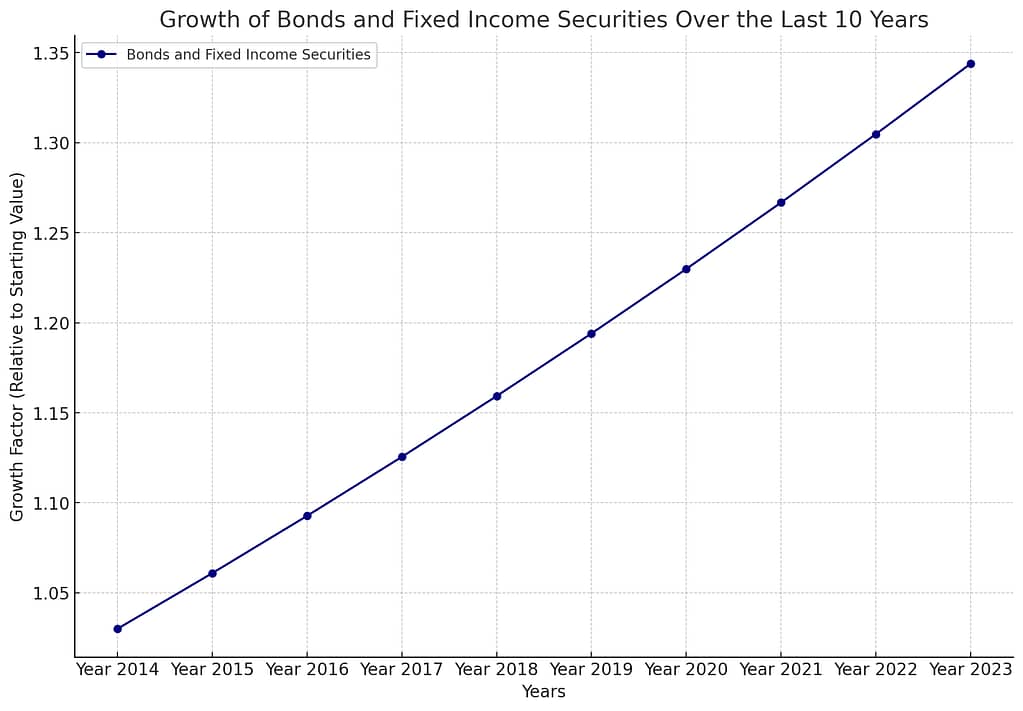

In the dynamic world of investing, bonds and fixed income securities play a crucial role in diversifying portfolios and generating stable income streams. These investment vehicles represent debt obligations issued by governments, municipalities, and corporations, offering investors the opportunity to lend their money in exchange for regular interest payments and the eventual return of the principal amount.

Bonds and fixed income securities may seem relatively straightforward, but they encompass a diverse range of products with varying characteristics, risks, and potential rewards. Whether you’re a seasoned investor or just starting your journey, understanding the nuances of this asset class is essential for making informed decisions and aligning your investments with your financial goals.

In this comprehensive guide, we’ll explore the intricacies of bonds and fixed income securities, delving into their types, key features, valuation methods, and strategies for incorporating them into a well-diversified portfolio. So, let’s embark on this journey together and unlock the potential of these versatile investment vehicles.

Understanding Bonds and Fixed Income Securities

A bond is a debt instrument that represents a loan made by an investor to an issuer, such as a government, municipality, or corporation. In exchange for this loan, the issuer agrees to pay the investor periodic interest payments (known as coupon payments) and to repay the principal amount (face value) upon the bond’s maturity date.

Fixed income securities, on the other hand, encompass a broader range of investment products that generate fixed or predictable income streams. These can include bonds, as well as other instruments like certificates of deposit (CDs), money market funds, and annuities.

Types of Bonds and Fixed Income Securities

The world of bonds and fixed income securities is diverse, offering investors a variety of options to choose from based on their investment objectives, risk tolerance, and time horizons. Here are some of the most common types:

Government Bonds

- Treasury Bonds: Issued by the U.S. federal government and considered among the safest investments due to their low risk of default.

- Municipal Bonds: Issued by state and local governments, offering potential tax advantages for investors.

