The world of bond trading offers a fascinating avenue for investors seeking to diversify their portfolio and engage with the fixed income market. Bonds, representing loans made by an investor to a borrower, typically a corporation or government, are traded globally, providing both stability and opportunities for returns. This introduction aims to demystify the process of bond trading, exploring the different types of bonds, how to trade them, and effective strategies for beginners.

Deep Dive into Understanding Bonds

Bonds, as fixed income securities, represent not just a loan from the investor to the issuer but also a pact of trust and a vehicle for achieving a balanced and diversified investment portfolio. They offer a dual advantage: the predictability of fixed interest payments over the bond’s life and the return of the principal amount upon maturity. This financial instrument’s inherent stability makes it a cornerstone of conservative investment strategies, aiming to preserve capital while generating steady income.

Types of Bonds

The bond market’s diversity allows investors to choose securities that align with their risk tolerance, investment goals, and interests. Let’s explore the characteristics and nuances of the main types of bonds:

Government Bonds

- Often referred to as sovereign bonds, these are issued by national governments and are backed by the full faith and credit of the issuing country. Examples include U.S. Treasury bonds, which are considered among the safest investments worldwide. The risk of default is low, making them an attractive option for conservative investors. However, their safety is often mirrored in lower yield returns compared to riskier bonds.

Corporate Bonds

- These bonds are issued by companies looking to raise capital for expansion, projects, or refinancing existing debt. Corporate bonds are categorized into grades based on the issuer’s creditworthiness, with ‘investment grade’ bonds being the safest, albeit with lower yields, and ‘high-yield’ or ‘junk’ bonds offering higher returns at a greater risk of default. Investors in corporate bonds need to assess the issuing company’s financial health and the bond’s terms to understand the risk/reward ratio fully.

Municipal Bonds

- Also known as munis, these are issued by states, cities, counties, or other governmental entities below the national level to fund public projects like schools, highways, and infrastructure projects. One of the most appealing features of municipal bonds is their tax-exempt status, where the interest income is often free from federal income tax and, in some cases, state and local taxes if the investor lives in the state where the bond was issued. This tax advantage can make municipal bonds particularly attractive to investors in higher tax brackets.

Additional Types Worth Noting

Zero-Coupon Bonds

- Unlike traditional bonds, which pay periodic interest, zero-coupon bonds are issued at a discount to their face value and do not pay interest during their life. Instead, investors receive the bond’s full face value at maturity. This type of bond can be appealing for long-term investors seeking to lock in a guaranteed rate of return.

Convertible Bonds

- These corporate bonds offer the holder the option to convert the bond into a predetermined number of the company’s shares, usually at any time during the bond’s life. This feature provides the potential for capital appreciation, though it comes with higher risk compared to non-convertible corporate bonds.

Inflation-linked Bonds

- Such as Treasury Inflation-Protected Securities (TIPS) in the United States, these government bonds are designed to help protect investors from inflation. The principal value of the bond increases with inflation, as measured by indices such as the Consumer Price Index (CPI), ensuring that the bond’s yield reflects real purchasing power at maturity.

Understanding the varied landscape of bonds is crucial for investors looking to navigate the fixed income market effectively. Each type of bond carries its own set of characteristics, risks, and benefits, making it essential for investors to conduct thorough research and consider their investment objectives before diving into bond trading.

How to Trade Bonds

Bond trading, while offering a pathway to diversification and steady income, requires a nuanced approach different from stock trading. The over-the-counter (OTC) nature of most bond transactions adds layers of complexity but also presents unique opportunities for the informed investor. Here’s a detailed exploration of how to navigate the bond market effectively:

In-Depth Research is Key

Before engaging in bond trading, thorough research is paramount. This involves more than just a cursory glance at the bond’s yield:

- Issuer’s Creditworthiness: Assessing the financial health and stability of the issuer can help gauge the risk of default. For corporate bonds, this might involve reviewing the company’s balance sheet, earnings reports, and future revenue projections. For government and municipal bonds, consider the issuing entity’s economic and fiscal health.

- Bond Features and Terms: Beyond the basic yield and maturity date, understand any special features (such as call provisions, convertibility, or inflation protection) that could affect the bond’s performance.

Choosing the Right Broker

Selecting a broker that fits your bond trading needs is crucial. Consider the following when making your choice:

- Access to a Broad Range of Bonds: A broker with a wide selection can provide more opportunities to diversify and find bonds that match your investment criteria.

