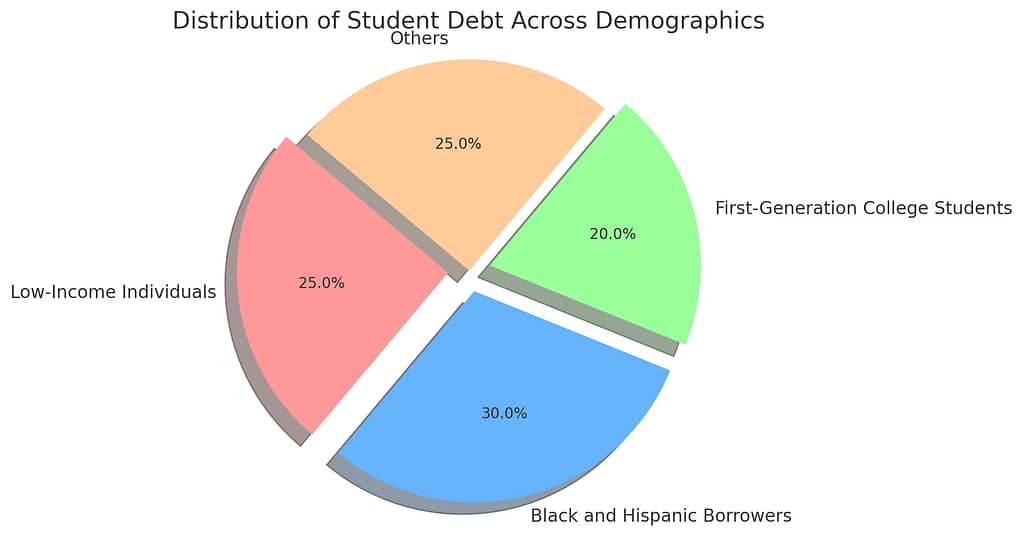

The impact of student debt extends beyond individual borrowers, affecting entire communities and exacerbating existing socioeconomic disparities. In this section, we will examine how student debt disproportionately affects certain demographics and explore the potential social and economic benefits of canceling student debt for affected individuals and communities.

Examination of How Student Debt Disproportionately Affects Certain Demographics

Student debt disproportionately affects certain demographic groups, including low-income individuals, Black and Hispanic borrowers, and first-generation college students. These groups are more likely to borrow larger amounts to finance their education and face greater challenges in repaying their loans.

Low-income individuals often have fewer financial resources to cover college costs upfront, leading them to rely more heavily on student loans. As a result, they may graduate with higher levels of debt relative to their income, making it more difficult to repay their loans and achieve financial stability.

Similarly, Black and Hispanic borrowers are more likely to borrow for college and tend to borrow larger amounts compared to their white counterparts. This racial disparity in student debt contributes to wealth inequality, as Black and Hispanic households typically have lower levels of wealth and assets to draw upon to repay their loans.

First-generation college students, who may lack family support and guidance in navigating the college financial aid process, are also more likely to borrow for college and accumulate higher levels of debt. This can perpetuate cycles of intergenerational poverty and limit economic mobility for these individuals and their families.

Exploration of the Potential Social and Economic Benefits of Canceling Student Debt

Canceling student debt has the potential to provide significant social and economic benefits for affected individuals and communities. By alleviating the burden of student debt, borrowers could experience improved financial well-being, increased disposable income, and greater economic mobility.

For low-income individuals and marginalized communities, debt cancellation could provide much-needed relief from financial stress and create opportunities for upward economic mobility. With reduced debt obligations, borrowers may be better positioned to pursue further education, start businesses, or invest in their communities.

Additionally, canceling student debt could have positive ripple effects on the broader economy. Increased consumer spending by relieved borrowers could stimulate demand for goods and services, creating job opportunities and supporting economic growth. Moreover, debt cancellation could contribute to a more equitable distribution of wealth and resources, narrowing socioeconomic disparities and fostering a more inclusive economy.

Furthermore, debt cancellation could have positive social implications, such as improving mental health outcomes for borrowers struggling with the stress and anxiety of managing student debt. It could also promote social cohesion and strengthen social bonds within communities by reducing financial burdens and increasing opportunities for social and economic participation.

In conclusion, student debt disproportionately affects certain demographic groups and perpetuates socioeconomic disparities. Canceling student debt has the potential to provide significant social and economic benefits for affected individuals and communities, including improved financial well-being, increased economic mobility, and greater social cohesion. By addressing the student debt crisis, we can work towards creating a more equitable and inclusive society for all.

Policy Considerations

Addressing the student debt crisis requires thoughtful policy interventions that balance the need for relief for borrowers with the broader economic and societal implications. In this section, we will discuss potential policy approaches to canceling student debt and analyze the implications of different policy options on the economy, taxpayers, and future generations.

Discussion on Potential Policy Approaches to Canceling Student Debt

There are several potential policy approaches to canceling student debt, each with its own set of implications and considerations. One approach is blanket debt cancellation, which would involve forgiving all or a significant portion of outstanding student loan debt for borrowers. This approach aims to provide broad relief to borrowers burdened by student debt, regardless of their financial circumstances.

Another approach is targeted debt cancellation, which would focus on providing relief to specific groups of borrowers who are most in need, such as low-income individuals, borrowers from historically marginalized communities, or borrowers who attended for-profit institutions with high default rates. This approach seeks to address disparities in student debt burden and provide targeted relief to those who need it most.

Additionally, policymakers could consider implementing reforms to existing student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or income-driven repayment plans. These programs aim to provide relief to borrowers who work in certain public service fields or have low incomes relative to their debt, but they often have complex eligibility requirements and limited effectiveness in providing relief to all borrowers.

Analysis of the Implications of Different Policy Options

Each policy approach to canceling student debt comes with its own set of implications for the economy, taxpayers, and future generations. Blanket debt cancellation, while providing immediate relief to borrowers, could have significant budgetary implications and raise concerns about moral hazard, as it may incentivize future generations to take on more debt with the expectation of forgiveness.

Targeted debt cancellation, on the other hand, could help address disparities in student debt burden and provide relief to those most in need, but it may not provide sufficient relief to all borrowers or fully address the systemic issues driving the student debt crisis.

Reforms to existing loan forgiveness programs could streamline the process for borrowers and provide more targeted relief to specific groups, but they may not be sufficient to address the magnitude of the student debt crisis or provide relief to all borrowers struggling with debt.

Moreover, policymakers must consider the broader economic and societal implications of debt cancellation, including its impact on credit markets, government finances, and the higher education sector. They must also consider the potential effects on future generations, ensuring that any policy interventions do not create unintended consequences or exacerbate existing challenges.

In conclusion, addressing the student debt crisis requires careful consideration of potential policy approaches and their implications for borrowers, taxpayers, and future generations. Policymakers must balance the need for relief for borrowers with the broader economic and societal considerations to ensure effective and equitable solutions to the student debt crisis.