Corporate Bonds

- Investment-Grade Bonds: Issued by companies with high credit ratings, offering relatively lower risk and lower yields.

- High-Yield Bonds: Also known as “junk bonds,” these are issued by companies with lower credit ratings and carry higher risk but offer potentially higher yields.

International Bonds

- Sovereign Bonds: Issued by foreign governments, providing exposure to global markets and potential currency diversification.

- Emerging Market Bonds: Issued by governments or companies in developing economies, offering higher yields but with increased risk.

Structured Products

- Mortgage-Backed Securities (MBS): Backed by a pool of mortgages, offering exposure to the real estate market.

- Asset-Backed Securities (ABS): Backed by various types of consumer debt, such as credit card receivables or auto loans.

| Bond Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Treasury Bonds | Issued by the U.S. federal government | High credit quality, low risk | Lower yields |

| Municipal Bonds | Issued by state and local governments | Tax advantages, lower risk | Limited liquidity |

| Investment-Grade Corporate Bonds | Issued by companies with high credit ratings | Relatively low risk | Lower yields |

| High-Yield Corporate Bonds | Issued by companies with lower credit ratings | Potentially higher yields | Higher risk of default |

Key Features of Bonds and Fixed Income Securities

When investing in bonds and fixed income securities, it’s essential to understand their key features and characteristics:

- Face Value (Par Value): The principal amount that the issuer agrees to repay the investor upon the bond’s maturity date.

- Coupon Rate: The annual interest rate paid by the issuer to the bondholder, expressed as a percentage of the bond’s face value.

- Maturity Date: The date on which the bond’s principal amount is due for repayment to the investor.

- Credit Rating: A measure of the issuer’s creditworthiness and ability to meet its debt obligations, assigned by independent rating agencies.

- Yield to Maturity (YTM): The expected rate of return an investor will receive if they hold the bond until its maturity date, taking into account the bond’s purchase price, coupon payments, and maturity value.

Valuation and Analysis

Investors employ various methods to analyze and value bonds and fixed income securities, including:

- Credit Analysis: Assessing the issuer’s creditworthiness and financial health to determine the risk of default.

- Interest Rate Risk Analysis: Evaluating how changes in interest rates can impact the bond’s price and yield.

- Duration and Convexity: Measures that estimate the sensitivity of a bond’s price to changes in interest rates.

- Yield Curve Analysis: Studying the relationship between bond yields and their maturities to identify potential opportunities or risks.

Strategies for Investing in Bonds and Fixed Income Securities

Investors can employ various strategies when incorporating bonds and fixed income securities into their portfolios, including:

- Laddering: Building a portfolio of bonds with staggered maturity dates to manage interest rate risk and provide a consistent stream of income.

- Barbelling: Combining short-term and long-term bonds to balance risk and return in a portfolio.

- Immunization: Structuring a bond portfolio to match the investor’s liabilities or investment horizon, minimizing interest rate risk.

- Active Management: Employing professional fund managers to actively buy and sell bonds based on market conditions and opportunities.

Risks and Considerations

While bonds and fixed income securities are generally considered less volatile than stocks, they still carry inherent risks that investors should be aware of:

- Interest Rate Risk: Changes in interest rates can impact the value of existing bonds, with bond prices typically falling when interest rates rise.

- Credit Risk: The risk that the issuer may default on its debt obligations, failing to make interest payments or repay the principal amount.

- Reinvestment Risk: The risk of having to reinvest coupon payments or principal at potentially lower interest rates in the future.

- Inflation Risk: The risk that inflation will erode the real value of fixed income returns over time.

Conclusion

Bonds and fixed income securities offer investors a valuable opportunity to diversify their portfolios, generate stable income streams, and potentially mitigate overall portfolio risk. However, navigating this asset class requires a deep understanding of its nuances, valuation methods, and potential risks.

By carefully evaluating your investment objectives, risk tolerance, and time horizons, you can strategically incorporate bonds and fixed income securities into your portfolio, balancing the pursuit of returns with prudent risk management.

Remember, successful investing in bonds and fixed income securities often involves seeking guidance from financial professionals, staying informed about market trends, and continuously adapting your strategies to changing market conditions.