As an investor always on the lookout for progressive opportunities, I’ve observed the growing buzz around PAMM accounts. I’m here to take you through a journey of discovery, deciphering the varied aspects of investing through PAMM accounts. It’s one of those investment channels that blend the potential for significant returns with the ease of having seasoned traders manage your investments. However, this comes with its own set of risks and rewards. In my endeavor to unpack the PAMM account benefits, I’ll also delve into the best PAMM account strategies and give you the lowdown on how you can maneuver through this investment landscape securely and profitably.

Key Takeaways

- Understanding the structure and operational mechanics of PAMM accounts is crucial for informed investing.

- Assessing the balance of PAMM account risks and rewards aids in determining suitability for individual investment profiles.

- PAMM account strategies can significantly influence the success of an investor’s portfolio.

- Engagement in PAMM accounts requires a careful analysis of the account manager’s past performance and management style.

- Strategic investment in PAMM accounts can result in substantial benefits when done with meticulous risk management.

- Diversification may play a pivotal role in reducing risks and enhancing rewards within PAMM account investing.

- Transparency in fee structures of PAMM accounts is essential for evaluating the true potential of the investment’s returns.

Understanding PAMM Accounts and How They Work

As an investor, navigating the sea of investment opportunities can be overwhelming. To steer you in the right direction, let’s embark on an exploratory journey into the world of PAMM accounts. This particular investment vessel may not be as familiar to you as stocks or bonds, but it plays a significant role in the world of Forex trading, where both expert strategies and investment capital come together in a unique way.

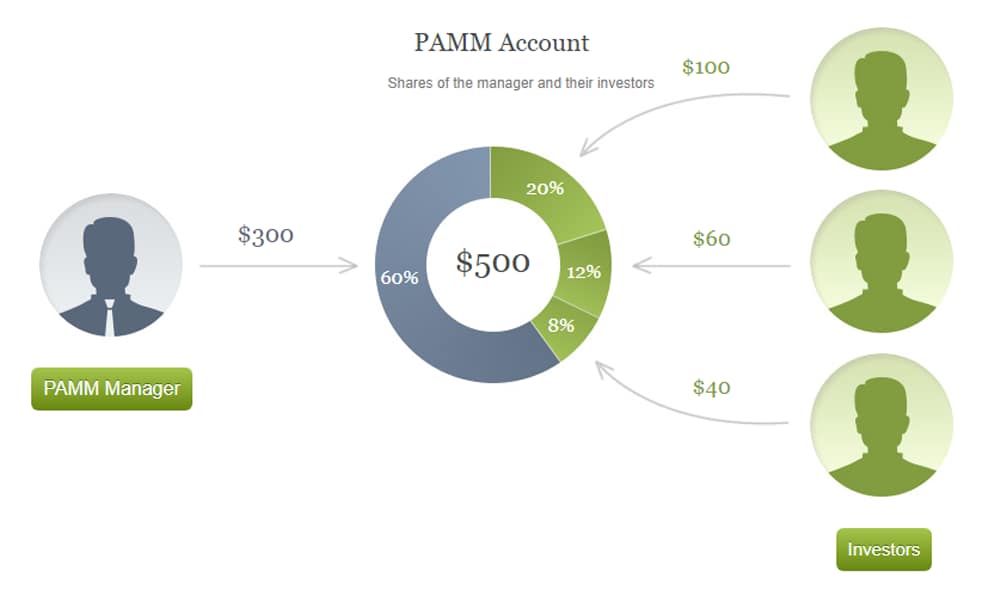

What is a PAMM Account?

A PAMM account, standing for Percentage Allocation Management Module, is a type of Forex account that allows investors to allocate a percentage of their money to be managed by a trader or fund manager. The PAMM account manager trades on behalf of the investors, with profits and losses distributed proportionally. Thus, PAMM account management is critical, as the performance of the manager directly influences the outcomes for investors.

The Basic Structure of a PAMM Account

The structure of a PAMM account is fairly straightforward. It involves an account managed by a professional trader who executes trades. Investors, often referred to as ‘followers’, contribute funds to the PAMM account. Their contribution is not fixed and can be scaled according to their investment capacity or risk preference. PAMM account analysis is essential for followers to assess the performance and tactics of the manager, ensuring their investment objectives are aligned with the trading strategy in place.

