Futures trading is a pivotal component of the financial markets, enabling traders and investors to speculate on price movements and hedge against potential risks. This overview will delve into the basics of futures trading, underscore the roles of speculation and hedging, and guide newcomers on embarking on their futures trading journey.

Understanding Futures Trading

Futures contracts are standardized agreements to buy or sell a specific asset at a predetermined price on a specified future date. These contracts are traded on futures exchanges and cover a variety of asset classes, including commodities, currencies, indices, and interest rates.

Key Concepts

- Contract Size: The amount of the asset covered by the contract.

- Expiration Date: The date when the contract must be settled by physical delivery or cash settlement.

- Margin: A performance bond or deposit required to open and maintain positions, ensuring the financial integrity of the trading process.

The Role of Speculation and Hedging

Futures trading serves two primary purposes: speculation and hedging. Speculators aim to profit from price changes in the futures contracts, while hedgers use these contracts to protect against adverse price movements in the underlying asset.

Speculation

Traders speculate on the direction of asset prices to generate profits. This involves buying contracts when prices are expected to rise (going long) or selling contracts when prices are anticipated to fall (going short).

Hedging

Hedging involves taking a position in the futures market that is opposite to one’s position in the physical market to offset potential losses. For example, a farmer might sell futures contracts on wheat to lock in a price, protecting against the risk of falling prices before harvest.

Getting Started in Futures Trading

Embarking on futures trading requires careful preparation, including understanding the market, choosing a broker, and developing a trading plan.

Steps to Get Started

- Educate Yourself: Learn the fundamentals of futures trading and familiarize yourself with the market dynamics.

- Choose a Broker: Select a reputable broker that provides access to the futures markets and offers robust trading platforms and tools.

- Develop a Trading Plan: Outline your trading strategy, risk management techniques, and goals.