- Competitive Pricing and Fees: Understand all associated costs, including commissions and any markups or markdowns on bond prices.

- Quality of Research and Tools: Access to high-quality research and analytical tools can significantly enhance your ability to make informed decisions.

Mastering Order Placement

Placing orders for bonds involves specifying the exact bond, the quantity you wish to buy or sell, and the price you’re willing to accept. Here are some nuances:

- Understanding Quoting Conventions: Bonds can be quoted in terms of price or yield, and understanding these conventions is vital to placing orders correctly.

- Market Orders vs. Limit Orders: Decide whether you need to execute the trade immediately at the current market price (market order) or set a specific price at which you’re willing to buy or sell (limit order).

Strategies for Beginner Bond Traders

Embarking on bond trading with a strategic approach can mitigate risks and enhance potential returns:

Embrace Diversification

Diversifying your bond investments can help spread risk. Consider a mix of government, corporate, and municipal bonds, and pay attention to different sectors, credit ratings, and geographical regions.

Implement Bond Laddering

A laddering strategy involves purchasing bonds with staggered maturities. This approach can provide a balance between locking in higher yields on longer-term bonds and maintaining liquidity with shorter-term bonds. It also helps manage interest rate risk, as bonds mature at different times, allowing for reinvestment at potentially higher rates.

Stay Alert to Interest Rate Movements

Interest rates have an inverse relationship with bond prices. When rates rise, bond prices typically fall, and vice versa. Being mindful of the interest rate environment and its potential direction can inform your bond buying or selling strategy, especially in terms of selecting bond maturities and assessing the risk/reward profile of your bond investments.

Trading bonds requires a blend of diligent research, strategic thinking, and an understanding of the market’s nuances. By leveraging the strategies outlined above and continuously educating yourself on the dynamics of the bond market, you can navigate the complexities of bond trading with greater confidence and success. Remember, the goal is not just to trade but to do so in a way that aligns with your overall investment objectives and risk tolerance.

Visual Insights: The Bond Market Landscape

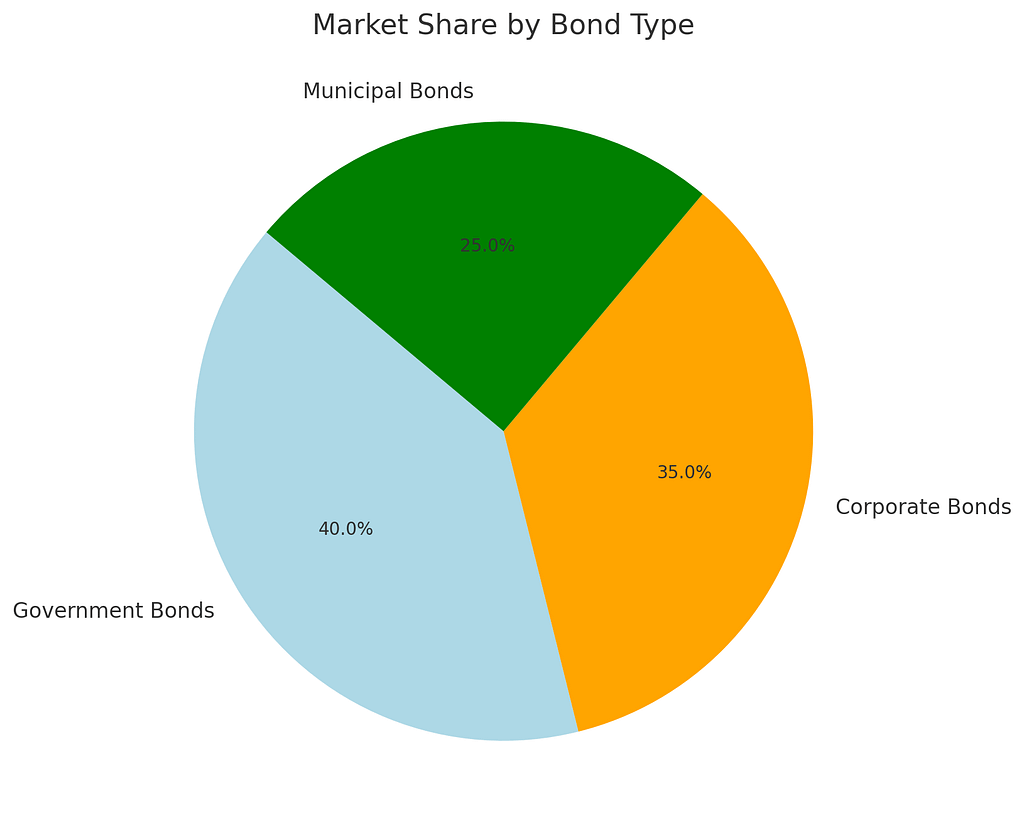

Pie Chart: Market Share by Bond Type

This pie chart displays the distribution of market share among different bond types, with government bonds holding 40%, corporate bonds 35%, and municipal bonds 25%.

