In the world of trading, deciding between day trading and swing trading is pivotal. Both strategies offer distinct approaches to the markets, with differences in time commitment, risk tolerance, and potential returns. This comparative analysis will highlight the key aspects of day trading and swing trading, helping you determine which path aligns best with your trading style and objectives.

What is Day Trading?

Day trading involves buying and selling financial instruments within the same trading day. Traders capitalize on small price movements and close all positions before the market closes to avoid overnight market volatility. It requires quick decision-making, constant market monitoring, and a thorough understanding of short-term market movements.

Advantages of Day Trading

- Quick Returns: Profits are realized within the same day, allowing for fast capital turnover.

- No Overnight Risk: Positions are not held overnight, mitigating the risk of significant adverse movements due to after-hours news or events.

What is Swing Trading?

Swing trading is a strategy that involves holding positions for several days to weeks to capture gains from expected price “swings.” Swing traders rely on technical analysis and market trends, requiring less constant monitoring compared to day trading. This approach suits those who cannot dedicate entire days to trading but still seek active involvement in the markets.

Advantages of Swing Trading

- Flexibility: Less time-intensive, allowing traders to maintain a regular job or other commitments.

- Potential for Larger Gains: Positions held over days or weeks may capture larger market movements than day trading.

Comparing Day Trading and Swing Trading

| Feature | Day Trading | Swing Trading |

|---|---|---|

| Time Commitment | High (Full-time) | Moderate |

| Capital Required | High (due to higher frequency of trades) | Lower (fewer, but larger trades) |

| Risk Level | High (from market volatility) | Moderate (longer timeframes reduce some volatility) |

| Potential Returns | Limited by daily market movements | Can be significant from capturing larger trends |

| Technical Analysis | Essential for short-term predictions | Crucial for identifying trends and entry/exit points |

