In the ever-evolving world of finance, understanding the different types of investments is crucial for building a well-diversified portfolio and achieving your financial goals. Whether you’re a seasoned investor or just starting your journey, navigating the vast array of investment options can be daunting. In this comprehensive guide, we’ll explore the various types of investments available, their unique characteristics, risks, and potential rewards.

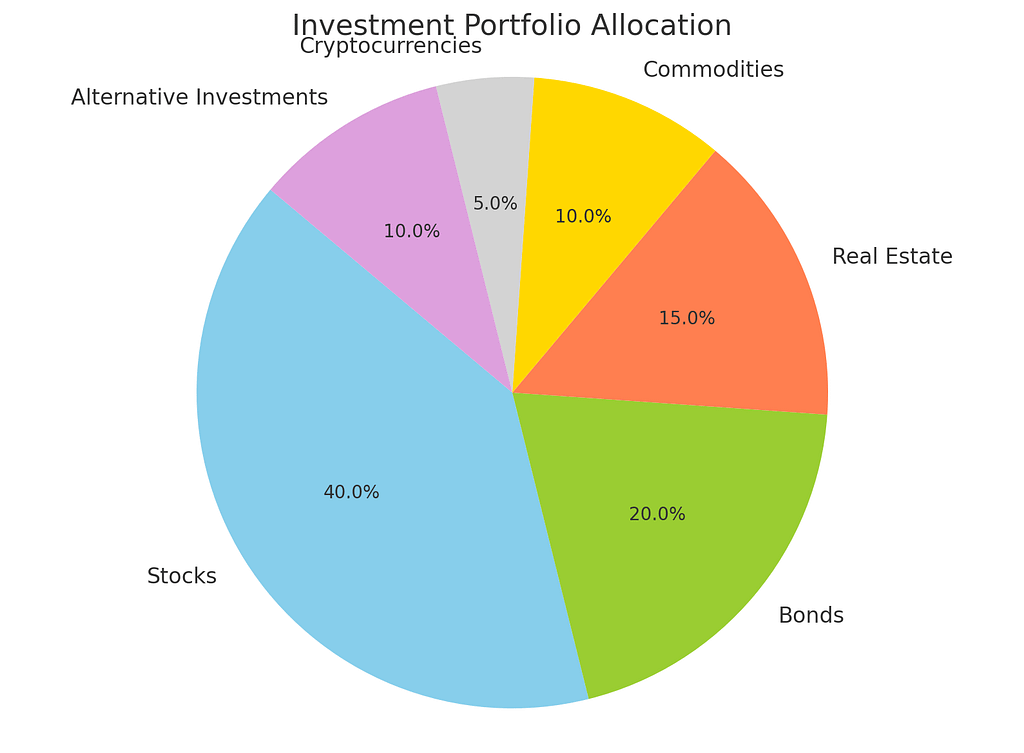

Investing is more than just a means of growing your wealth; it’s a strategic approach to securing your financial future. By diversifying your investments across different asset classes, you can mitigate risk and maximize returns. However, before diving into the world of investments, it’s essential to clearly define your investment objectives, risk tolerance, and time horizon.

So, let’s embark on this journey together, uncovering the nuances of each investment type and empowering you to make informed decisions that align with your personal financial goals.

Stocks

Stocks, also known as equities, represent ownership shares in publicly traded companies. When you purchase stocks, you become a partial owner of the company, entitled to a portion of its profits and assets. Investing in stocks offers the potential for capital appreciation, as the value of the shares can increase over time, and dividend income, if the company distributes a portion of its earnings to shareholders.

Stocks can be categorized based on various factors, such as market capitalization (large-cap, mid-cap, or small-cap), industry sector (technology, healthcare, finance, etc.), or investment strategy (growth, value, or income).

| Stock Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Large-Cap | Established companies with large market capitalizations | Stability, dividends, liquidity | Limited growth potential |

| Mid-Cap | Companies with moderate market capitalizations | Balance of growth and stability | Volatility, liquidity risk |

| Small-Cap | Smaller companies with high growth potential | Significant growth opportunities | Higher risk, volatility |

Bonds

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When you invest in bonds, you essentially lend money to the issuer in exchange for periodic interest payments (coupon payments) and the eventual return of the principal amount (face value) upon maturity.

Bonds are generally considered less risky than stocks, as they provide a fixed stream of income and have a predetermined maturity date. However, they also offer lower potential returns compared to stocks.

