The cryptocurrency market, known for its volatility and potential for significant returns, has captured the attention of investors worldwide. This dynamic market offers a unique set of opportunities and challenges, requiring traders to employ specific strategies for successful navigation. This guide provides an overview of the cryptocurrency market, highlights key currencies, outlines effective trading strategies, and emphasizes the importance of risk management.

Overview of the Cryptocurrency Market

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks based on blockchain technology. Unlike traditional currencies, they are immune to government interference or manipulation. The cryptocurrency market is characterized by rapid price movements, making it both appealing and risky for traders.

Key Currencies

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold.

- Ethereum (ETH): Known for its smart contract functionality, it’s the second-largest cryptocurrency.

- Ripple (XRP), Litecoin (LTC), and Cardano (ADA): Other popular cryptocurrencies with unique features and use cases.

Trading Strategies for Cryptocurrencies

Successful cryptocurrency trading requires a well-thought-out strategy. Some of the most common strategies include:

- Day Trading: Involves buying and selling cryptocurrencies within the same trading day, capitalizing on short-term price movements.

- Swing Trading: This strategy aims to capture gains in a crypto asset over a few days to weeks.

- Scalping: A strategy that focuses on making small profits on minor price changes, often executed numerous times a day.

- HODLing: Derived from a misspelling of “hold,” it refers to buying and holding a cryptocurrency long-term, based on its potential future value.

Risk Management in Cryptocurrency Trading

Effective risk management is crucial in the highly volatile cryptocurrency market. Key practices include:

- Setting Stop Losses: Limits potential losses by setting a predetermined price at which your position will automatically close.

- Diversification: Spreading investments across different cryptocurrencies to reduce risk.

- Understanding Leverage: Trading with leverage can amplify gains but also losses, so it’s important to use it wisely.

