Understanding your paycheck is an essential part of managing your finances. Many people simply glance at their paycheck and assume that everything is correct without taking the time to understand the details. However, taking a closer look at your paycheck can help you ensure that you are being paid correctly and that the proper deductions are being taken out.

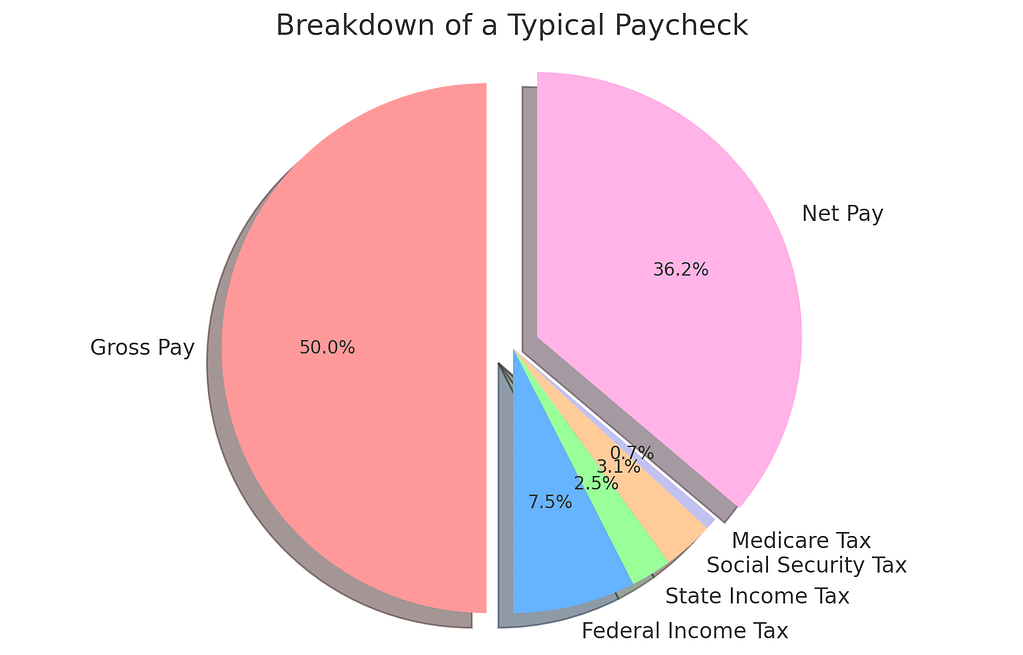

Your paycheck is made up of several components, including your gross pay, deductions, and net pay. Gross pay is the amount of money you earned before any taxes or deductions are taken out. Deductions include taxes, insurance premiums, and retirement contributions. The net pay is the amount of money you take home after all deductions have been taken out.

Understanding the different pay periods is also important. Pay periods can vary by employer, but they typically occur weekly, bi-weekly, or monthly. It’s important to understand your pay period so you can properly budget your money and plan for upcoming expenses.

Key Takeaways

- Your paycheck is made up of several components, including gross pay, deductions, and net pay.

- Understanding the different pay periods is important for budgeting and planning.

- Taking a closer look at your paycheck can help you ensure that you are being paid correctly and that the proper deductions are being taken out.

Components of Your Paycheck

Understanding your paycheck can be a daunting task, but it is essential to ensure that you are being paid accurately and fairly. A typical paycheck contains several components, including Gross Pay, Net Pay, Deductions, Taxes, and Benefits.

Gross Pay

Gross Pay is the amount of money that an employee earns before any deductions are taken out. This includes the employee’s regular pay rate, as well as any overtime pay, bonuses, or commissions. Gross Pay is an essential component of the paycheck because it determines the amount of money an employee will receive before any deductions.

Net Pay

Net Pay, also known as take-home pay, is the amount of money that an employee receives after all deductions have been taken out. This includes federal and state taxes, Social Security, Medicare, and any voluntary deductions such as retirement contributions or health insurance premiums. Net Pay is the amount of money that an employee can use to pay bills, buy groceries, and cover any other expenses.

Deductions

Deductions are amounts of money that are taken out of an employee’s paycheck for various reasons. These can include federal and state taxes, Social Security, Medicare, and any voluntary deductions such as retirement contributions or health insurance premiums. Deductions are subtracted from Gross Pay to determine Net Pay.

Taxes

Taxes are a mandatory deduction from an employee’s paycheck. Federal and state taxes are calculated based on an employee’s Gross Pay and are withheld from each paycheck. Social Security and Medicare taxes are also mandatory deductions and are calculated as a percentage of an employee’s Gross Pay.

Benefits

Benefits are optional deductions that an employee can choose to have taken out of their paycheck. These can include retirement contributions, health insurance premiums, and other benefits such as life insurance or disability insurance. Benefits are subtracted from Gross Pay to determine Net Pay.

In conclusion, understanding the components of your paycheck is essential to ensure that you are being paid accurately and fairly. By understanding Gross Pay, Net Pay, Deductions, Taxes, and Benefits, employees can make informed decisions about their finances and plan for their future.

Pay Periods

One of the most important aspects of understanding your paycheck is understanding the pay period. The pay period is the length of time during which an employee earns wages, and it can vary depending on the employer. In general, pay periods can be weekly, bi-weekly, semi-monthly, or monthly.