Bonds can be categorized based on the issuer (government, municipal, or corporate), maturity date (short-term, intermediate, or long-term), and credit quality (investment-grade or high-yield).

| Bond Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Government Bonds | Issued by national or local governments | High credit quality, low risk | Lower returns |

| Corporate Bonds | Issued by private companies | Higher yields than government bonds | Credit risk, default risk |

| Municipal Bonds | Issued by state and local governments | Tax advantages, lower risk | Limited liquidity |

Real Estate

Real estate investing involves the purchase, ownership, management, and sale of properties, such as residential homes, commercial buildings, or land. This type of investment offers multiple avenues for generating returns, including rental income, property appreciation, and tax benefits.

Real estate investments can be made directly by purchasing physical properties or indirectly through real estate investment trusts (REITs) or real estate crowdfunding platforms.

| Real Estate Investment Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Residential Properties | Single-family homes, apartments, condos | Rental income, appreciation | Property management, vacancies |

| Commercial Properties | Office buildings, retail spaces, warehouses | Steady cash flow, long-term leases | High upfront costs, economic cycles |

| Real Estate Investment Trusts (REITs) | Publicly traded companies that own and operate real estate portfolios | Diversification, liquidity, dividends | Market volatility, interest rate risk |

Commodities

Commodities are natural resources or raw materials that are traded on global markets, such as precious metals (gold, silver), energy products (crude oil, natural gas), and agricultural products (wheat, corn). Investors can gain exposure to commodities through futures contracts, exchange-traded funds (ETFs), or direct physical ownership.

Commodity investments are often used as a hedge against inflation and a diversification strategy, as their prices tend to move independently of traditional asset classes like stocks and bonds.

| Commodity Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Precious Metals | Gold, silver, platinum | Inflation hedge, portfolio diversification | Price volatility, storage costs |

| Energy Products | Crude oil, natural gas | Potential for price appreciation, income generation | Supply and demand fluctuations, geopolitical risks |

| Agricultural Products | Wheat, corn, soybeans | Portfolio diversification, inflation hedge | Weather conditions, global demand shifts |

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for secure financial transactions. They operate on decentralized blockchain networks, eliminating the need for intermediaries like banks or governments.

While cryptocurrencies like Bitcoin and Ethereum have gained significant attention and adoption, they are also known for their high volatility and regulatory uncertainties.

| Cryptocurrency Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Bitcoin | The first and most widely recognized cryptocurrency | Potential for high returns, decentralization | Extreme volatility, regulatory uncertainty |

| Ethereum | A blockchain platform supporting smart contracts and dApps | Growth potential, innovative use cases | Technology risks, adoption challenges |

| Altcoins | Alternative cryptocurrencies to Bitcoin and Ethereum | Speculative opportunities, niche applications | High risk, liquidity concerns |

Alternative Investments

Alternative investments are non-traditional asset classes that typically have low correlations with traditional investments like stocks and bonds. These can include hedge funds, private equity, venture capital, art and collectibles, and more.

Alternative investments are often accessible only to accredited or institutional investors due to their complexity and higher risk profiles.

| Alternative Investment Type | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Hedge Funds | Actively managed investment pools utilizing complex strategies | Potential for high returns, portfolio diversification | High fees, illiquidity, complex structures |

| Private Equity | Investment in private companies or buyout deals | Significant growth potential, active management | Illiquidity, high minimums, long lock-up periods |

| Venture Capital | Investment in early-stage, high-growth companies | Potential for outsized returns | High risk, illiquidity, long investment horizons |

| Art and Collectibles | Investments in art, antiques, coins, wine, etc. | Portfolio diversification, potential appreciation | Illiquidity, storage costs, authentication risks |

Conclusion

As you can see, the investment landscape is vast and diverse, offering a wide range of opportunities to grow your wealth while aligning with your risk tolerance and financial goals. Whether you opt for traditional investments like stocks and bonds or venture into alternative assets like real estate or cryptocurrencies, it’s essential to conduct thorough research, understand the risks involved, and seek guidance from financial professionals when needed.

Remember, successful investing is not just about chasing returns; it’s about building a well-diversified portfolio that strikes the right balance between risk and reward. By exploring the various types of investments and their unique characteristics, you can make informed decisions and navigate the ever-changing financial markets with confidence.