Visual Insights into Cryptocurrency Trading

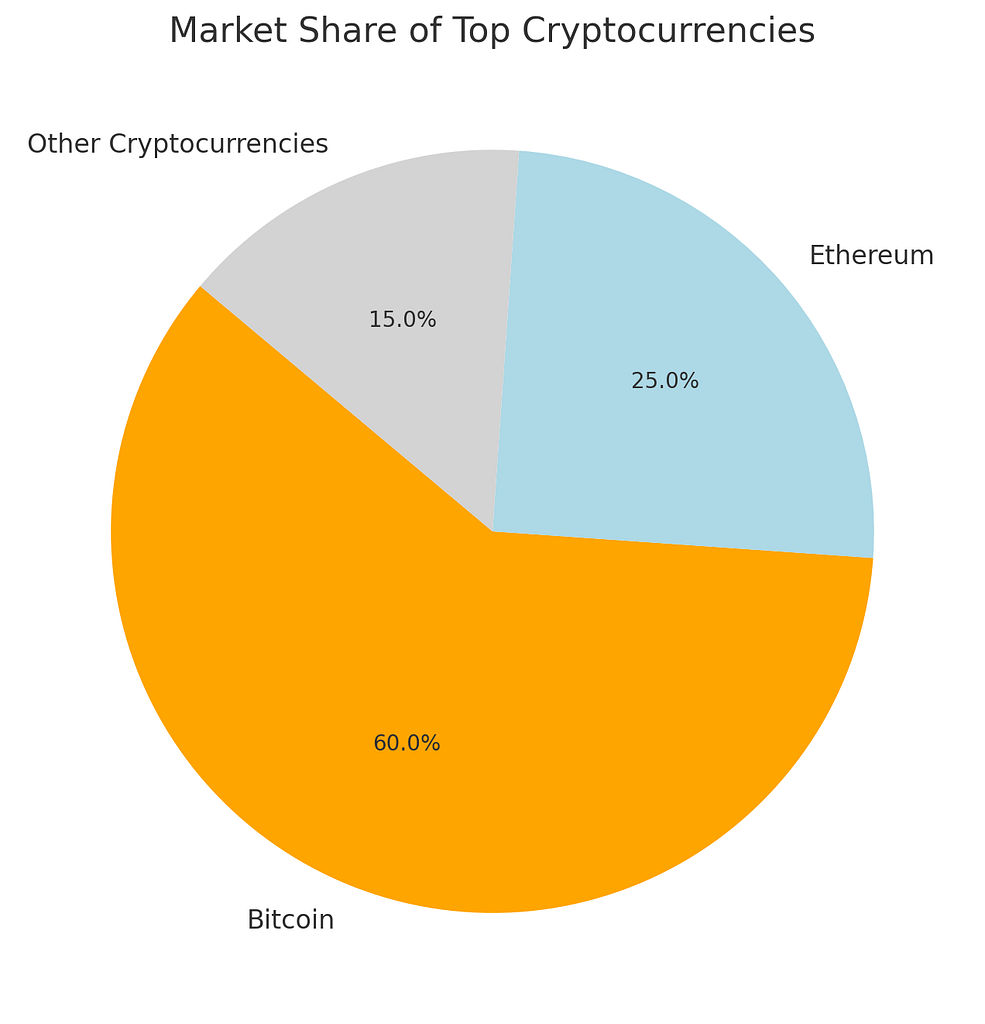

Pie Chart: Market Share of Top Cryptocurrencies

This pie chart shows the distribution of market share among the top cryptocurrencies, with Bitcoin holding a dominant 60%, Ethereum at 25%, and other cryptocurrencies making up the remaining 15%.

The chart illustrates the significant market dominance of Bitcoin and Ethereum, underscoring their importance to traders within the cryptocurrency space.

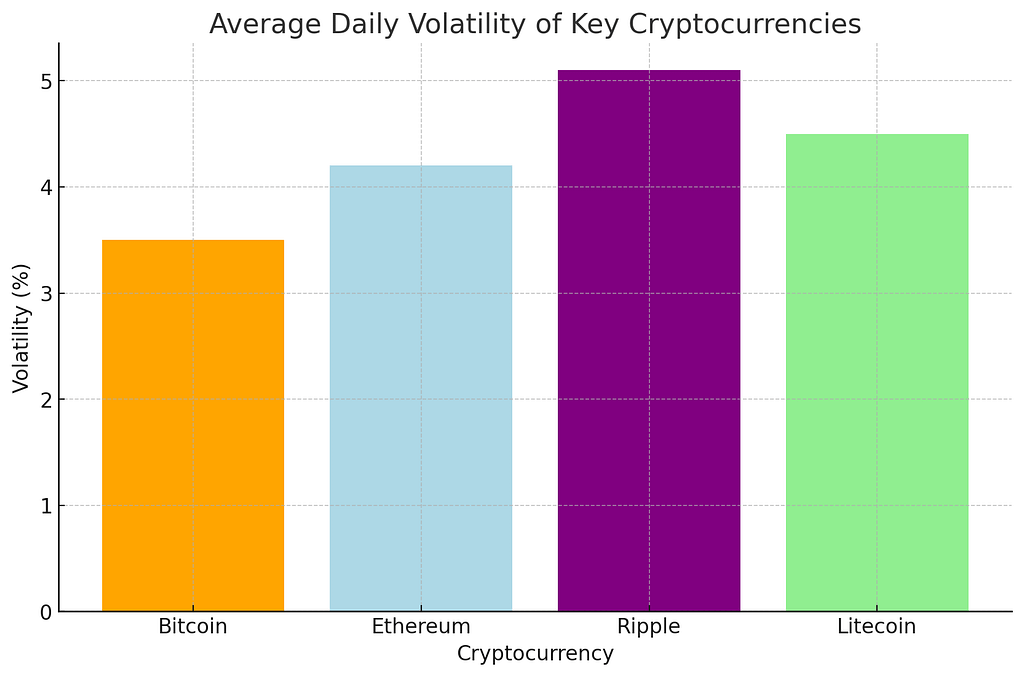

Bar Graph: Average Daily Volatility of Key Cryptocurrencies

The bar graph presents the average daily volatility for several key cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin.

With volatility percentages of 3.5% for Bitcoin, 4.2% for Ethereum, 5.1% for Ripple, and 4.5% for Litecoin, the graph highlights the fluctuations that traders can expect.

This insight into volatility is crucial for traders to understand the risk and potential for rapid price movements in the cryptocurrency market.

Conclusion

Cryptocurrency trading offers vast opportunities but comes with high risk due to market volatility. By understanding the market, employing effective trading strategies, and implementing stringent risk management practices, traders can navigate the complexities of digital currencies. It’s important to stay informed about market trends, technological advancements, and regulatory changes affecting cryptocurrencies to make well-informed decisions.