The chart highlights the significant presence of government and corporate bonds in the market, reflecting their importance to investors seeking various levels of risk and return.

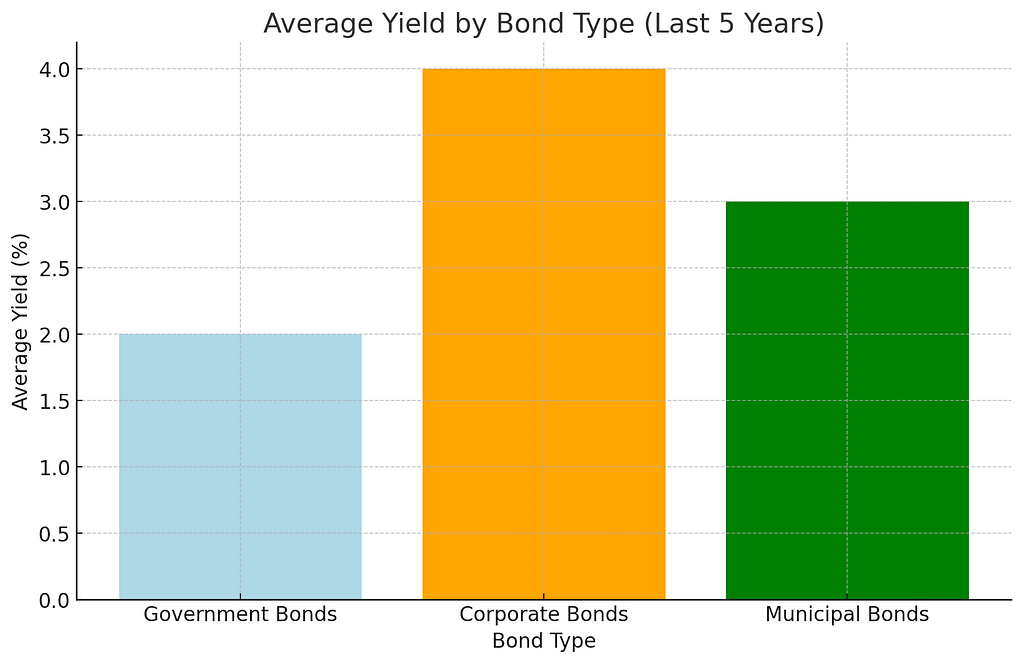

Bar Graph: Average Yield by Bond Type (Last 5 Years)

The bar graph illustrates the average yield provided by different types of bonds over the last five years. Corporate bonds lead with an average yield of 4%, followed by municipal bonds at 3% and government bonds at 2%.

This data shows that corporate bonds typically offer higher yields compared to government and municipal bonds, aligning with their higher risk profile compared to more secure government bonds.

Personal Insights: The Value of Bond Trading for Beginners

As an expert in the field, I’ve witnessed firsthand the benefits and challenges associated with bond trading. For beginners, navigating the fixed income market can seem daunting, but it offers a crucial pathway to portfolio diversification and a steady income stream. Understanding the nuances of different bond types and their market dynamics is key to successful trading.

The fixed income market demands patience and a keen eye for detail. Beginners should focus on building a diversified bond portfolio, taking into consideration credit risk, interest rate risk, and liquidity needs. By employing strategies such as bond laddering, investors can manage these risks effectively while ensuring a regular income.

Moreover, staying informed about economic indicators and interest rate trends is vital, as these factors significantly impact bond prices and yields. Engaging with the bond market provides valuable learning opportunities, offering insights into broader economic and financial market dynamics.

Bond trading can be a rewarding endeavor for beginners, offering a blend of income generation and risk management. By starting with a solid foundation of knowledge and employing strategic approaches, new investors can navigate the fixed income market with confidence, leveraging bonds as a cornerstone of a well-rounded investment portfolio.