How PAMM Accounts Differ From Other Investment Options

Comparing PAMM accounts with other investment alternatives like mutual funds, Exchange-Traded Funds (ETFs), or direct trading accounts, reveals some stark differences. Unlike mutual funds or ETFs, PAMM accounts offer direct exposure to the Forex market with a more hands-on approach by the chosen fund manager. Equally, unlike direct trading accounts, where the individual is responsible for all decisions, a PAMM account allows investors to leverage the expertise and experience of seasoned traders. Here’s a comparative table that succinctly crystallizes these distinctions:

| Investment Type | Direct Market Access | Fund Manager Influence | Investor Involvement |

| PAMM Account | Yes | High | Low |

| Mutual Fund | No | Medium | Low |

| ETF | No | Low | Low |

| Direct Trading Account | Yes | None (self-managed) | High |

Embarking on a PAMM account journey holds the promise of expertise-driven investment in the volatile Forex market. Yet, what must always be at the forefront is rigorous PAMM account analysis and understanding the essence of PAMM account management, ensuring that every nautical mile traversed in this financial ocean is done with a seasoned captain at the helm.

The Attraction of PAMM Accounts for Investors

As an industry insider, I’ve seen firsthand the growing trend in passive investment, and PAMM accounts are at the forefront of this movement. These investment vehicles cater remarkably well to investors who lack the time or expertise to manage their trades but still wish to partake in the financial markets. Let’s explore the compelling reasons why investors are drawn to PAMM accounts and the lucrative rewards they can offer.

The Appeal of Passive Investment Strategies

Passive investment strategies have a magnetic pull for a good reason—they offer an investment experience that is less hands-on, yet can still be highly rewarding. With a PAMM account, an investor can benefit from the skills of seasoned traders without having to constantly monitor markets or make day-to-day decisions. This is particularly appealing for those who have busy careers or prefer to spend their time on other pursuits. It also opens the door for individuals who have an interest in financial markets but might feel intimidated by the complexity of active trading.

PAMM Account Performance Metrics to Consider

When delving into PAMM account performance, I always encourage investors to look beyond the surface. It’s not just about the returns; it’s about understanding the underlying metrics that drive performance. Here are some key performance indicators that can provide deeper insights into a PAMM account’s potential rewards:

- Profit and Loss (P&L): This straightforward metric tells you the net gain or loss the account has experienced over a period.

- Drawdown: The maximum drawdown shows the largest drop from peak to trough in an account’s value, a significant risk factor to consider.

- Risk-Reward Ratio: Evaluating the risk taken per trade against the potential reward can give you a sense of a manager’s trading style and risk tolerance.

- Consistency of Performance: An account that shows consistent returns as opposed to volatile spikes may suggest a more stable investment.

By examining these PAMM account performance metrics, savvy investors can not only anticipate potential rewards but also align their investment choices with their personal risk tolerance and long-term financial goals.

The Risks and Rewards of Investing Through PAMM Accounts

When we delve into the intricate world of PAMM accounts, we’re essentially betting on the dual forces of risk and reward. The allure of potentially high returns coaxes many to step into this arena, yet the associated risks cannot be ignored. As I discern the inherent dynamics of PAMM investing, my focus pivots on a clear communication of what awaits you, the investor, in this financial journey.

Rewards of PAMM Accounts often tempt investors with their promise of high earnings without the need for direct involvement in trading activities. Here are some key rewards:

- Access to skilled money managers’ expertise

- Potential for higher returns compared to traditional savings

- Diversification of investments across various strategies and asset classes

PAMM account risks, on the other hand, are just as real and demand attention:

- Dependence on the manager’s performance and strategy

- Fluctuating or unpredictable returns

- Risk of loss due to market volatility or manager’s poor decision-making

With these points in mind, I encourage investors to think critically about their risk appetite and investment goals. PAMM accounts can be a golden ticket for some, but for others, they may not align with a conservative investment philosophy.

Reflecting on my own experiences, I’ve seen the powerful impact that knowledge and due diligence can have when weighing the potential PAMM account risks against the attractive PAMM account rewards. Ultimately, the choice to invest should harmonize with your financial landscape and the degree of certainty you crave in your investments.

Assessing PAMM Account Management Strategies

When diving into the realm of PAMM account management, I’ve found it crucial to highlight the core attributes that signify a robust strategy. The ability to discern these qualities can serve as a beacon for investors navigating through the diverse selection of PAMM managers. Let’s explore the integral elements that define strong management and the role of historical performance in fine-tuning our selection.

Key Elements of Strong PAMM Account Management

In my analysis of effective PAMM account strategies, I uncovered that the top managers share a common set of characteristics:

- Transparency: They provide clear and understandable performance reports, ensuring that investors are always in the loop.