Weekly

A weekly pay period is the shortest pay period and covers one week of work. This means that employees will receive a paycheck every week. This pay period is often used for hourly employees or those who work irregular hours.

Bi-Weekly

A bi-weekly pay period is a pay period that covers two weeks of work. This means that employees will receive a paycheck every other week. This pay period is often used for salaried employees or those who work regular hours.

Semi-Monthly

A semi-monthly pay period is a pay period that covers half a month of work. This means that employees will receive a paycheck twice a month, usually on the 15th and the last day of the month. This pay period is often used for salaried employees or those who work regular hours.

Monthly

A monthly pay period is the longest pay period and covers one month of work. This means that employees will receive a paycheck once a month. This pay period is often used for salaried employees or those who work regular hours.

It is important to note that the pay period is different from the pay date. The pay date is the day on which employees receive their paycheck, and it can be different from the last day of the pay period. Employers will typically provide employees with a pay stub that shows the pay period dates, the pay date, and other important information about the paycheck.

Understanding Tax Withholdings

When you receive your paycheck, you may notice that the amount you earned is not the same as the amount you take home. This is because your employer withholds taxes from your paycheck. Understanding tax withholdings is an essential part of understanding your paycheck. Here are the different types of taxes that may be withheld from your paycheck:

Federal Income Tax

Federal income tax is a tax on your income that is collected by the federal government. The amount of federal income tax that is withheld from your paycheck depends on your income, your filing status, and the number of exemptions you claim on your W-4 form. The more exemptions you claim, the less federal income tax will be withheld from your paycheck. If you claim too many exemptions, you may end up owing money to the IRS at tax time.

State Income Tax

In addition to federal income tax, you may also have state income tax withheld from your paycheck. State income tax is a tax on your income that is collected by your state government. The amount of state income tax that is withheld from your paycheck depends on the state you live in and your income.

Social Security Tax

Social Security tax is a tax that is collected by the federal government to fund the Social Security program. The Social Security program provides retirement, disability, and survivor benefits to eligible individuals. The amount of Social Security tax that is withheld from your paycheck is a percentage of your income, up to a certain limit. In 2024, the Social Security tax rate is 6.2% on income up to $147,000.

Medicare Tax

Medicare tax is a tax that is collected by the federal government to fund the Medicare program. The Medicare program provides healthcare benefits to eligible individuals. The amount of Medicare tax that is withheld from your paycheck is a percentage of your income, with no limit. In 2024, the Medicare tax rate is 1.45%.

Understanding tax withholdings is important because it helps you to plan your budget and avoid any surprises at tax time. If you have any questions about your tax withholdings, you should speak to your employer or a tax professional.

Reading Your Pay Stub

When it comes to understanding your paycheck, the pay stub is the most important document to review. It provides a detailed breakdown of your earnings, deductions, and taxes withheld. Here are the key components of a pay stub:

Pay Stub Overview

The top of the pay stub will typically display your personal information, including your name, address, and social security number. It will also include the pay period dates and the date of the paycheck.

Earnings and Hours

Below your personal information, you will see a breakdown of your earnings and hours worked. This section will list your hourly rate or salary, the number of hours worked, and your total earnings for the pay period. If you worked overtime or received any bonuses, they will be listed separately.

Year-to-Date Totals

The year-to-date (YTD) section will show your total earnings and deductions for the year. This section is important because it can help you track your progress towards financial goals, such as saving for retirement or paying off debt.

Employer Information

The bottom of the pay stub will typically include information about your employer, such as their name, address, and federal tax ID number. It may also include information about your benefits, such as contributions to a 401(k) or health insurance premiums.

Overall, reviewing your pay stub can help you understand your income, taxes, and benefits. If you have any questions or concerns about your pay stub, be sure to speak with your employer or HR representative.

FAQs

Every paycheck includes mandatory deductions that are required by law. These deductions include federal and state income taxes, Social Security taxes, and Medicare taxes. Depending on the state, workers may also have to pay state disability insurance, state unemployment insurance, or other state taxes.

To accurately analyze and understand their paycheck, workers should review their pay stub carefully. They should check that their gross pay, taxes, and other deductions are accurate. They should also make sure that their hours worked, overtime pay, and other earnings are correct. If they have any questions about their paycheck, they should contact their employer or human resources department.

The codes and abbreviations on a pay stub represent different types of earnings, taxes, and deductions. For example, “FICA” stands for Federal Insurance Contributions Act, which includes Social Security and Medicare taxes. “FIT” stands for Federal Income Tax, while “SIT” stands for State Income Tax. Other codes may represent health insurance premiums, retirement plan contributions, or other benefits.

Net pay is calculated by subtracting all of the mandatory deductions, taxes, and other withholdings from an employee’s gross income. This includes federal and state income taxes, Social Security taxes, Medicare taxes, and any other deductions. Once all of these deductions have been subtracted, the remaining amount is the employee’s net pay.

Federal tax withholdings are required by the federal government and are based on the employee’s taxable income, filing status, and number of exemptions claimed on their W-4 form. State tax withholdings vary by state and are based on the employee’s taxable income, filing status, and state tax rates.

To determine if their paycheck deductions are accurate, workers should compare their pay stub to their W-4 form and other tax documents. They should also verify that their hours worked, overtime pay, and other earnings are correct. If they notice any discrepancies or errors, they should contact their employer or human resources department.