Visual Insights: Trader Preference and Success Rate

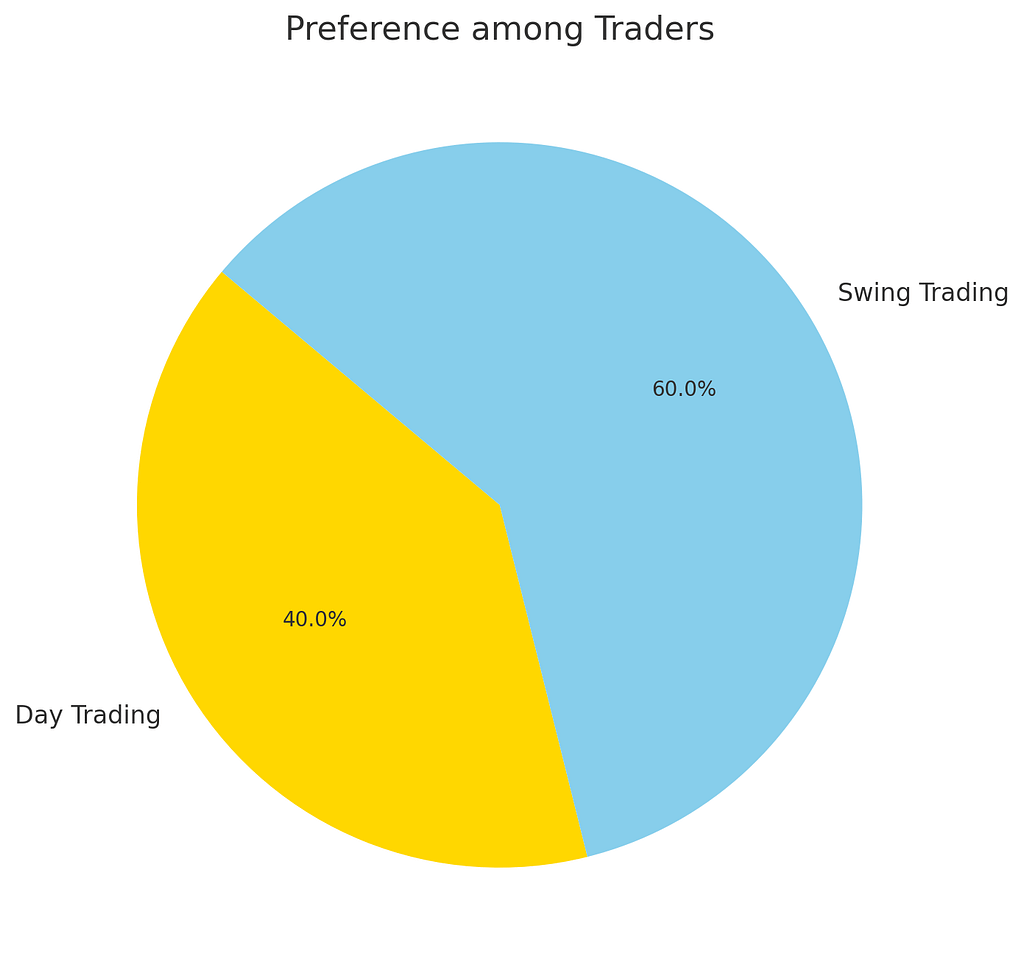

Pie Chart: Preference among Traders

This pie chart shows that 60% of traders prefer swing trading over day trading, which accounts for 40% of the preference.

The higher inclination towards swing trading suggests that traders value the flexibility and potential for capturing larger market movements that this strategy offers.

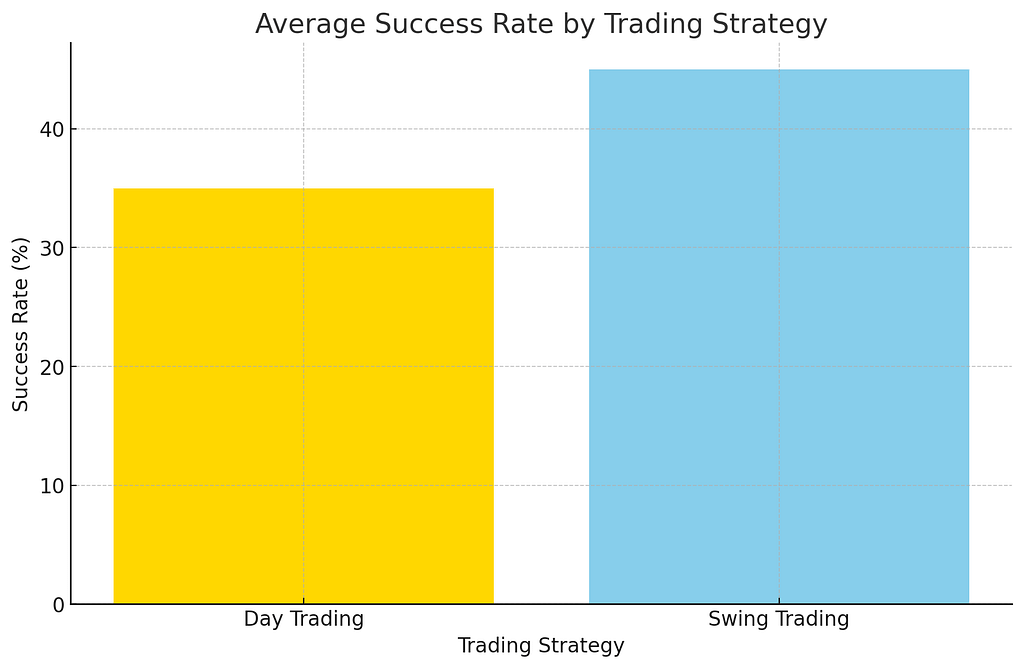

Bar Graph: Average Success Rate by Trading Strategy

The bar graph highlights the average success rates for day trading and swing trading, at 35% and 45% respectively. Swing trading exhibits a slightly higher success rate compared to day trading.

This difference could be attributed to swing trading’s reduced exposure to daily market noise and its ability to leverage more significant trends, potentially leading to more successful outcomes over time.

Conclusion

Choosing between day trading and swing trading depends on various factors, including your available time, capital, risk tolerance, and trading goals. Day trading suits those who can dedicate a significant amount of time and prefer quick returns without overnight risk. Swing trading, on the other hand, is better for individuals seeking flexibility and the potential for larger gains over more extended periods.

Regardless of the path you choose, success in trading requires a solid understanding of market principles, disciplined risk management, and continuous learning. By aligning your trading strategy with your lifestyle and investment goals, you can navigate the markets more effectively and work towards achieving your financial objectives.