- Risk Control: They have solid risk management protocols in place, crucial for protecting investments against volatile market swings.

- Consistent Record: They demonstrate a history of consistent performance, hinting at a reliable investment approach.

- Adaptability: They show an ability to adapt strategies in response to changing market conditions, which is vital in the fluid landscape of forex markets.

- Investor Relations: They maintain excellent communication with their investors, building trust and ensuring that all parties are aligned on investment objectives.

Analyzing Historical Performance Data of PAMM Managers

Evaluating the historical performance of PAMM managers is tantamount to performing due diligence before any investment. This review process not only offers insights into the past successes and failures of a manager but also prepares us for potential future outcomes. Let’s look at an example of what essential data to consider:

| Year | Profit/Loss Percentage | Max Drawdown | Number of Trades | Win Ratio |

| 2020 | +18% | -7% | 320 | 65% |

| 2021 | +26% | -5% | 400 | 68% |

| 2022 | +22% | -9% | 370 | 70% |

The table above paints a clear picture of a PAMM manager’s performance over the years. By closely inspecting these figures, I’m able to discern the level of consistency in their results and understand the risks involved. A PAMM manager with such a performance profile would likely be a strong candidate for those looking to tap into PAMM account strategies with a sense of reassurance and anticipation of fruitful outcomes.

PAMM Account Risks: What Investors Should Watch Out For

When it comes to investing through PAMM accounts, it’s not just the potential profits that catch my eye, but a closer look at the inherent PAMM account risks is essential for informed decision-making. From fluctuating market conditions to the varying skills of account managers, the stakes can be as high as the rewards. In this section, my aim is to illuminate the shadows where these investment risks lurk, providing you with the knowledge needed to navigate them wisely.

Volatility stands out as a significant concern. With assets being traded in often turbulent financial markets, the value of investments under a PAMM account can swing dramatically. It prompts me to ask, “How can these fluctuations impact my investment, and am I comfortable with this level of uncertainty?”

Another aspect is the reliance on a manager’s expertise. No matter how seasoned a manager might appear, their past performance doesn’t guarantee future results. As I peel back the layers, I also consider factors such as the manager’s strategy alignment with my risk tolerance and their decision-making in response to market shifts. An investment can be a mirror, reflecting not only the potential for growth but also the chance of missteps.

- Detailed scrutiny of a manager’s track record

- Understanding the risk management strategies in place

- Being cognizant of the market trends affecting traded assets

Investing through PAMM accounts presents a complex tapestry of risks and opportunities. As I compile these cautionary notes, from the deep-diving inspection of manager profiles to measuring the tremors of market volatility, my goal is to equip you to make the most informed investment choices in your portfolio.

Maximizing PAMM Account Rewards: Tips and Best Practices

As an investor, the objective of delving into PAMM accounts is to amplify the potential financial gains. To ensure we’re on the path to maximizing PAMM account benefits, let’s explore some strategic angles and best practices that can elevate the profitability of these investments.

Strategically Selecting PAMM Accounts

Selecting the right PAMM account is not a matter of luck; it’s a decision molded by careful analysis and understanding of individual financial goals. I emphasize looking for accounts managed by seasoned professionals with a transparent track record. Diving into their historical performance, investment style, and risk tolerance levels can offer significant insight into whether their approach aligns with your investment objectives.

- Examine the manager’s performance over various market conditions to ensure consistency.

- Check for alignment between the manager’s risk approach and your own risk profile.

- Prioritize clear communication and regular reporting from the manager to maintain transparency.

Effective Risk Management Techniques

Mitigating risks is integral to safeguarding your investment in a PAMM account. Employing effective risk management techniques can serve as a protective buffer against market volatility. Setting loss limits and diversifying across different PAMM accounts or asset classes are prudent steps in building a resilient investment portfolio.

- Allocate funds across several PAMM accounts to disperse risk.

- Implement stop-loss orders to protect your capital against severe downturns.

- Regularly review your investment strategy in response to changing market dynamics.

In concluding this section, remember that exploiting the PAMM account rewards entails more than just understanding the benefits; it requires a hands-on approach to strategic selection and risk management. By adhering to these tips and best practices, investors can foster a rewarding PAMM account experience grounded in savvy decision-making and prudent financial scrutiny.

The Role of Diversification in PAMM Account Investing

As I delve further into the realm of PAMM accounts, I’ve come to appreciate the strategic importance of PAMM account diversification. By allocating funds across various PAMM accounts, investors can achieve a more balanced investment portfolio. This strategy potentially mitigates risk while still allowing for exposure to the promising rewards that PAMM accounts can offer. So, let’s explore how diversification influences the dynamics of risk and reward in the context of PAMM account investing.