Visual Insights: The Futures Trading Landscape

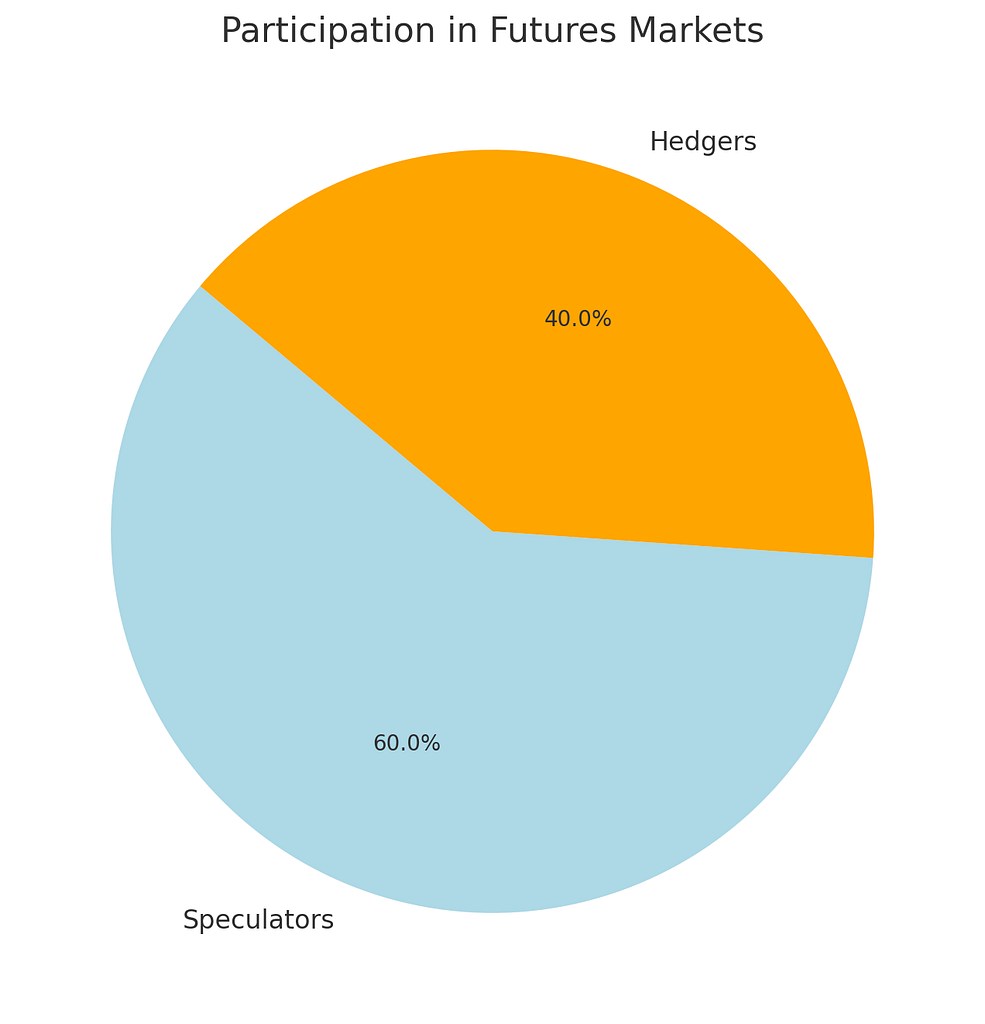

Pie Chart: Participation in Futures Markets

This pie chart displays the distribution of market participants, with speculators accounting for 60% and hedgers making up 40%.

The chart highlights the significant role of speculation in driving trading volume and liquidity in futures markets, indicating that a large portion of activity stems from traders aiming to profit from price movements rather than hedging against them.

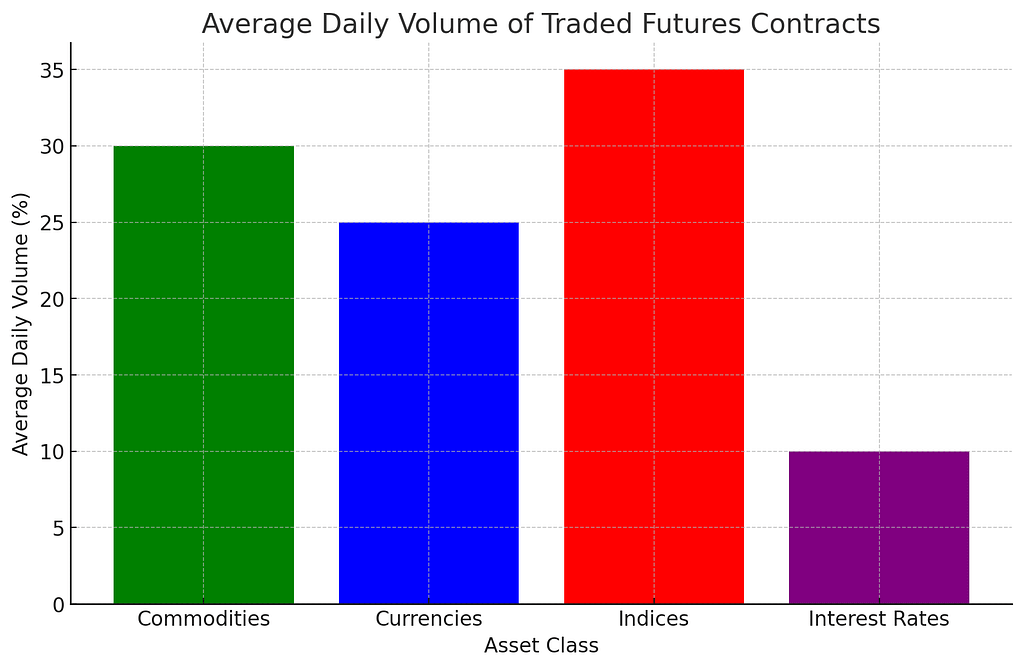

Bar Graph: Average Daily Volume of Traded Futures Contracts

The bar graph showcases the diversity in futures trading by illustrating the average daily volume of traded futures contracts across different asset classes.

Indices lead with 35%, followed by commodities at 30%, currencies at 25%, and interest rates at 10%.

This distribution indicates the popularity of indices and commodities among traders, reflecting their interest in a wide range of markets and the various opportunities they offer for speculation and hedging.

Conclusion

Futures trading offers a versatile platform for market speculation and hedging, presenting opportunities for profit and risk management. Whether you’re looking to speculate on price movements or hedge against future price risks, understanding the basics of futures trading is the first step toward navigating this complex market. By educating yourself, choosing the right broker, and adhering to a disciplined trading plan, you can embark on a potentially rewarding futures trading journey.