How Diversification Affects Risk and Reward in PAMM Accounts

The concept of “don’t put all your eggs in one basket” is highly relevant when it comes to investing through PAMM accounts. To put it simply, diversification allows you to spread your investment risk among different assets or strategies. For instance, you might choose to invest in PAMM accounts managed by traders with various levels of aggression in their trading styles or across different markets and financial instruments. In effect, if one account suffers a downturn, the others may not be as adversely affected, which can protect your overall investment value from significant swings.

Diversifying Across Multiple PAMM Accounts

One of the PAMM account strategies that I find particularly pertinent is dividing your capital amongst several PAMM accounts. But the question is, how do you choose the right mix? It’s essential to analyze the historical performance, risk levels, and the trading strategy of each PAMM manager. I’ve developed a handy table to guide you through the factors worth considering:

| Factor | Impact on Diversification | Examples |

| Manager’s Track Record | Provides insight into reliability and performance consistency. | Years of profitable trading, recovery from drawdowns. |

| Risk Level | Helps balance high-risk and low-risk PAMM accounts for an averaged risk profile. | Aggressive vs. conservative trading strategies. |

| Market Diversity | Spreads risk across different markets which may react differently to the same event. | Forex, commodities, indices, and cryptocurrencies. |

| Correlation | Investing in managers with low-correlation strategies can reduce portfolio volatility. | Divergent strategies that typically don’t follow the same market movements. |

Remember, while diversification is a valuable tool in PAMM account investing, it’s no silver bullet. It cannot eliminate risk entirely, but it’s a critical component in crafting an effective PAMM account strategy. In my journey as an investor, I’ve certainly realized that a well-diversified PAMM portfolio can bring peace of mind while navigating the ebb and flow of the markets.

Real World Examples of PAMM Account Successes and Failures

In my journey to understand the landscape of PAMM accounts, nothing has been more enlightening than examining real-life cases where investors have either flourished or floundered. These examples have allowed me to grasp the tangible effects of PAMM account strategies and the critical importance of comprehensive PAMM account analysis. Let’s delve into some compelling stories that underscore the diverse outcomes in PAMM account performance.

Case Studies of Profitable PAMM Account Investments

Through a detailed analysis of successful PAMM accounts, I’ve been privy to a variety of effective approaches. Many prosperous investors prioritize accounts managed by those with transparent trading histories and consistent performance metrics. For example, a retail investor who allocated funds into a diversified PAMM portfolio showcased a remarkable return by selecting managers with steady year-over-year growth. This reinforces the importance of due diligence and the impact of analytical savvy in PAMM investments.

Lessons Learned From PAMM Account Losses

On the flip side, I’ve come across unhappy tales where investors have faced losses. Often, these losses stemmed from an inadequate risk assessment and failure to monitor PAMM account performance regularly. One such unfortunate event involved an investor who failed to realize their PAMM manager had deviated from their stated strategy. This underscores a crucial lesson: Constant vigilance in PAMM account analysis is essential for early detection of warning signs, allowing investors to mitigate potential losses promptly.

Honing in on PAMM Account Fees and their Impact on Returns

When exploring the landscape of PAMM account management, a keen eye on fee structures is paramount to ensuring that the PAMM account benefits you anticipate are not overshadowed by costs. Just like any managed investment service, PAMM accounts have intricacies in fee models that can significantly affect profitability. I’ve taken a critical look at these fees to help you discern how they might influence your net returns, and what you should be attentive to when selecting a PAMM account.

Fees in PAMM accounts might include management fees, performance fees, and sometimes even entry or exit fees. Management fees are charged for the ongoing operation of the account, while performance fees are a cut of the profits earned, generally adhering to the High Water Mark principle to align with investors’ interests. It’s important for you to delve into these fee particulars as they directly eat into your investment returns. By understanding the fee structure in detail, you’ll be better equipped to pick a PAMM account that offers a favorable balance between the costs and the potential benefits.

Moreover, grappling with the fee specifics allows for a more transparent assessment when comparing different PAMM accounts. Monitoring these expenses is a crucial part of savvy PAMM account management—after all, the lower the fees you incur, the higher your share of the profits. Always remember, even minor differences in fee percentages can amount to a significant impact over time. So, don your analytical hat and scrutinize those fees, for they are a decisive factor in the fruitful cultivation of your investment portfolio through PAMM accounts.